Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

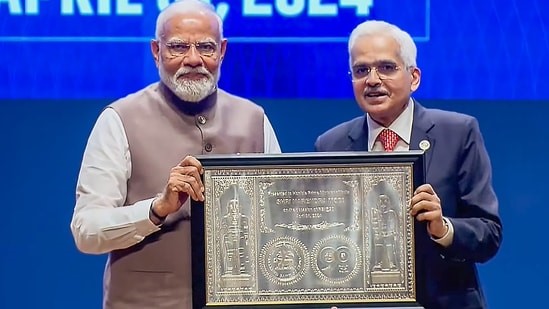

Context

All about RBI

All about RBI's history

ALL ABOUT RBI: https://www.iasgyan.in/daily-current-affairs/rbi

|

PRACTICE QUESTION Q. Discuss the role of the Reserve Bank of India (RBI) in regulating and stabilizing the country's financial system. Highlight its major functions and the challenges it faces in maintaining monetary stability and promoting economic growth. |

© 2024 iasgyan. All right reserved