Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

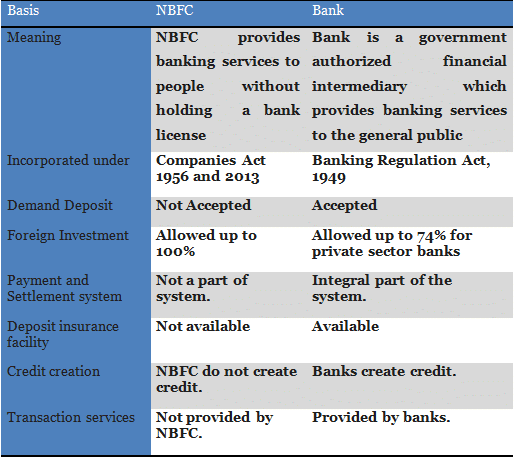

NBFC is a company incorporated as per the Companies Act,2013, or any other previous act. NBFC is governed by both the Ministry of Corporate Affairs and the RBI. Though NBFC provides financial services, it is different from Banks in many ways. It cannot accept public deposits by allowing people to open savings/current accounts with it.

However, NBFCs can receive deposits under any arrangement or scheme in one lump sum or regular contributions or some similar method. An NBFC, also, cannot issue cheques and drafts, drawn on itself.

NBFCs provide credit and loans at the micro-level. That is mainly to small, medium scale enterprises, to help them overcome their liquidity cash insufficiency.

Through its Personalized Customer Services, Implementation of Advance technology, and Customized Loan Product, NBFC helps in providing finance to the economically weaker section of the society.

There are a few requirements that the business has to meet before applying to RBI for NBFC License.

The expansion and growth of the NBFC have resulted in the categorization of NBFCs, predetermined to focus on specific sectors/classes. The classification of NBFC is based on deposits, and the kind of business activity is performed.

There are certain businesses that are involved in providing financial activities but do not need to obtain a registration with RBI. These types of entities are regulated by other financial sector regulators, and to avoid dual regulation, they are not required to obtain an NBFC License from RBI. They are:

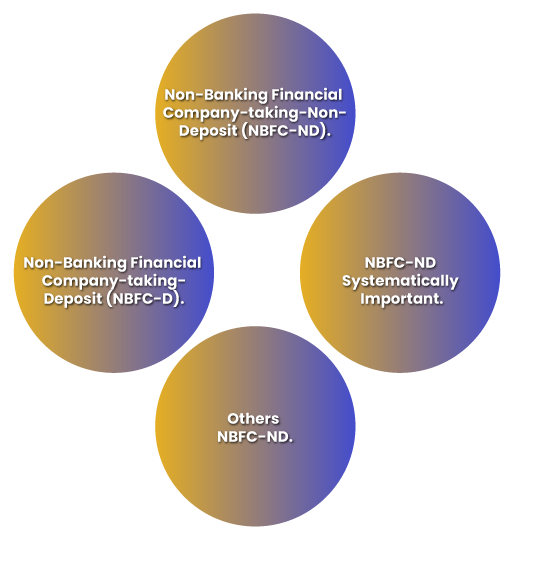

The NBFCs can be categorised under two broad heads:

1. On the nature of their activity

2. On the basis of deposits

The different types of Non-Banking Financial Corporations or NBFCs are as follows:

Further, NBFC-ND Non-Deposit taking Non-Banking Financial Company is sub-categorized into 2 parts-

Deposit Accepting NBFC Meaning

Deposit Accepting NBFCs must get themselves registered with RBI as per the provisions in the RBI Act, 1934. They need a Certificate of Registration (CoR) from the RBI. And there are additional guidelines and specific regulations prescribed by RBI for them.

Non-Deposit Accepting NBFC Meaning

Non-Deposit Accepting NBFCs also need to get registered themselves. The only difference is additional guidelines do not apply to them.

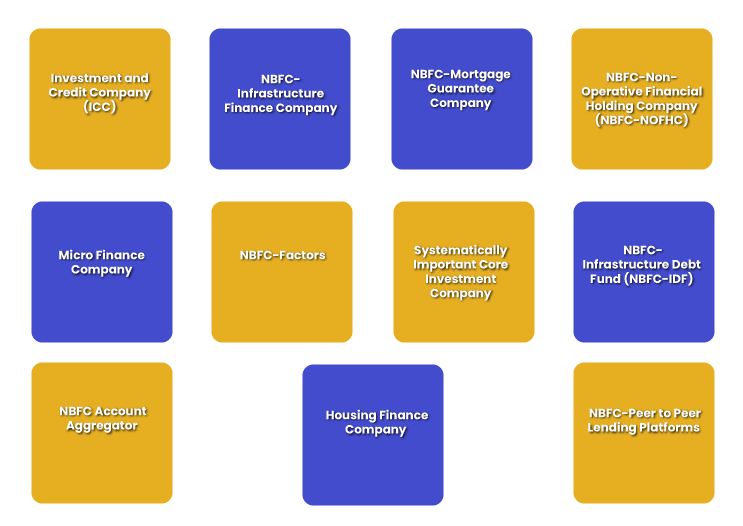

Within the above broad categorization, the NBFCs can, be further, broadly divided into:

Asset Finance Company (AFC): The financial institution (FI) with the primary business of financing physical assets.

Investment Company (IC): An FI engaged in the acquisition of securities, as its principal business.

Loan Company (LC): An FI providing finance, as its principal business. The business activity is to make loans or advances or otherwise for any venture other than its own but does not include an Asset Finance Company.

Infrastructure Finance Company (IFC): An NBFC-IFC meaning is a company which:

In a nutshell, Classification on the nature of their activity:

Based on business activity, there are different types of NBFCs

Investment and Credit Company

Investment and Credit Company is a company carrying on its principal business-asset finance the providing finance whether by making loans or advances or otherwise for any activity other than its own and the acquisition of securities.

Infrastructure Finance Company

Infrastructure Finance Company is a company that utilizes at least 75 % of its total assets in the infrastructure loans. An IFC company has a minimum net owned fund of Rs 300 crores and a CRAR of 15%. It is a type of NBFC which requires the best credit rating from the credit rating agencies.

Mortgage Guarantee Company

Mortgage Finance Company is the Non-Banking Financial Company whose-

NBFC-Non-Operative Financial Holding Company

Through Non-Operative Financial Holding Company, a promoter/promoter groups will be authorized to set up a new bank. It is a type of NBFC which will hold the bank as well as all other financial companies regulated by RBI or other financial sector regulators, to the extent allowed under the applicable regulatory prescriptions.

Micro Finance Company

Micro Finance Companies in NBFC, are the companies that perform the functions as similar to Banks. Loans are offered by the Micro Finance companies to various small businesses that do not have access to the formal banking channels and are not eligible for availing loans. MFI shall qualify the following criteria –

NBFC Factors

NBFC-Factor is a different type of NBFC (Non-deposit taking) engaged in the principal business of factoring. The financial assets in the NBFC Factor (Factoring business) should aggregate at least 50 % of its total assets, and also income acquires from factoring business should at least 50 % of the gross income.

Systematically Important Core Investment Company

Systematically Important Core Investment Company is a type of NBFC which carry on the business of share (Equity and Preference) and securities acquisition but subject to a condition that –

it holds not less than 90% of its Total Assets as an investment in equity or preference shares, and debt or loans in group companies.

It should be noted systematically. Important Core Investment Companies do accept public funds.

Infrastructure Debt Fund NBFC

Infrastructure Debt Fund NBFC is a non-deposit taking NBFC that deals in the facilitation of long-term debt into an infrastructure sector. Infrastructure Debt Fund NBFC raises the resources either through an issue of the rupee or dollar-denominated bonds of 5 years. IDF NBFCs can only be sponsored by Infrastructure Finance Company.

Note – The maturity period is of 5 years.

NBFC Account Aggregator

NBFC Account Aggregator is a new concept in the NBFC. NBFC Account Aggregator provides data of several users and shifts their financial needs to various financial organizations. The activities of an Account Aggregator involve providing customers financial information in a consolidated and retrievable manner to the customer. NBFC Account Aggregator provides reliable information.

NBFC Peer to Peer Lending Platforms

NBFC Pear to Peer lending platforms provides a platform to bring lenders and borrowers together by using a digital platform. It provides an opportunity for investors to diversify their portfolio. NBFC P2P has removed the cumbersome process of loan and has provided the ease of processing the loans. NBFC P2P Platform is the key player in the small business sector.

Housing Finance Company

Housing Finance Company is a form of NBFC with the principal business of financing of acquisition or construction of houses. HFCs are regulated by the Reserve Bank of India. A Housing Finance company cannot commence the business without obtaining a certificate of registration (CoR) from the Reserve Bank of India.

© 2024 iasgyan. All right reserved