Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: copyright infringement not intended.

As quoted by Wasserman and Haltman, international trade can be connoted as transactions among the inhabitants of different countries. International trade acts as a major contributing factor in global economic activity and a catalyst of economic growth in developing as well as developed countries. Differences in various conditions, like resource availability, natural climatic conditions, cost of production, etc., act as the motive behind trade between the countries. International trade has made it all possible and has provided a large number of employment opportunities as well as several goods and services for the consumer. It has been a major reason for the rising living standards of people all over the globe.

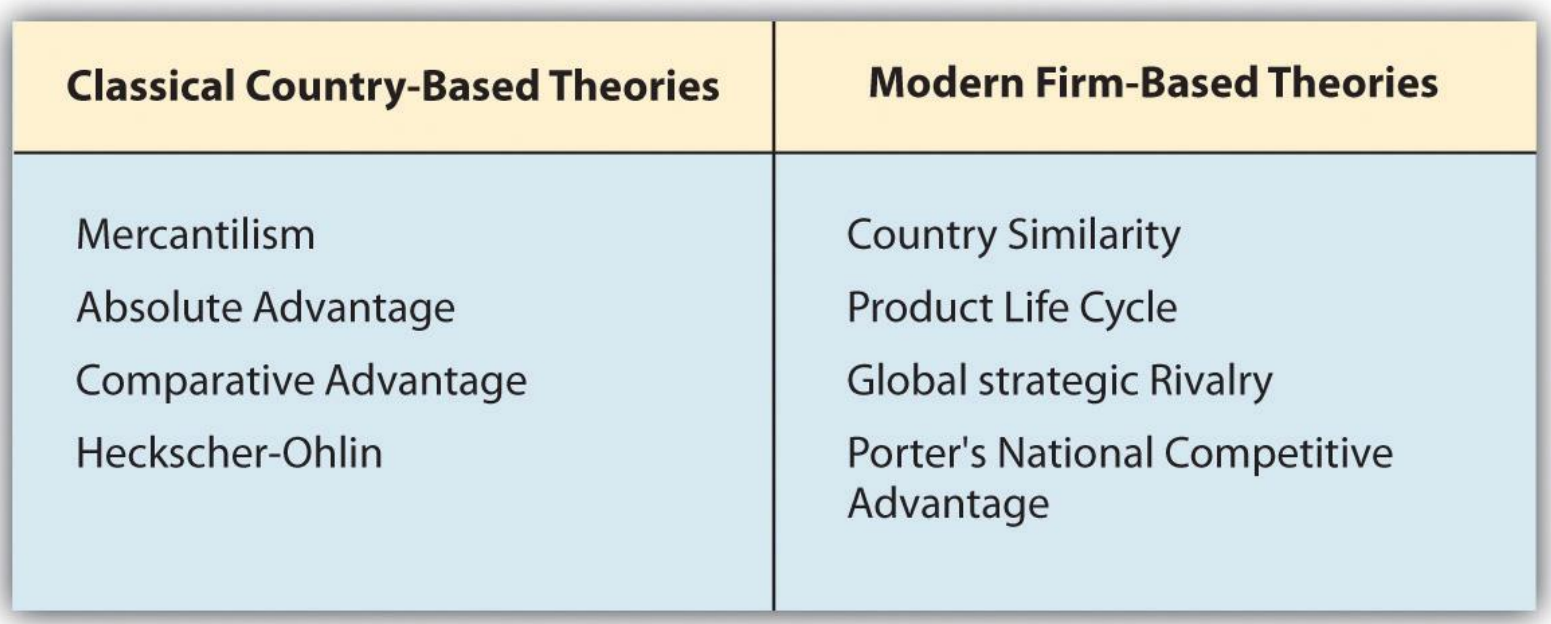

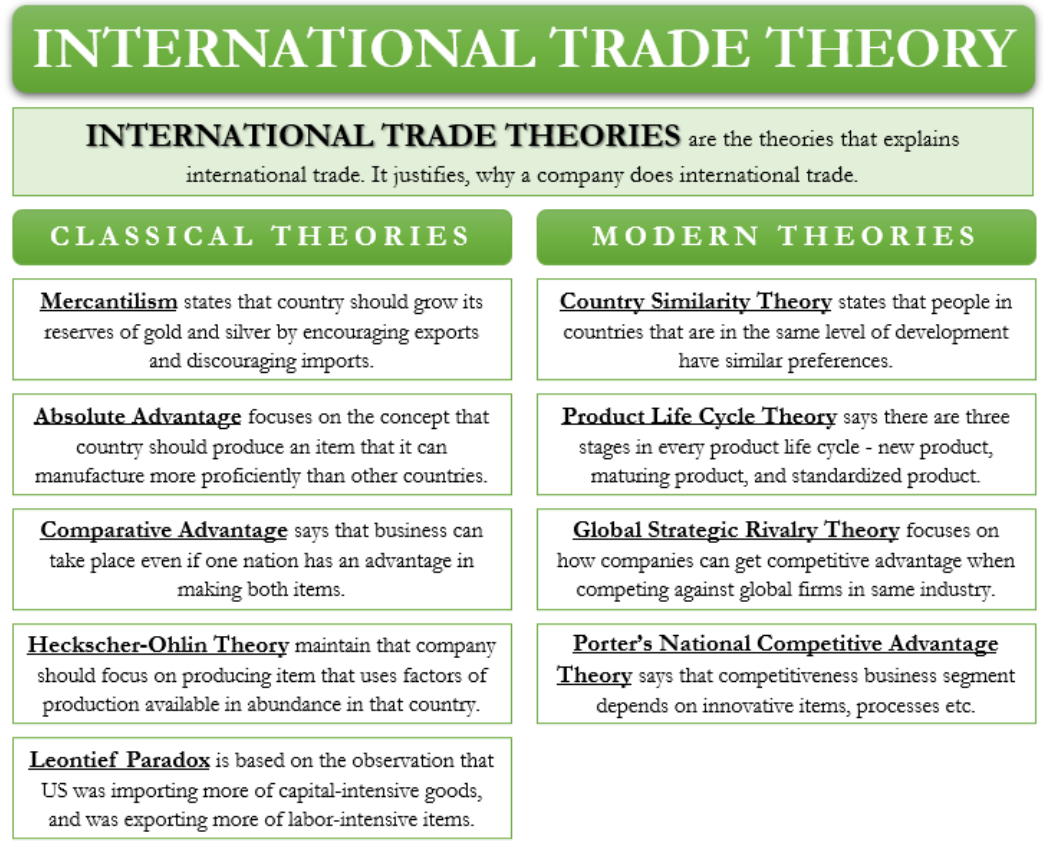

With time, economists have established theories that explain global trade. These theories explain the mechanism of international trade which is how countries exchange goods and services with each other. International trade theories help countries in deciding what should be imported and what should be exported, in what quantity, and with whom trade should be done internationally. Initially, economists developed international trade theories on the basis of the country which were termed - Classical Theories. However, these theories, later on, shifted from country-based to firm or company based by the mid-twentieth century which were termed - Modern Theories.

The founders of the various theories of the classical country-based approach were mainly concerned with the fact that the priority should be increasing the wealth of one’s own nation. They were mainly of the view that focus should be on economic growth on a priority basis. The main classical theories in reference to international trade are discussed below.

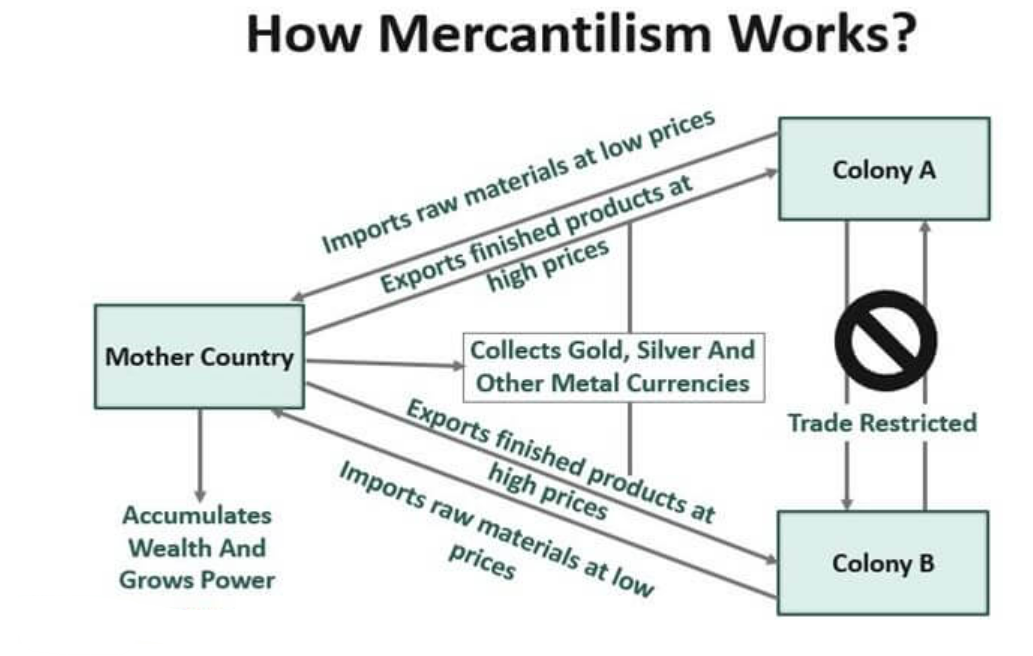

The Mercantilism theory is the first classical country-based theory, which was propounded around the 17-18th century. The Theory is focused on the motto that, on a priority basis, a country must look after its own welfare and therefore, expand exports and discourage imports. The theory also propounded the view that the first thing a nation must focus on is the accumulation of wealth in the form of gold and silver, thus, strengthening the treasure of the nation.

In the 17th-18th Century, the wealth of the nation only consisted of gold or other kinds of precious metals so the theorists suggested that the countries should start accumulating gold and other kinds of metals more and more. The European Nations started doing so. Mercantilists, during this period, stated that all these precious stones denoted the wealth of a nation, they believed that a country will strengthen only if the nation imports less and exported more. They said that this is a favorable balance of trade and that this will help a nation to progress more.

History is evident that by implementing this theory, many nations benefited by strictly following the theory of Mercantilism. Various studies done by economists prove why this theory flourished in the early period. In the early period, i.e., around 1500, new nations and states were emerging and the rulers wanted to strengthen their country in all possible ways, be it the army, wealth, or other developments. The rulers witnessed that by increasing trade they were able to accumulate more wealth and, thus, certain countries became very strong because of the massive amount of wealth they stored. The rulers were focused on increasing the number of exports as much as possible and discouraging imports. The British Imperialist is the perfect example of this theory. They utilized the raw materials of other countries by ruling over them and then exporting those goods and other resources at a higher price, accumulating a large amount of wealth for their own country.

This theory is often called the protectionist theory because it mainly works on the strategy of protecting oneself. Even in the 21st century, we find certain countries that still believe in this method and allow limited imports while expanding their exports. Japan, Taiwan, China, etc. are the best examples of such countries. Almost every country at some point in time follows this approach of protectionist policies, and this is definitely important. But supporting such protectionist policies comes at a cost, like high taxes and other such disadvantages. Import restrictions lead to higher prices of goods and services. Free-trade benefits everyone, whereas, mercantilism's protectionist policies only profit select industries.

Limitations

In 1776, the economist Adam Smith criticised the theory of mercantilism in his publication, “The Wealth of Nations”, and propounded the theory of Absolute advantage. Smith firmly believed that economic growth in reference to international trade firmly depends on specialization and division of labour. Specialisation ensures higher productivity, thereby increasing the standard of living of the people of the country. He proposed that the division of labour in small markets would not cater for specialization, which would otherwise become easy in the case of larger markets. This increase in size fostered a more refined specialisation and thus increased productivity all around the globe.

Smith’s theory proposes that governments should not try to regulate trade between countries, nor should they restrict global trade. His theory also encapsulated the consequences of the involvement and restraint of the government in free trade. Also, he firmly believed that it is the standard of living of the residents of a country that should determine the country’s wealth and the amount of gold and silver that a country’s treasure has. He states that trading should depend on market factors and not the government’s will. He stated that trade should flow naturally according to market forces.

Smith was firmly against the mercantilist theory, and he argued that diminishing importation and just focusing on exports was not a great idea, and thus restricting global trade is not what needs to be done. He proposed that even though we might succeed in forcing our country’s people to buy our own goods, however, we may not be able to do so with foreigners, and hence it is better that we make it a two-way trade and just focus on exports.

In relation to the restrictions imposed on import, Smith stated that even though the restrictions on import may benefit some domestic industries and merchants when looked at from a broad spectrum, it will result in decreasing competition. Along with this, it will increase the monopoly of some merchants and companies in the market. Another disadvantage is that the increase in the monopoly will cause inefficiency and mismanagement in the market.

Smith completely denied the promotion of trade by the government and restrictions on free trade. He reiterated that it is wasteful and harmful to the country. He proposed that free trade is the best policy for trading unless, otherwise, some unfortunate or uncertain situations arise.

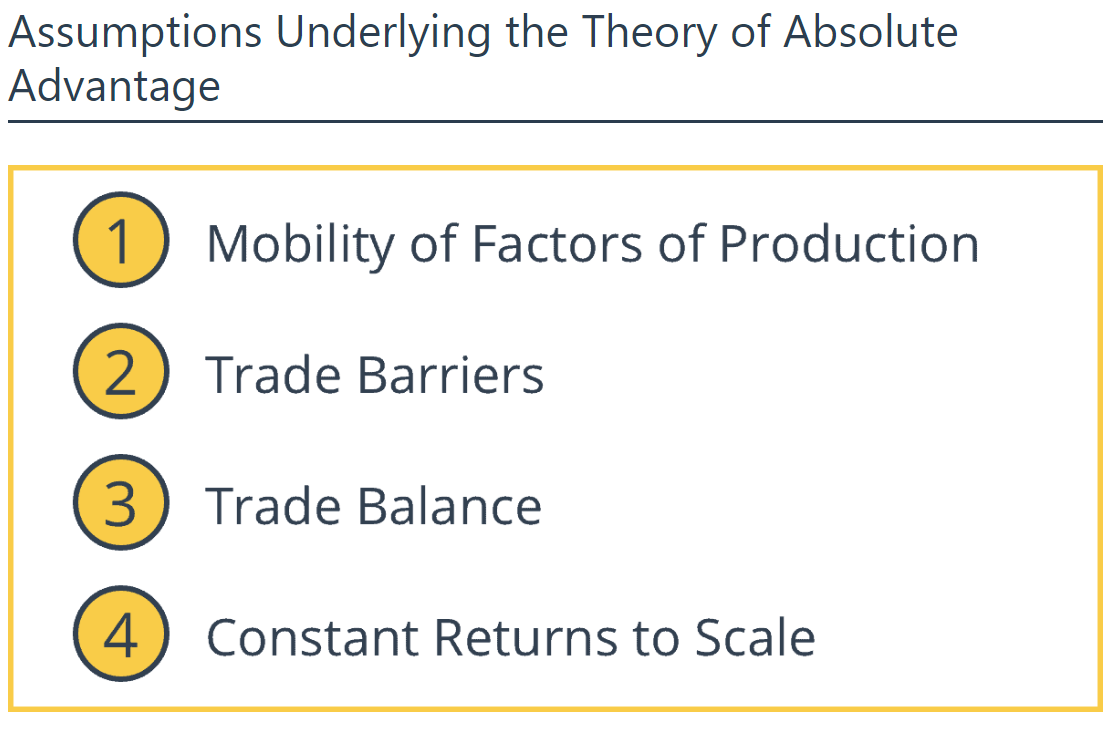

The idea of absolute advantage rests on a number of assumptions on the part of Adam Smith. While influential and insightful, the theory of absolute advantage is not always entirely accurate because many of these fundamental assumptions are in fact not true in practice. Here are the most significant of these assumptions:

Adam Smith assumes that factors of production cannot move between countries. This assumption also implies that the Production Possibility Frontier of each country will not change after the trade.

There are no barriers to trade for the exchange of goods. Governments implement trade barriers to restrict or discourage the importation or exportation of a particular good.

Smith assumes that exports must be equal to imports. This assumption means that we cannot have trade imbalances, trade deficits, or surpluses. A trade imbalance occurs when exports are higher than imports or vice versa.

Adam Smith assumes that we will get constant returns as production scales, meaning there are no economies of scale. For example, if it takes 2 hours to make one loaf of bread in country A, then it should take 4 hours to produce two loaves of bread. Consequently, it would take 8 hours to produce four loaves of bread.

However, if there were economies of scale, then it would become cheaper for countries to keep producing the same good as it produced more of the same good.

Absolute Advantage Example

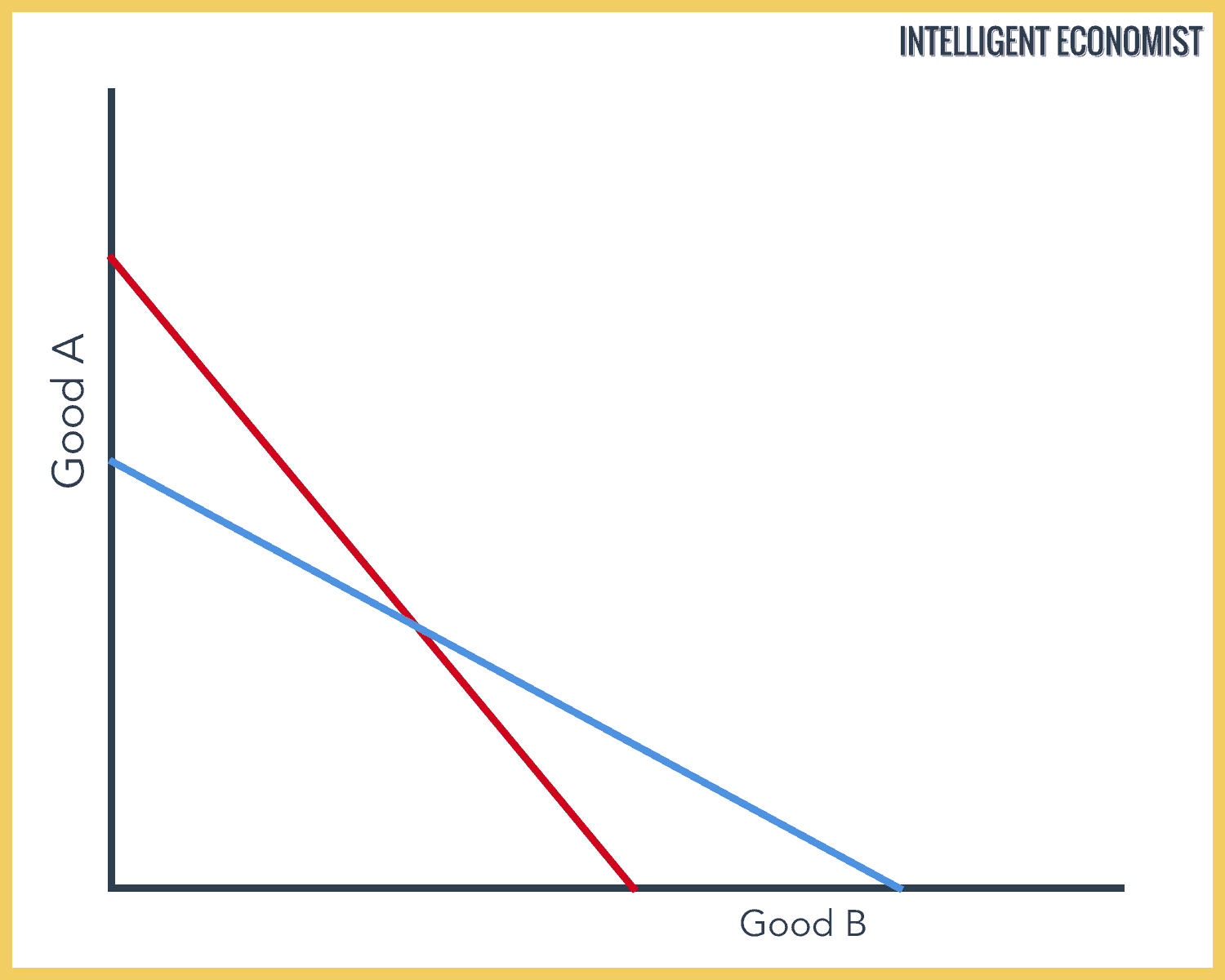

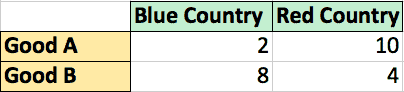

In our absolute advantage example, we assume that there are two countries, which are represented by a blue and red line. They are called Blue Country and Red Country respectively.

To keep things simple, we also assume that only two goods are produced. They are Good A and Good B. From the table below, we can determine how many hours it takes to create one product.

Consider this table, which gives hours required to produce one unit of Good A and Good B by Blue and Red country:

The Blue country has an Absolute Advantage in the production of Good A (2 hours). Blue county has an absolute advantage because it takes fewer hours to produce a unit of Good A than Red country, which takes 10 hours.

Red Country takes fewer hours to produce Good B (4 hours). Therefore Red Country has an Absolute Advantage in the production of Good B.

As a result, Blue Country will be better off if it specializes in the production of Good A.

Red Country will be better off if it specializes in Good B.

As we can see from our example, it makes sense for businesses and countries to trade with one another. All countries engaged in open trade benefit from lower costs of production.

The theory of comparative advantage flourished in the 19th century and was propounded by David Ricardo in his book ‘Principles of Political Economy and Taxation’ in 1817. This theory strengthened the understanding of the nature of trade and acknowledges its benefits. The theory suggests that it is better if a country exports goods in which its relative cost advantage is greater than its absolute cost advantage when compared with other countries.

For instance, let’s take the examples of Malaysia and Indonesia. Let’s say Indonesia can produce both electrical appliances and rubber products more efficiently than Malaysia. The production of electrical appliances is twice as much as that of Malaysia, and for rubber products, it is five times more than that of Malaysia. In such a condition, Indonesia has an absolute productive advantage in both goods but a relative advantage in the case of rubber products. In such a case, it would be more mutually beneficial if Indonesia exported rubber products to Malaysia and imported electrical appliances from them, even if Indonesia could efficiently produce electrical appliances too.

What Ricardo proposed is that even though a country may efficiently produce goods, it may still import them from another country if a relative advantage lies therein. Similar is the case with export, even if a country is not very efficient in certain goods from other countries, it may still export that product to other countries. This theory basically encourages trade that is mutually beneficial.

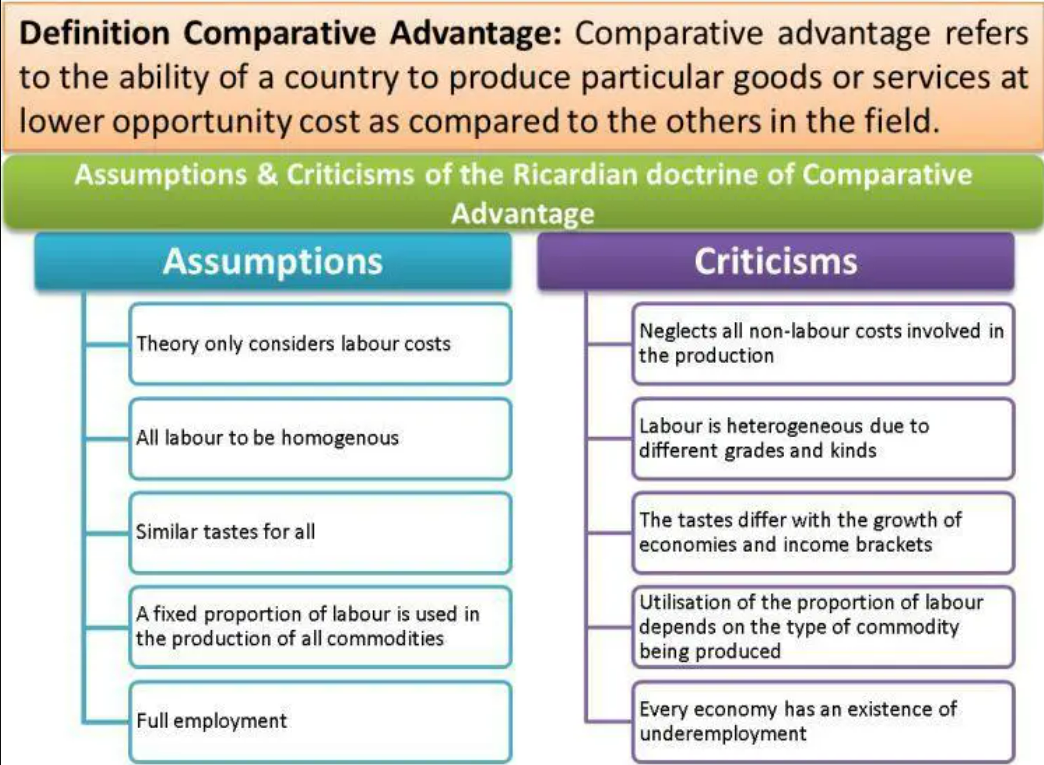

Assumptions of Comparative Advantage

The following are the assumptions of the Ricardian doctrine of comparative advantage:

Criticisms of Comparative Advantage

The following are the criticisms of the Ricardian doctrine of comparative advantage:

Takeaway

Despite weaknesses, The Ricardian theory of comparative advantage has remained significant over the years. The basic structure of the theory still exists with a few refinements. It is believed that a nation that neglects this theory may have to pay a heavy price in terms of the potential rate of growth and living standards.

The theories founded by Smith and Ricardo were not efficient enough for the countries, as they could not help the countries determine which of the products would benefit the country. The theory of Absolute Advantage and Comparative Advantage supported the idea of how a free and open market would help countries determine which products could be efficiently produced by the country. However, the theory proposed by Heckscher and Ohlin dealt with the concept of comparative advantage that a country can gain by producing products that make use of the factors that are present in abundance in the country. The main basis of their theory is on a country’s production factors like land, labour, capital, etc. They proposed that the approximate cost of any factor of resource is directly related to its demand and supply. Factors which are present in abundance as compared to demand will be available at a cheaper cost, and factors which are in great demand and less availability will be expensive. They proposed that countries produce goods and export the ones for which the resources required in their production are available in a much greater quantity. Contrary to this, countries will import goods whose raw materials are in shorter supply in their own country as compared to the one from which they are importing.

For example, India has a large number of labourers, so foreign countries establish industries that are labour-intensive in India. Examples of such industries are the garment and textile industries.

The core premises of the Heckscher-Ohlin model are;

Real World Example of the Heckscher-Ohlin Model

The Heckscher-Ohlin Model can be studied extensively in the real-world trade between different countries. For example, while some countries are the largest exporters of oil and petroleum products, some have coal in abundance, some cotton, some precious metals, while others have agricultural products in abundance. The Heckscher-Ohlin model explains the imbalance of natural resources throughout the world and gives an explanation of why countries export the resource they have at most. For example, OPEC countries are the largest exporters of oil, this does not mean they do not have other natural resources such as coal, metal, and others, but they have oil reserves in abundance, wherein lies their strength. The Heckscher-Ohlin model also amplifies the benefits of international and how exporting resources that are naturally abundant in some countries help other countries.

The emergence of modern or firm-based theories is marked after period of World War II. The founders of these theories were mainly professors of business schools and not economists. These theories majorly came up after the rising popularity of multinational companies. The Country based classical theories were mainly focused on the country, however, the modern or firm-based theories address the needs of companies. The following are the modern or firm-based theories propounded by various business school professors:

Steffan Linder, a Swedish economist, was the founder of this theory. The theory marked its emergence in the year 1961 and explained the concept of in-train industry trade. Linder suggested that countries that are in a similar phase of development will probably have similar preferences. The suggestion proposed by Linder was that companies first produce goods for their domestic consumption and later expand production, thereby exporting those products to other countries where customers have similar preferences. Linder suggested that most of the trade in manufactured goods, in most circumstances, will be between countries with similar per capita incomes, and that the in-train industry trade will thus be common among them. This theory is generally more applicable in understanding trade where buyers mainly decide on the basis of brand names and product reputations.

This theory was propounded by Raymond Vernon, a business professor at Harvard Business School, in the 1960s. The theory that originated in the field of marketing proposed that a product life cycle has three stages, namely, new product, maturing product, and standardized product. The theory assumed that production of the new product will occur completely in the home country of its innovation. In the 1960s this was a useful theory to explain the manufacturing success of the United States. US manufacturing was the globally dominant producer in many industries after World War II.

It has also been used to describe how the personal computer (PC) went through its product cycle. The PC was a new product in the 1970s and developed into a mature product during the 1980s and 1990s. Today, the PC is in the standardized product stage, and the majority of manufacturing and production process is done in low-cost countries in Asia and Mexico.

The product life cycle theory has been less able to explain current trade patterns where innovation and manufacturing occur around the world. For example, global companies even conduct research and development in developing markets where highly skilled labor and facilities are usually cheaper. Even though research and development is typically associated with the first or new product stage and therefore completed in the home country, these developing or emerging-market countries, such as India and China, offer both highly skilled labor and new research facilities at a substantial cost advantage for global firms. The theory has a presumption that the production of a new product will completely arise in the country where it was invented. This theory, up to a good extent, helps in explaining the sudden rise and dominance of the United States in manufacturing. This theory also explained the stages of computers, from being in the new product stage in the 1970s and thereby entering into their maturing stage in the 1980s and 1990s. In today’s scenario, computers are in a standardized stage and are mostly manufactured in low-cost countries in Asia. However, this theory has not been able to explain the current trading pattern where products are being invented and manufactured in almost all parts of the world.

Paul Krugman and Kelvin Lancaster were the founders of this theory. This theory emerged around the 1980s. The theory majorly focused on multinational companies and their strategies and efforts to gain a comparative advantage over other similar global firms in their industry. This theory acknowledges the fact that firms will face global competition and prove their superiority. They must surely develop a competitive advantage over each other. The ways through which the firms can gain competitive advantage were termed as barriers to entry for that particular industry. These barriers are basically the obstacles that a firm will face globally when they enter the market. The barriers that companies and firms may try to optimise are

The theory emerged in the 1990s with the aim of explaining the concept of national competitive advantage. The theory proposes that a nation’s competitiveness majorly depends upon the capability and capacity of the industry to come up with innovations and upgrades. This theory attempted to explain the reason behind the excessive competitiveness of some nations as compared to others. The main determinants proposed in this theory were local market resources and capabilities, local market demand conditions, local suppliers and complementary industries, and local firm characteristics. The theory also mentioned the crucial role of government in forming the competitive advantage of the industry.

In the continuing evolution of international trade theories, Michael Porter of Harvard Business School developed a new model to explain national competitive advantage in 1990. Porter’s theory stated that a nation’s competitiveness in an industry depends on the capacity of the industry to innovate and upgrade. His theory focused on explaining why some nations are more competitive in certain industries. To explain his theory, Porter identified four determinants that he linked together.

The four determinants are

(1) local market resources and capabilities,

(2) local market demand conditions,

(3) local suppliers and complementary industries, and

(4) local firm characteristics.

In addition to the four determinants of the diamond, Porter also noted that government and chance play a part in the national competitiveness of industries. Governments can, by their actions and policies, increase the competitiveness of firms and occasionally entire industries.

Porter’s theory, along with other modern, firm-based theories, offers an interesting interpretation of international trade trends. Nevertheless, they remain relatively new and minimally tested theories.

Conclusion

For years, theories concerning international trade have been the subject of intense research and debate. Growing international trade has its own pros and cons. The analysis of the system of international trade by way of various theories has enabled a systematic framework for better understanding. International trade contributes to the economic growth of a country, thereby increasing the standard of living of its people, creating employment opportunities, a greater variety of choices for consumers, etc. The development of trade theories has seen a major shift from the view of restricting free trade as stated in the theory of mercantilism to the various modern theories providing a better understanding to facilitate smooth international trade with increasing benefits.

Citations

http://bgc.ac.in/pdf/study-material/International-Trade.pdf

https://www.economicshelp.org/blog/58802/trade/the-importance-of-international-trade/

https://corporatefinanceinstitute.com/resources/knowledge/economics/international-trade/

https://learn.saylor.org/mod/book/view.php?id=32092&chapterid=10524

Horvat, B. (1999). The Evolution of International Trade Theory. In: The Theory of International Trade. Palgrave Macmillan, London

https://efinancemanagement.com/international-financial-management/comparative-advantage

© 2024 iasgyan. All right reserved