Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

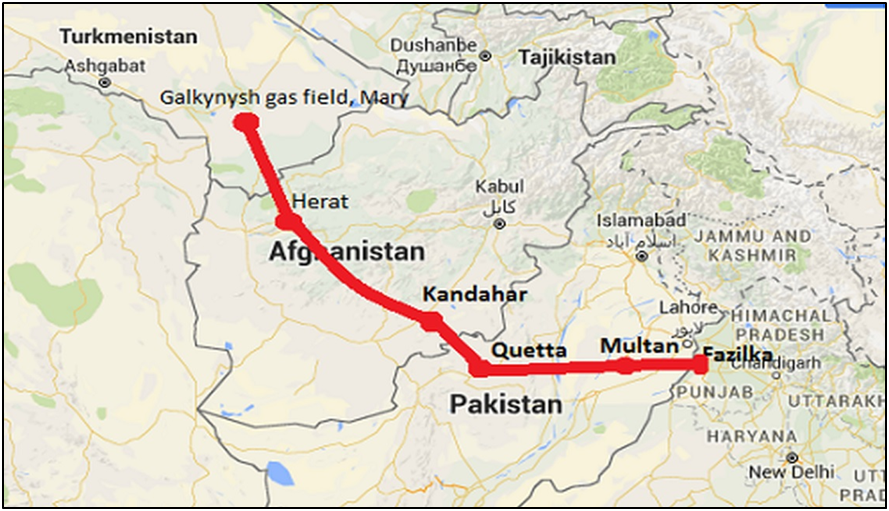

The Turkmenistan–Afghanistan–Pakistan–India (TAPI) Pipeline, also known as Trans-Afghanistan Pipeline, is a natural gas pipeline being developed by the Galkynysh – TAPI Pipeline Company Limited with participation of the Asian Development Bank.

The pipeline will transport natural gas from the Galkynysh Gas Field in Turkmenistan through Afghanistan into Pakistan and then to India. Construction on the project started in Turkmenistan on 13 December 2015, work on the Afghan section began in February 2018, and work on the Pakistani section was planned to commence in December 2018. The abbreviation TAPI comes from the first letters of those countries. Proponents of the project see it as a modern continuation of the Silk Road.

As of 2022, construction of the pipeline remains stalled.

If completed the 1,814-kilometer gas pipeline will pass through Afghanistan to Pakistan and India. The TAPI gas pipeline will transport gas produced from the Galkynysh gas field in Turkmenistan to Afghanistan, Pakistan and India.

The pipeline will start from Mary region of Turkmenistan and cover a total distance of 214km up to Afghanistan. The Afghanistan section will be built along the highway.

The pipeline will run through Kandhar and Herat highway in Afghanistan, for a length of 774km. It will cover 826km in Pakistan, across the cities of Quetta and Multan, finally terminating in Fazilka at the Indo-Pakistan border in Punjab region, India.

The TAPI project is being funded by the Asian Development Bank (ADB), which is also acting as transaction adviser for the development.

The pipeline is expected to facilitate a unique level of trade and co-operation across the region, while also supporting peace and security between the four nations.

More than 1.5 billion people in Afghanistan, Pakistan, and India are expected to benefit from the long-term energy security provided by the project.

In addition, the project is expected to boost the revenues of Turkmenistan via the sale of gas.

Afghanistan and Pakistan will also receive benefits through transit fees.

Political instability and violence in Afghanistan, however, stalled its progress after a groundbreaking ceremony was held in Serhetabad in Turkmenistan in February, 2018.

India’s approach to TAPI positions Turkmenistan as a crucial nexus for its connectivity with Central Asia as a whole. Equally, for landlocked Turkmenistan, the much anticipated TAPI pipeline represents an opportunity to find alternative export partners and one that comes with few strings attached.

The TAPI pipeline represents a small but important step away from coal in regions primed for economic growth. Residents of Mumbai, Karachi, Delhi, and Islamabad may get some relief from the respiratory diseases associated with air pollution.

The TAPI pipeline’s significance extends beyond energy security and into the geopolitical. TAPI may contribute to regional stability as Afghanistan, Pakistan, and India experience higher degrees of energy security.

India is world's third largest energy consumer and fourth largest importer of Liquefied natural gas and India's energy requirement is increasing steadily.

According to BP Energy Outlook 2035, India will account for 9% of world energy consumption, while its share in global production will remain at 5%. In the same period, natural gas demand will increase by 131% and domestic natural gas production will be far from meeting consumption. For this reason, India's natural gas imports are expected to quadruple by 2040. This emerging and future energy gap explains India's interest in TAPI and the importance of the project for India.

Moreover, the project has the particular advantage of providing an entry point to Central Asia, enabling future energy deals or similar pipelines to be concluded with this energy-rich region. This is a very important factor for a large economy with a large population like India. In addition, the pipeline could lead to the creation of a trade corridor between the four countries, stretching as far as Kazakhstan.

TAPI Gas Pipeline will transform the politics of this region and help build trust and confidence among ourselves as neighbours and partners in progress

India has concerns relating to the safety of the pipeline and safe transit of gas through restive areas in Afghanistan and Pakistan.

India strongly feels that these key issues need to be addressed to make this a win-win project.

International North-South Transport Corridor (INSTC) is a multi-modal transportation for the purpose of promoting transportation cooperation among the Member States. It was established on September 12, 2000, by Iran, Russia and India. It is a 7,200-km-long multi-mode network of ship, rail, and road route for moving freight between India, Iran, Azerbaijan, Russia, Central Asia and Europe.

The route primarily involves moving freight from India, Iran, Azerbaijan and Russia via ship, rail and road. The main purpose of the corridor was to reduce carriage costs and transit time between India and Russia. Another objective of the corridor is to increase trade connectivity between major cities such as Mumbai, Moscow, Tehran, Baku, Bandar Abbas, Astrakhan, Bandar Anzali, etc.

Dry runs of two routes were conducted in 2014, the first was Mumbai to Baku via Bandar Abbas and the second was Mumbai to Astrakhan via Bandar Abbas, Tehran and Bandar Anzali.

This corridor connects India Ocean and Persian Gulf to the Caspian Sea via Iran, Islamic Rep., and is then connected to Saint Petersburg and North European via Russia.

INSTC will also synchronize with the Ashgabat agreement, a Multimodal transport agreement signed by India (2018), Oman (2011), Iran (2011), Turkmenistan (2011), Uzbekistan, (2011) Kazakhstan (2015), for creating an international transport and transit corridor facilitating transportation of goods between Central Asia and the Persian Gulf.

Armenia ;

Azerbaijan ;

Belarus ;

Bulgaria ;

India ;

Iran, Islamic Republic of ;

Kazakhstan ;

Kyrgyz Republic ;

Oman ;

Russian Federation ;

Syrian Arab Republic ;

Tajikistan ;

Turkey ;

Ukraine

India supports the corridor to reduce transit cost and time. Europe-bound shipments that take 45-60 days to reach Europe, via Suez Canal, can be delivered in 23 days using INSTC.

The corridor will improve India’s economic engagement with gulf countries like Iran and Iraq. India has also been pushing for boosting regional connectivity. It is already working with Iran to develop the Chabahar port.

India has proposed to include the port in the framework of the INSTC. The Chabahar Port is a key regional transit hub including Afghanistan.

Also, the route may help India is fulfilling its energy needs. The improved connectivity along with RBI's latest rupee settlement announcement may help the country import oil from Iran. Once a leading importer of Iranian oil, India stopped buying the commodity after the USA imposed sanctions on Iran in 2018.

India may also provide humanitarian aid to crisis-stricken Afghanistan through INSTC.

For India, it provides a shorter trade route with Iran, Russia, and beyond to Europe, creating scope for increased economic engagement and direct trade opportunities with untapped markets in Central Asia and the Balkans. When looked at in sync with the Ashgabat Agreement, the INSTC could be the key to India’s “Connect Central Asia’’ policy.

It will help develop India’s economic and strategic importance in Eurasia and Central Asia.

A transport corridor like the INSTC is necessary to facilitate transit and increase market access. If India is to counter China’s BRI, something as big as INSTC is necessary.

The INSTC spirals across the following corridor:

India has proposed the inclusion of the India-invested Chabahar Port in Iran within the scope of the INSTC, which has traction among Central Asian countries as well. India had also backed the extension of membership to Afghanistan and Uzbekistan and envisaged an “eastern corridor” comprising a land route between Kabul (Afghanistan) and Tashkent (Uzbekistan). Chabahar port holds significance for India as it helps India bypass its fractious neighbour Pakistan, which has blocked India’s access to Afghanistan and other landlocked Central Asian Region (CAR) countries. Chabahar is also often pitted against the China-invested Gwadar port in Pakistan. Meanwhile, the Iranian government has invited China and Pakistan to consider the integration of Gwadar into the INSTC, calling it Chabahar’s “twin sister”.

Central Asia has a major security threat in the form of the Islamic State (IS), a terrorist organization. The issue of differential tariffs and customs in the region is a major challenge that India needs to overcome.

Presently, the trade levels of India with several of the above-mentioned (Commonwealth of Independent States) CIS countries are less than one-per cent, mainly because of a lack of connectivity. However, the bilateral trade relations between India and these countries have been improving. The Indian primary export promotion board also identifies the category of goods that are likely to see a rise in trade given this development. These are, namely:

Trade between Iran and India has deepened despite the sanctions’ impact. India exports rice, machinery and instruments, metals, primary and semi-finished iron and steel, pharmaceuticals and fine chemicals, processed minerals, manmade yarn and fabrics, tea, organic/inorganic/agrochemicals, and rubber-manufactured products to Iran. Over 80% of India’s crude oil imports are from Iran. With India’s growing energy consumption, it can benefit from the untapped hydrocarbon reserves of Iran. Though, India’s bilateral trade with Iran had remained stagnant after 2019, it remains one of Iran’s major oil importers after China. Thus, the development of INSTC will also mean greater energy security for India. INSTC would also augment the bilateral preferential trade agreement under the Global System of Trade Preferences between India and Iran that has been in the pipeline for some years by facilitating connectivity.

India’s exports to Russia in 2021-22 stood at USD 3.25bn while imports were USD 9.87 bn. Major items of export from India include electrical machinery, pharmaceuticals, organic chemicals, iron and steel, apparel, tea, coffee, and vehicle spare parts. Major items of import from Russia include defence equipment, mineral resources, precious stones and metals, nuclear power equipment, fertilizers, electrical machinery, articles of steel, and inorganic chemicals.

The development of this corridor can prove to strengthen the bilateral trade ties between India and Russia, especially with the deterioration of Russia’s relations with Western countries. Currently, India exports mainly primary goods and lower-end manufactured goods to Russia. A deepening of trade relations in the wake of the Ukraine-Russia conflict may provide the opportunity for India to be the exporter of some of the higher value-added goods like aircraft, spacecraft, and electrical machinery, that were earlier imported from the U.S. and Europe.

In the past, the trade volumes between India and Russia had seen a considerable fall, which mostly accounts for the lack of knowledge on the demand in both the economies and the logistical complexities. Though the mere development of this corridor cannot guarantee an acceleration of inter-regional trade, the development of infrastructure in the markets is expected to amplify demand and lead to growth.

The progress of INSTC will also lead to the development of Iran and Azerbaijan as transit hubs and has the potential to lead to a multi-fold increase in trade by expanding it to the Baltic, Nordic and Arctic regions.

Although the construction of the route is underway, the growth is slow due to several geo-political and technical reasons. The infrastructure development is moving slowly because of a lack of political will and long-term financing strategy. The different members of the convention are characterised by their own different legal regimes and transport laws that are not consistent with each other. Along with that, there remain other areas of lacunae like the security of cargo, insurance coverage, regulatory bureaucracy etc.

Currently, the building up of political tensions between India and the trilateral alliance among Pakistan, Azerbaijan and Turkey may significantly impact the development and operations of INSTC. Pakistan and Azerbaijan share a very strong military cooperation with each other. The former also helped Azerbaijan in its military advancements against Armenia. Thus, Azerbaijan is inclined to assist Pakistan, along with Turkey fuelled by religious sentiments, in its war against India for the Indian State of Kashmir. India on the other hand has maintained cordial relations with Armenia over the decades. With all these countries (except Pakistan), being a member of the INSTC arrangement, political unrest and terrorism-led activities can pose a great threat to the trade taking place through this route. This tension can further be augmented with an expected intervention from China which already maintains a contentious relationship with India. However, the development of the corridor could also be a channel to ease such political tensions given all the member countries are collaboratively working to develop the route and its infrastructure indicating the priority they accord to commercial growth. Increased trade among the member states can bring about cordial relations and may even augment the possibility of the development of a new regional block.

Apart from that, a big challenge facing the development of the INSTC is the ongoing political tension between the US and Iran to deter the development of nuclear weapons by Iran. With the US currently holding a dominant position in the financial market, the negative effects faced by Iran in the form of sanctions also impacted the growth of INSTC. Although Europe and other Asian countries have devised means like Instrument in Support of Trade Exchanges (INSTEX) and Asian Clearing Union (ACU) to trade with Iran to skirt the sanctions, political uncertainties may cause disruption to the operationality of the corridor.

The development and operations of the INSTC will benefit the private sector of India. With Asia now projected to account for 66% of the global middle class possessing significant purchasing power, the entry into the new markets, that will be provided by the INSTC routes, is expected to benefit the private players in India. The Indian firms engaged in the production of primary goods in the agriculture sector, textiles, organic chemicals etc. can greatly benefit from this advancement. Not only the manufacturers but the cost savings through the shorter route can bring down the transportation costs of the products and make them more competitive in the market which will eventually lower the costs for the retailers and the consumers as well.

India is one of the major importers of crude oil and edible oil, importing about 70% of its total consumption of Sunflower oil from Ukraine and 20% from Russia. With the geo-political constraints imposed by the Ukraine-Russia war and consequent hike in prices, this commercially cheaper route of transportation provided by INSTC will lead to a lowering of import costs of edible oils like sunflower oil. This will lead to significant cost savings for the Indian corporates importing the same from Ukraine by substituting the exporting country and shipping routes.

This development is likely to benefit conglomerates in the primary goods industry and the port and the marine infrastructure development industry. Apart from that, there are also prospective opportunities for developing the transit corridor into a development corridor with industrial parks and special economic zones to add commercial value to INSTC. Such a development would lead to the building of local logistical hubs at locations like Nagpur and Bhiwandi in Maharashtra. Indian firms that already possess expertise and presence in the domain and the location can utilise this opportunity for the development of infrastructure facilities in Mumbai- the south trail of the corridor.

Even though overland transport routes over a more time-efficient delivery, the shipping liners trump this mode by offering cheap rates particularly due to less demand. With India now focusing on improving its logistics sector with a well-defined policy aiming to develop a logistics hub, it seeks on attracting public-private-partnership. The policy also specifies a more focused approach towards the development of railway and waterway transport. This could serve as a rewarding opportunity for the Big Indian conglomerates in the logistics sector to engage with the government in changing the logistics scenario of the country.

With India now flagging a digital multimodal TIR with Iran to facilitate seamless movement of goods, trade would further be pushed to INSTC. INSTC can become operational at a crucial time in the geo-political scenario. It can put India at a great advantage to utilize its trade opportunities with Iran and Russia and gain access to Europe and Central Asia along the same. The INSTC route will also allow India to bypass Pakistan, which is infamous for having contentious relations with the country. This will open new markets for Indian exports and Indian producers as well as provide a diverse consumer base for the exports of these engaging countries. With the development of infrastructure, many Indian companies would find themselves inclined to exploit the logistical facilities. On the international front, this would greatly facilitate the upcoming bilateral and preferential trade agreements between India and the CIS countries. India has also framed a Comprehensive Logistics Action Plan (CLAP) to revive its logistics sector under the Draft National Logistics Policy. India’s vision for making its logistics sector more time and cost-efficient is greatly aligned with the development of this project. The well-defined action areas under CLAP will resolve the connectivity issues that had obstructed India’s trade with these countries in the past. With increased digitalization and the proposed development of logistics parks under the Master Plan, the NLP will give a boost to this sector.

© 2024 iasgyan. All right reserved