Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context:

Background:

Angel Investors:

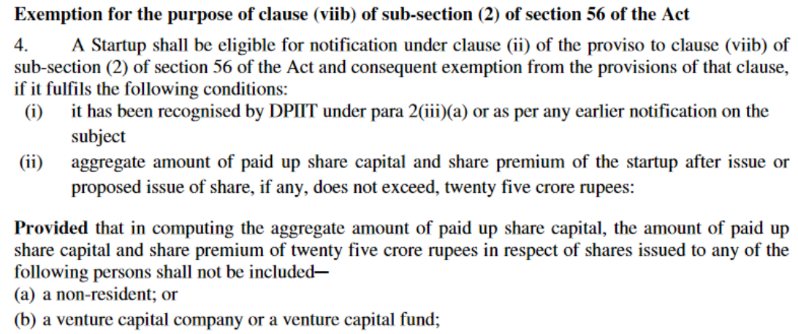

Tax benefits available to an Eligible Start-Up:

What is Angel Tax? Decoded

Definition

Note that angel tax (as of now) is not applicable in the case of investments made by venture capital firms or foreign investors. It’s limited to investments made only by Indian investors.

Description

|

A step to prevent Money Laundering In India, unlike in the US, the angel investor does not get any tax rebate for investment in small businesses. So, people can invest their black money in start-ups and make it legal. Angel tax was introduced to prevent money laundering that might happen in the name of investment. |

|

FAIR MARKET VALUE It’s difficult to determine the fair market value of a start-up. Section 56 of the Income Tax Act 1961 explains how to calculate this value. It may be determined by considering intangible assets like good will, know-how, patents, licences, copyrights, and movable assets. However, this definition brews the discontent among start-ups and the income tax department. Income tax is strictly run by the rule book in India. So, it’s not possible to correctly estimate the projected growth of start-ups while calculating the fair value. |

Implications:

Government’s step:

So, Have These Exemptions Changed In 2023?

The rationale behind the move:

Plausible Implications:

Moving ahead:

|

Mains Model Question Q) What do you understand by the term Angel Tax? The angel tax had been in the news with startups calling it an unfair tax burden. Comment. |

© 2024 iasgyan. All right reserved