Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Copyright infringement not intended

Picture Courtesy: www.wallstreetmojo.com

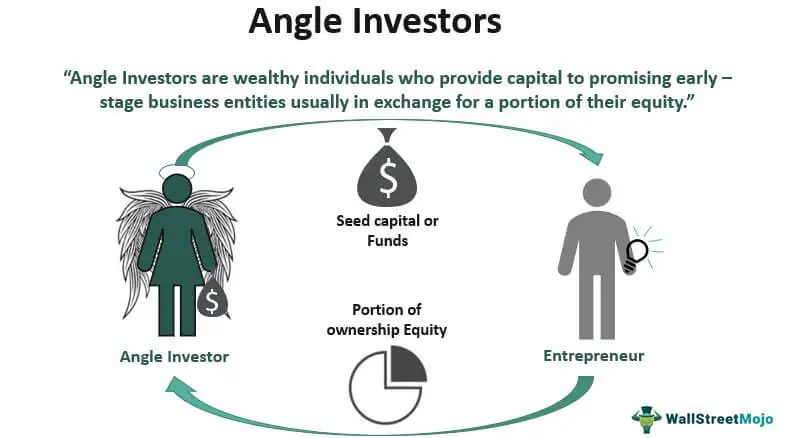

Context: The Indian government has made amendments to the angel tax provisions introduced in the year's budget, specifically related to investments in startups by non-resident investors at a premium over their fair market value. These changes are aimed at providing relief to prospective foreign investors in startups and simplifying the valuation process.

Key Highlights

Conclusion

Must Read Articles:

ANGEL TAX: https://www.iasgyan.in/daily-current-affairs/angel-tax-1

|

PRACTICE QUESTION Q. Consider the following statements: Statement 1: Angel investors are often individuals who have a high net worth. Statement-2: Angel investors do not have any influence or involvement in the startups they invest in. Which one of the following is correct in respect of the above statements? A) Both Statement-1 and Statement-2 are correct, and Statement-2 is the correct explanation for Statement-1. B) Both Statement-1 and Statement-2 are correct, and Statement-2 is not the correct explanation for Statement-1. C) Statement-1 is correct, but Statement-2 is incorrect. D) Statement-1 is incorrect, but Statement-2 is correct. Answer: C Explanation: Statement-1 is correct as angel investors are often individuals with a high net worth. However, Statement-2 is incorrect because angel investors typically have influence and involvement in the startups they invest in, often providing guidance, mentorship, and support. |

© 2024 iasgyan. All right reserved