Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

The Automobile component industry in India is composed of organized and unorganized sector. The organized sector refers to original equipment manufacturers (OEMs) and is engaged in the manufacture of high-value precision instruments. Whereas, the unorganized sectors comprise of low-valued products catering to after-market services.

Various sub-sectors of the Automobile component industry in India are engine parts, drive transmission & steering parts, body and chassis, suspension and braking parts, equipment, electrical parts and others such as fan belts, die-casting and sheet metal parts.

India’s auto components sector has always imported more than it exported, leading to a trade deficit. For the first time ever, the industry saw a significant $700 million trade surplus in FY22.

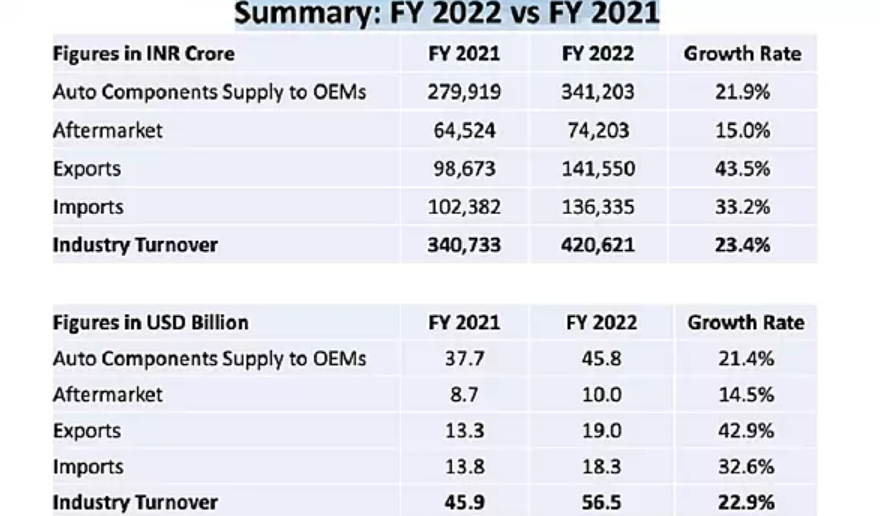

The turnover of the automotive component industry stood at INR 4.20 lakh crore ($56.5 billion) for the period April 2021 to March 2022, registering a growth of 23% over the previous year. This was the highest ever revenue recorded by the Indian auto component industry.

Key findings of the Automotive Component Manufacturers Association Performance Review for FY 2021-22

Sales to OEMs:

Component sales to OEMs, in the domestic market, at Rs.3.41 lakh crore grew 22% YoY. Enhanced raw material prices, consumption of increased value-added components and shift in market preference towards larger and more-powerful vehicles contributed to the increased turnover of the auto-components sector.

Exports

Exports of auto components grew by 76% to Rs.68,746 crore (USD 9.3 billion) in H1 2021-22 from Rs 39,003 crore (USD 5.2 billion) in H1 2020-21. Europe accounted for 31% of exports, saw an increase of 81%, while North America and Asia, accounting for 32% and 25% respectively also registered an increase of 81 and 73% respectively.

Imports

Traction in the domestic market also reflected on imports of component into India. Imports of auto components grew by 71% from Rs.37,710 crore (USD 5.0 billion) in H1 2020-21 to Rs.64,310 crore (USD 8.7 billion) in H1 2021-22. Asia accounted for 63% of imports followed by Europe and North America, with 29% and 7% respectively. Imports from all geographies witnessed a steep increase reflecting growth in domestic manufacturing activities.

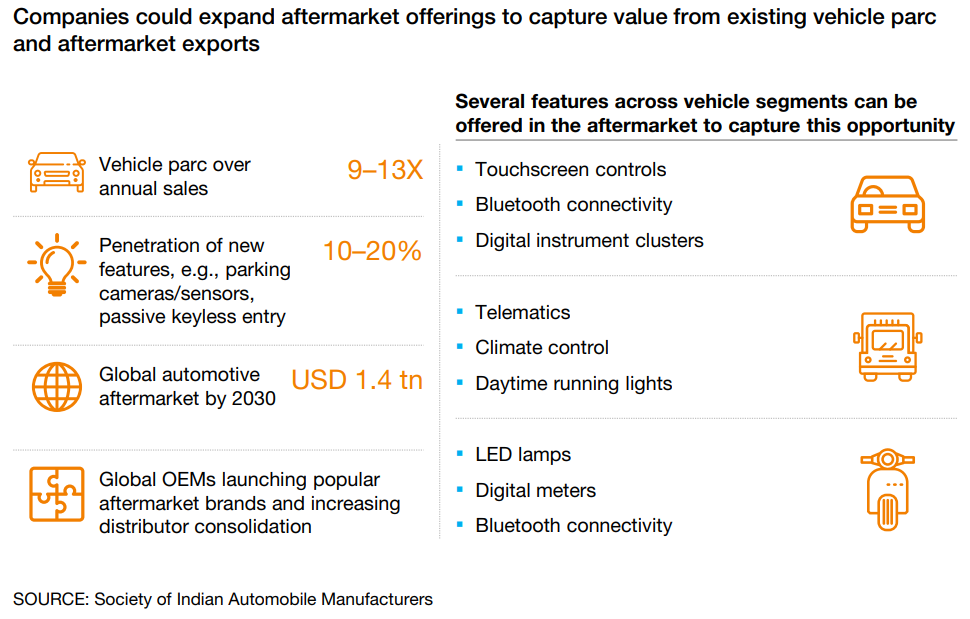

Aftermarket

Increased movement of vehicles post-pandemic and surge in demand for used- vehicles led to buoyancy in the aftermarket, across all segments. The aftermarket in H1 2021-22 witnessed a growth of 25% to Rs 38,895 crore (USD 5.3 billion) from Rs.31,116 crore (USD 4.1 billion) in H1 2020-21.[Aftermarket denotes the market for auto components that are used to replace the original auto parts when they are not functioning properly]

Contributing factors

Enhanced raw material prices, consumption of increased value-added components and shift in market preference towards larger and more-powerful vehicles contributed to the increased turnover of the auto-components sector.

The key export items included drive transmission and steering, engine components, body/chassis, suspension and braking, etc.

Significant growth was witnessed across all segments including supply to OEMs, Exports as also the Aftermarket.

The aftermarket’s turnover crossed the pre-pandemic levels in 2021-22 because of more vehicles on road, prolonged usage of vehicles, increase in demand of second-hand vehicles, increase in commodity prices, and emergence of new sales channels such as online retailers and multi-brand outlets.

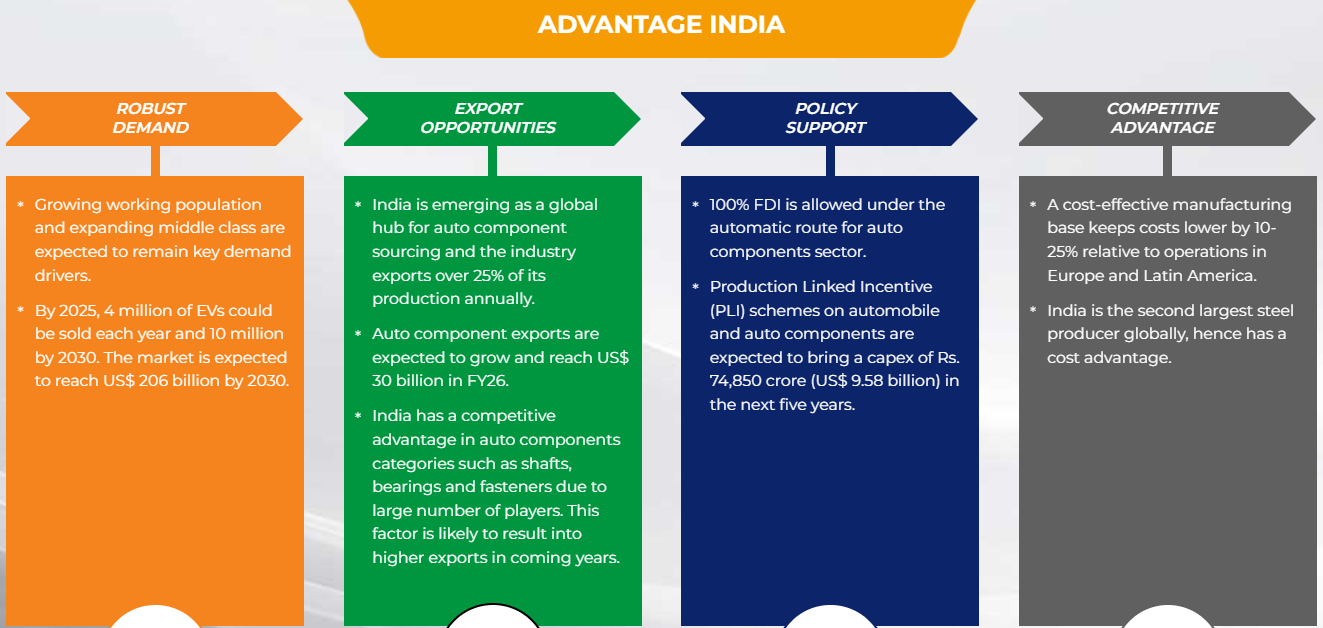

The sector is also getting the benefit of multiple tailwinds such as high estimated GDP growth in 2022-23, strong demand in domestic vehicle market, surge in exports, focus on clean and new technology, states’ electric vehicles policy and the government’s production-linked incentive (PLI) scheme.

The auto components industry accounted for 7.1% of India’s GDP, contributed 49% to the manufacturing GDP, and provided employment to 50 lakh people in FY21.

India has a very strong position in the international market. It is the largest manufacturer of tractors, second-largest manufacturer for buses and the third largest for heavy trucks in the world.

Domestic Automobile Production

Domestic automobile production increased at 2.36% CAGR during FY16-FY20 with 26.36 million vehicles being manufactured in the country in FY20. Production of two wheelers, passenger vehicles, commercial vehicles and three wheelers reached 17.71 million, 3.65 million, 0.80 million, and 0.75 million, respectively, in FY22. In FY22, the total output of passenger vehicles, commercial vehicles, three-wheelers, two-wheelers and quadricycles was 22,933,230 units.

Growth drivers of India’s Auto Component Industry

Sector Policies

National Auto Policy

The National Auto Policy had been formulated aiming at prescribing policy guidelines and enabling the framework to achieve the predicted growth objectives. *

Licensing exemptions

In the Automobile component industry in India, manufacturing and imports are exempted from licensing and approvals.

NATRiP

National Automotive Testing and R&D Infrastructure Project (NATRiP), the largest and most significant initiatives by the Government of India, in the Automobile component industry in India.

The chief aim of the project is:

The key focus lies in providing low-cost manufacturing and product development solutions.

National Electric Mobility Mission Plan

NEMMP aims to bring the transformational paradigm shift in the Automotive and Transportation industry by promoting hybrid and electrical mobility in India. It is a composite scheme involving demand-side incentives to facilitate the acquisition of hybrid/electric vehicles along with the provision of supply-side incentives.

Fame Scheme

The scheme is proposed for faster adoption of electric mobility and development of its manufacturing eco-system in the country.

Department of Heavy Industries is the nodal agency and be responsible to review the scheme.

Export Incentives

Export subsidy is available to exporters as a % of duty credit scrip under Merchandise Exports from India Scheme (MEIS).

Additionally, the MEIS Scheme has been extended to additional tariff lines and expanded to 65 countries as per the recommendations by ACMA. [MEIS Scheme is designed to provide rewards to exporters to offset infrastructural inefficiencies and associated costs. The Duty Credit Scrips and goods imported/ domestically procured against them shall be freely transferable.]

Areas based Incentives

Incentives for units in Special Economic Zones (SEZs) / National Investment & Manufacturing Zones (NIMZs) as specified in respective Acts or setting up projects in special areas like the North-east region, Jammu & Kashmir, Himachal Pradesh & Uttarakhand.

Irrespective of the impeccable growth statistics, the Indian automobile industry is undergoing a significant structural slowdown in all 4 segments (passenger, two-wheelers, commercial, and three-wheeler vehicles) due to multiple economic reasons.

Challenges the Auto Industry is facing in India

Key Challenges Affecting Indian Automobile Sector

A host of factors are challenging the growth rate of the Indian automotive sector, like the new environmental safety regulations, fuel price hikes, liquidity crunch, amongst others. Some of the most crucial issues that all automobile manufacturers are currently facing include:

Global Shortage of Semiconductors

The worldwide shortage of semiconductors has significantly affected the sales of automobiles in India. The semiconductor chips are a crucial vehicle component that regulates a wide array of functions like navigation, infotainment, and traction control. India’s demand for semiconductors stands at around USD 24 billion and can reach a valuation of USD 100 billion by 2025. Consequently, with the global supply shortage of semiconductors, India’s passenger vehicle production is severely affected. In fact, the sales of passenger vehicles are reduced 11 to 13 % in the current financial year.

Rising Commodity Prices

Rising prices of raw materials and essential commodities for production also affect the growth of India’s automobile sector. For example, as per SIAM’s data, the copper prices are still about 66% more than a year ago. Also, most automobile companies are facing difficulty due to the high steel prices, which continue to rise even in FY21. As a result, they are now increasing the price of the car models, which in turn is affecting consumer demand. Therefore, as the cost of commodities continues to rise, foreign investors in the Indian automobile sectors need to strategize their production costs. For comprehensive planning, consulting with an automotive consulting company in India can be of great help.

Upcoming BSVI Phase 2 Regulations

The BSVI phase 2 regulations petrol vehicles must have a 25% reduction in the Nitrogen Oxide emission. Also, diesel-powered vehicles will have to reduce the hydrocarbon + nitrogen oxide emission by 43%. Also, the average permissible CO2 level for any car should be reduced from 130g/km to 113g/km. This move towards more stringent emission control norms is severely challenging for automakers because meeting new emission standards, good fuel efficiency, and low costs are absolutely contradictory. Furthermore, electrification of any form, programmed fuel injection will increase car prices affecting demand.

The ever-expanding Chinese market

One of the biggest challenges of automakers outside China, is the risk of competing with China. In the last fifteen years, China has been the leading automotive market. The volume growth has helped the country to overcome other structural and competitive challenges. The biggest challenge for the planners of the automotive market is to plan a strategy keeping in mind China’s outlook.

The evolution of connected cars

Connected are the biggest transformational changes in the automotive industry, but it is also one of the biggest unknowns. The concept of connected cars serve as a communication hub that receives and transmits data from its surroundings. However, this technology is still in such a nascent stage that it is creating uncertainties and questions such as who will buy the car, who will deliver these services, whether the current automakers will be able to navigate through all these uncertainties keep plaguing the automotive world.

Besides, the industry is also facing some medium-term challenges like ensuring a sustained demand, affordability for customers, localisation, preparing for long-term regulations, and new powertrain technologies.

Challenges Of Electrical Vehicles Segment

Though there is a growing demand for EV vehicles in India, and the EV market is estimated to become a USD 7.09 billion opportunity by 2025, the segment faces considerable challenges. To name a few, the high cost of batteries like Nickel-metal hydride (NiMH) and Lithium-Ion (LiON), due to demand-supply gaps, is increasing the overall price of EVs in India. Furthermore, increasing demand for electricity to charge EVs is also creating challenges from the grid side. The cost of a private charging station is also a significant point of concern for EV buyers. All these factors are significantly challenging the production and demand for electric vehicles in India.

Way Ahead

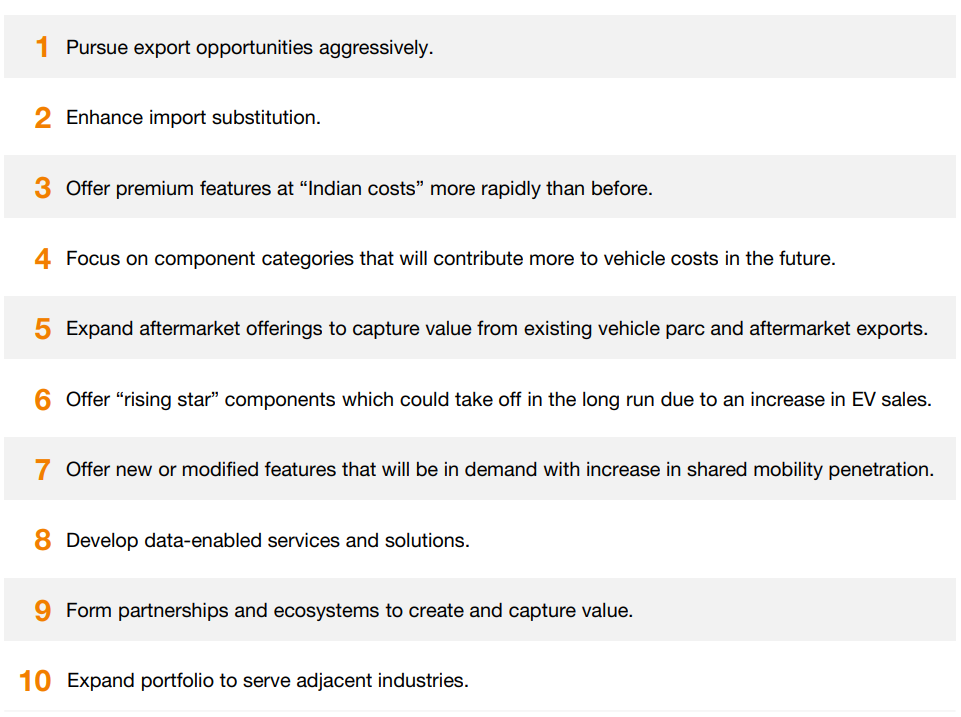

Promoting localization

Promoting localization or domestic production of different auto components in the country itself will significantly lower the production cost and thereby the overall price of vehicles in the Indian market. The Indian Government has already urged 100% localization for auto components in India. This will significantly cut India’s dependency on imports. However, it is not an easy process. This is because the dependency rate of the auto manufacturing sector on imports is around 70%. Hence, auto companies need to consult automotive management consulting services to frame an adequate localization target roadmap.

Focus on developing new powertrain technology

Investing foreign firms need to develop new powertrain technology with innovative R&D to conform to the new emission control demands.

Government’s Role

To push the local industry, it is now important for the government to extend the PLI scheme from OEMs to Tier I and Tier II suppliers as they form an integral part of the entire automotive component ecosystem. Currently, the OEMs are the biggest beneficiaries.

The government should have policies which encourage ease of doing business and ensure ready availability of capital at low rates for industries, viable logistics and low-energy costs – all prerequisites for safeguarding the interests of domestic industries. There are demands for reduction in GST and incentive-based scrappage policy from certain sections of the industry.

Role of Industries

Adaptability to digital technology and unavailability of skilled labour are major constraints limiting growth in the sector. Some Tier I industries are beginning to digitalise their supply chains, optimising the inventory and predicting machine breakdowns using data analytics. However, there is still a long way to go. To stay ahead in the race, it is necessary to make investments in technology and work towards fully digitalising manufacturing and non-manufacturing operations in the coming years. For example, the Internet of Things (IOT) platform, Industrial Internet of Things (IIoT) network, cloud and edge computing, robotic process automation, augmented or virtual reality, etc. are all essential additions.

Economies of Scale

Indian manufacturers need to start thinking big. The domestic market is large and growing, but it is also important to work towards becoming a state-of-the-art automotive value chain, contributing to the world market. Also, big-ticket international businesses will help in considerably reducing manufacturing costs. We need to develop India into an attractive source of high-quality, competitively priced, high-end automotive components. Data released by the Department for Promotion of Industry and Internal Trade (DPIIT) show that the foreign direct investment (FDI) inflow into the Indian automotive industry during the period April 2000-June 2021 stood at USD 30.51 billion.

Focus on Research and Development

It is vital for the research and development teams to be ready for several concomitant changes, transforming the whole automotive industry. Automotive component players and OEMs need to look for opportunities to shield and expand their market share. Shift to electronic mobility is real and is here to stay, and it is now for manufacturers to start arming themselves for the imminent disruption. The transition from ICE vehicles to electronic will occur in a phased manner, giving time to the industry to transition to a different product range. In times to come, the demand for ICE vehicle components is expected to drop sharply.

To be future ready, it is also prudent to develop the right collaborations globally and for OEMs to carve out their electric mobility paths. It is also essential to create the right assets and skill-sets to prepare for the demands of the electric vehicle (EV) industry in order to be able to thrive in the future. Going forward, it is important to have dedicated research and development wings to conduct studies in specialised areas such as product design, tribology and lubrication, virtual simulation, latest material and processes, and testing. There must be a concerted effort towards developing new-age research tools and patent filings. Currently, India ranks 10th in patent filings when compared with China which secured the first spot.

Final Thought

The automotive component industry is an essential pillar of the country’s economy. Strong international demand and resurgence in the local original equipment and aftermarket segments are predicted to help the Indian auto component industry grow. Indian automotive industry (including component manufacturing) is expected to reach between Rs. 16.16-18.18 trillion by 2026.

According to the Government of India’s estimates, India is expected to become the third largest automobile producer in the world by volume after China and the US by 2026. While we have long relied on Chinese imports and this dependency cannot end abruptly, what we need is a long-term, well-defined plan to build and scale up our domestic capabilities. The future is bright for India, and we need to stay focussed and battle-ready.

© 2024 iasgyan. All right reserved