Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

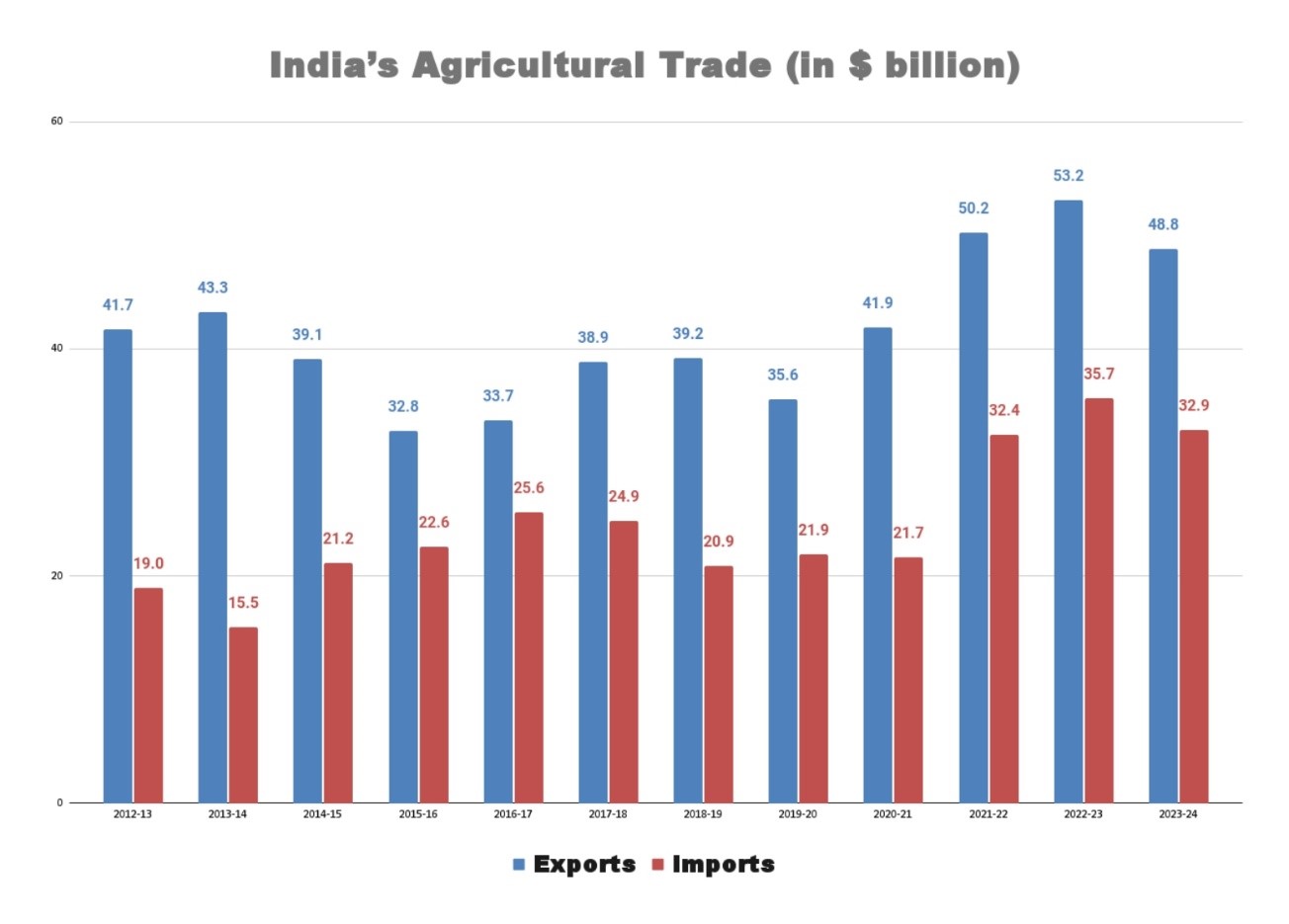

Statistical Data

Historical Context

Global Commodity Market Dynamics

Drivers of Exports

Sugar and Non-Basmati Rice

Sugar Export Restrictions

Non-Basmati Rice Export Restrictions

Wheat and Onion Export Restrictions

Other Export Items

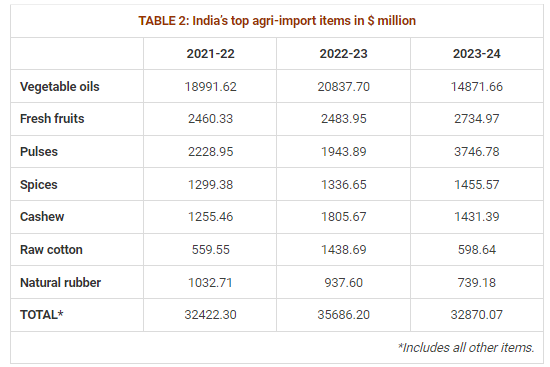

Drivers of Imports

Edible Oils

Pulses

Policy Takeaways

Stability and Predictability

Import Policies

Future directions

|

PRACTICE QUESTION Q. Discuss the trends and challenges associated with India's export sector, highlighting its significance in the country's economic growth and global competitiveness. What measures should be taken to enhance India's export performance in the context of emerging global trade dynamics? |

SOURCE: THE INDIAN EXPRESS

© 2024 iasgyan. All right reserved