Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Context

Details

Note:

Why farmers are in distress?

Past Indebtedness

Poverty

Insurance fails to serve

Collapsing farm prices

Land Improvement

Social and Other Obligations

Moneylenders

Bottlenecks in Institutional finance

Irrigation takes a hit

Marketing is ignored

Modern tech missing

Fragmented supply chains

Lack of food processing clusters

Delayed FCI reforms

Low productivity

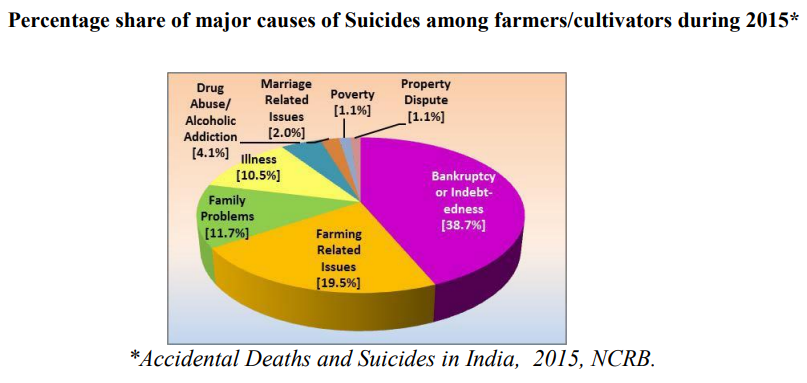

Farmers' Suicide

Initiatives taken to reduce debt burden of farmers

Conclusion

Read about the recommendations in detail here: https://pib.gov.in/newsite/PrintRelease.aspx?relid=114860

https://www.pib.gov.in/PressReleasePage.aspx?PRID=1753856

© 2024 iasgyan. All right reserved