Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

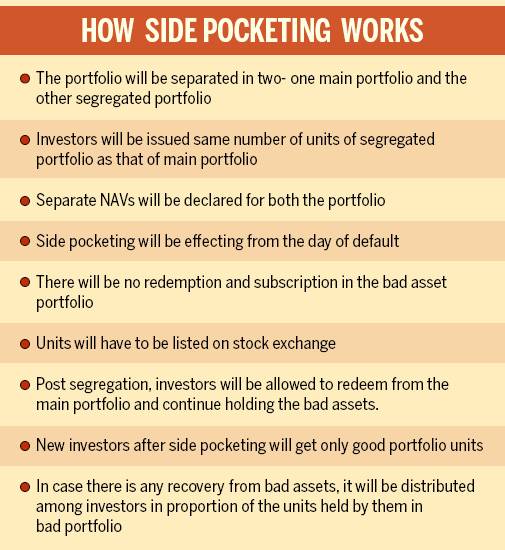

Side-pocketing is an accounting method that allows mutual funds to segregate the portfolio into two, separating the bad assets (illiquid assets) from the good ones (liquid assets).

Simply put, side pocketing is a framework that allows mutual funds to segregate the bad assets in a separate portfolio within their debt schemes.

This mechanism, therefore, segregates the affected portion of the portfolio in two asset pools so that the fund can continue to operate in a normal manner.

Accordingly, the mutual fund calculates two net asset value (NAV) for the same scheme by differentiating good and liquid assets from troubled and illiquid assets.

The Securities and Exchange Board of India (SEBI) introduced the framework in 2019 — primarily triggered by the IL&FS fiasco. It had realized that many fund houses have huge exposure to troubled entities and could potentially take a huge hit on their net asset value thereby affecting investor returns.

Mutual funds are allowed to use the side-pocketing option only when the rating agency has downgraded the debt paper 'below investment grade' or even lower.

In other words, if a debt instrument is downgraded to default rating by credit rating agencies, then the fund house has the option to create a side pocket so that good assets can be ring-fenced.

Side pocketing segregates the bad assets from the good ones.

It prevents panic redemption by investors and ring-fences liquid assets.

Side-pocketing also prevents the fund house from selling liquid papers to meet redemption requests.

Also, investors who take the hit in side-pocketing get the full upside of future recovery when the credit event happens.

By means of side-pocketing, mutual funds ensure that all existing investors are equally exposed to the fund’s entire portfolio and treated in an equitable and equal manner with reference to redemption and subscription requests.

All existing investors in the scheme are allotted equal number of units in the segregated portfolio as held in the main portfolio and no redemption or subscription is allowed in the segregated portfolio.

Thereafter, the units have to be listed on a stock exchange within 10 days to facilitate exit of the unit holders.

Effectively, this makes the price discovery of the bad assets through a transparent procedure. Investors have the freedom of either selling it at prevailing price or holding it if they expect the value to recover in future.

Note: In case of a rating downgrade, the fund pushes illiquid assets into a side pocket and its existing holders receive a pro rata allocation in it.

The side pocket ensures that only investors, who were in it at the time of the write off, will get the benefit of any future recovery from the bond.

A side pocket ensures that liquidity is not choked for investors holding the units of the main scheme because allotment and redemption happen on more liquid assets.

When side pocketing was introduced, a section of market participants felt that it could be misused by fund houses to hide their bad investment decisions.

Possible abuse of side-pocketing by the manager to move poorly performing investments into side-pockets in order to protect his management fees may be possible. Sometimes side-pockets may raise disclosure and investor distrust issues. Further, transparency and disclosure obligations to the investors may act to compromise the fund’s competitiveness.

SEBI, however, has put in place checks and balances to minimize any such misuse.

The regulator has said that trustees of all fund houses will have to put in place a framework that would negatively impact the performance incentives of fund managers, etc. involved in the investment process of securities under the segregated portfolio.

So, fund managers know that any creation of such side pocket in the future would also affect their own appraisals and incentives.

Further, SEBI has also said that side pocket should not be looked upon as a sign of encouraging undue credit risks as any misuse of the option would be considered serious and stringent action can be taken.

© 2024 iasgyan. All right reserved