Disclaimer: Copyright infringement not intended.

Context

- India has initiated an anti-dumping probe into imports of certain solar glass from China and Vietnam, following a complaint by domestic players.

Dumping

- Dumping is the practice of selling goods in a foreign market at a price lower than what is charged in the domestic market or below the cost of production.

- This can harm domestic producers in the importing country by undercutting their prices and making it difficult for them to compete.

Implications

Impact on Domestic Industries:

- Dumping can harm domestic industries by undercutting their prices and reducing their market share.

- This can lead to lower profits, reduced production, and potential job losses.

Consumer Impact:

- While dumping may benefit consumers in the short term by offering lower prices, it can lead to the weakening or elimination of domestic industries in the long term.

- This reduction in competition can potentially result in higher prices for consumers.

Impact on Exporting Country:

- Dumping can lead to overproduction and a reliance on export markets, which can be risky if those markets become less profitable or are subject to trade barriers.

Trade Relations:

- Dumping can strain trade relations between countries, leading to retaliatory trade barriers or anti-dumping measures.

Global Trade Environment:

- It can distort the global trade environment by encouraging unfair competition and discouraging sustainable trade practices.

Legal Challenges:

- Legal challenges can arise, with importing countries imposing anti-dumping duties to offset the effects of dumping, potentially leading to disputes at the World Trade Organization (WTO) or through bilateral trade agreements.

Measures taken to combat Dumping

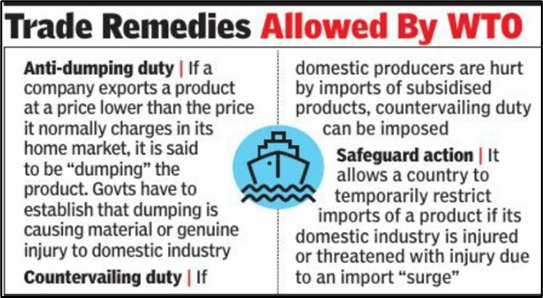

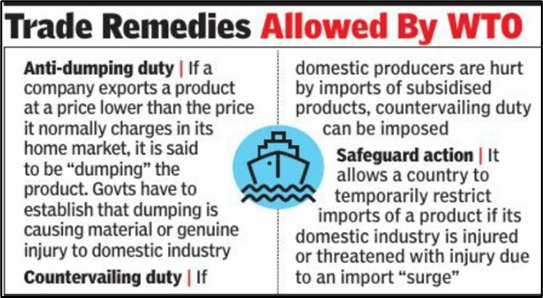

Anti-Dumping Duties:

- Countries can impose anti-dumping duties on imported goods that are being dumped in their market.

- These duties are designed to offset the price advantage gained through dumping and make the imported goods less competitive.

Anti-Dumping Investigations:

- Governments can initiate investigations to determine if dumping is occurring and if it is causing injury to domestic industries.

- If dumping is found to be taking place, anti-dumping measures can be imposed.

WTO Rules:

- The World Trade Organization (WTO) has established rules governing the use of anti-dumping measures.

- These rules aim to ensure that anti-dumping measures are applied fairly and transparently and do not unnecessarily restrict trade.

Negotiations and Consultations:

- Countries can engage in negotiations and consultations to address dumping issues bilaterally or through international forums like the WTO.

- This can help resolve disputes and find mutually acceptable solutions.

Export Restraints:

- Exporting countries can voluntarily restrain their exports or agree to limit their exports to avoid the imposition of anti-dumping measures by importing countries.

Monitoring and Surveillance:

- Governments can establish monitoring and surveillance mechanisms to track and analyze trade patterns and detect potential dumping activities.

Capacity Building:

- Countries can build the capacity of their industries to compete more effectively in the global market, reducing the incentive for other countries to dump goods in their market.

Public Awareness and Education:

- Public awareness campaigns and educational programs can help raise awareness about the impacts of dumping and the importance of fair trade practices.

Legal Action:

- In cases where dumping practices violate domestic or international trade laws, legal action can be taken to address the issue through the appropriate legal channels.

WTO’S ANTI-DUMPING MEASURES

The World Trade Organization (WTO) has established specific rules regarding anti-dumping measures through the Agreement on Implementation of Article VI of the General Agreement on Tariffs and Trade 1994 (the Anti-Dumping Agreement). Here are some key provisions:

- Definition of Dumping: The agreement defines dumping as the export of goods by a country at a price lower than the normal value of the goods in the exporting country's domestic market.

- Calculation of Dumping Margin: The agreement provides guidelines for calculating the margin of dumping, which is the difference between the export price and the normal value of the goods.

- Evidence of Injury: Before imposing anti-dumping measures, importing countries must demonstrate that the dumped imports are causing or threatening to cause material injury to a domestic industry.

- Imposition of Duties: If dumping is established and injury is demonstrated, importing countries can impose anti-dumping duties on the dumped imports. These duties should not exceed the margin of dumping.

- Duration of Measures: Anti-dumping duties are typically imposed for a period of five years, but they can be extended if the authorities determine that the dumping is likely to continue and continue to harm the domestic industry.

- Review and Sunset Reviews: The agreement allows for periodic reviews of anti-dumping measures to assess their continued need and effectiveness. Sunset reviews are conducted before the expiry of measures to determine if they should be extended.

- Non-Discrimination: The agreement prohibits the use of anti-dumping measures in a way that discriminates between trading partners or provides protection for domestic industries that is greater than necessary.

- Transparency and Due Process: The agreement requires that anti-dumping investigations be conducted in a transparent manner, with opportunities for all interested parties to present evidence and arguments. It also provides for the right of appeal against anti-dumping decisions.

These rules are intended to ensure that anti-dumping measures are applied in a fair and transparent manner, balancing the interests of domestic industries with the principles of free and fair trade.

|

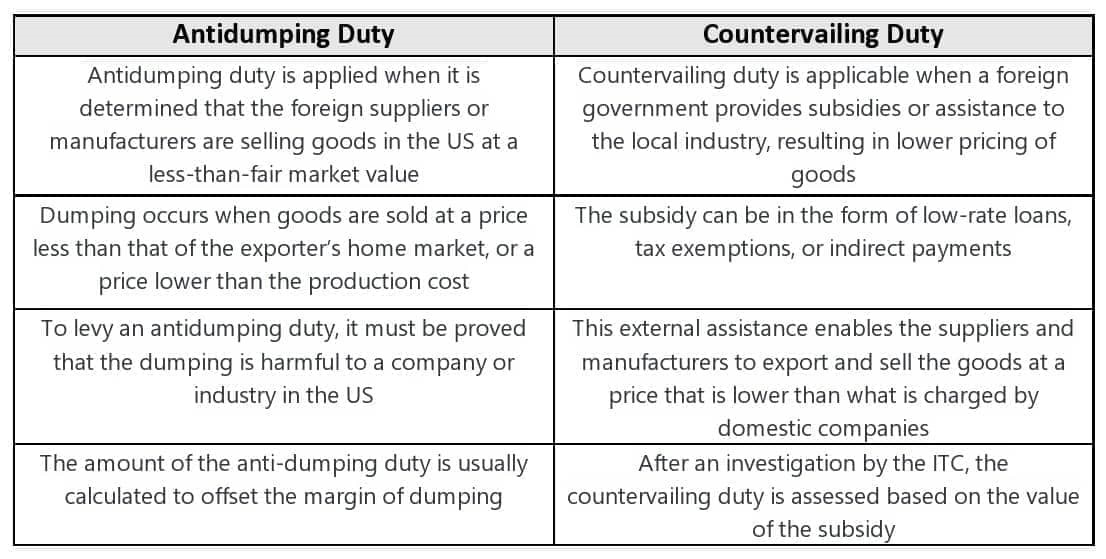

ADD VS CVD

Anti-dumping duties (ADD) and countervailing duties (CVD) are both trade remedies that countries use to protect their domestic industries from unfair competition. However, they target different types of unfair trade practices:

- Anti-Dumping Duties (ADD):

-

- Purpose: ADD are imposed to counteract the effects of dumping, which occurs when a foreign producer exports goods to another country at a price lower than the normal value (usually the price in the producer's domestic market).

- Objective: The objective is to ensure fair competition and protect domestic industries from injury caused by unfairly low-priced imports.

- Calculation: ADD are calculated based on the difference between the export price of the product and its normal value, known as the dumping margin.

- Scope: ADD are specific to dumping practices and do not address other types of unfair trade practices.

- Countervailing Duties (CVD):

-

- Purpose: CVD are imposed to counteract subsidies provided by foreign governments to their domestic producers. These subsidies can distort trade by giving an unfair advantage to the subsidized products.

- Objective: The objective is to neutralize the adverse effects of subsidies and create a level playing field for domestic and foreign producers.

- Calculation: CVD are calculated to offset the amount of subsidy received by the foreign producer, thus eliminating the subsidy's impact on pricing.

- Scope: CVD specifically target subsidies and do not address other unfair trade practices like dumping.

In summary, while both ADD and CVD are trade remedies aimed at protecting domestic industries, ADD target unfair pricing practices (dumping), while CVD target unfair subsidies provided by foreign governments.

|

Who can file a complaint against dumping activities in India?

- The Directorate of Anti-Dumping and Allied Duties (DGAD) can take a suo moto cognizance to impose anti-dumping duty on an importer when it is satisfied that a substantial and grave injury is caused to a domestic industry.

- A complaint can be filed by the domestic industry engaged in dumped goods. ‘Domestic industry’ includes the manufacturers who constitute a majority portion of the entire domestic industry of dumped goods. The application for anti-dumping duty must be supported by producers who collectively manufacture at least 50% of total production. The investigation process must also be supported by manufactures constituting 25% of total domestic production.

Anti-Dumping Duty in India

- Anti-dumping duty is a measure imposed by a country's government on imports from another country which exports its goods at a lower price as compared to the market value in its own domestic market. Anti-dumping duty is levied to protect the importing country's domestic market from unfair trade practices used by exporters to disrupt the domestic market and creating a monopoly by producing similar products at very low prices.

- The Customs Tariff Act, 1975 lays down the circumstances in which the Central Government can impose anti-dumping duties on dumped goods in Indian domestic market. The anti-dumping rules included by the 1995 amendment lays down provisions for identification, assessment and collection of anti-dumping duty from the importer.

- The anti-dumping laws state that the Indian government may impose anti-dumping duty after it conducts the inquiry and determines normal value, export value and the margin between two. The government has the power to make anti-dumping rules to identify goods that are liable for levying anti-dumping duty.

- In case any material or substantial injury is caused to the domestic industry, the Indian government has the power to levy other duty in addition to anti-dumping duty. The quantum of damage is analysed by the volume of goods dumped, their consumption and the effect they have on the domestic market.

- Anti-dumping duty is applicable only for a period of 5 years and its applicability ceases if the duty is not reviewed and renewed.

What is the procedure of levying Anti-dumping Duty in India?

- An application is filed by the domestic industry or DGAD on its own cognizance.

- The proceedings begin and responses are invited from 50% domestic producers constituting the total domestic market.

- Provisional anti-dumping duty is levied on the basis of preliminary findings.

- Final findings are drawn on the basis of inspection of domestic industry and importers.

- The final anti-dumping duty is levied on the exporting company.

The entire investigation process has to be concluded within 12 months from the date of filing the application. Anti-dumping rules also state that this period may be extended by the period of 6 months, limiting the time period to 18 months. An application for appeal can be filed against the final decision can be filed with the Customs, Excise and Service Tax Appellate Tribunal along with Rs. 15,000 within 90 days of final order.

|

PRACTICE QUESTION

Q. How many of the following statements regarding the imposition of anti-dumping duty in India is correct?

A) The Directorate of Anti-Dumping and Allied Duties (DGAD) can impose anti-dumping duty suo moto if it finds substantial and grave injury to a domestic industry.

B) A complaint for anti-dumping duty can only be filed by the domestic industry collectively manufacturing at least 50% of total production.

C) The entire investigation process for anti-dumping duty must be concluded within 24 months from the date of filing the application.

Options:

A) None of the statements

B) All of the statements

C) A and B only

D) B and C only

The correct answer is C) A and B only.

Explanation: A) The Directorate of Anti-Dumping and Allied Duties (DGAD) can impose anti-dumping duty suo moto if it finds substantial and grave injury to a domestic industry. This statement is correct. DGAD can initiate an investigation on its own if it has sufficient evidence of dumping and injury to the domestic industry.

B) A complaint for anti-dumping duty can only be filed by the domestic industry collectively manufacturing at least 50% of total production. This statement is also correct. As per the rules, the application for anti-dumping duty must be supported by producers who collectively manufacture at least 50% of the total production.

C) The entire investigation process for anti-dumping duty must be concluded within 24 months from the date of filing the application. This statement is incorrect. The investigation process must be concluded within 12 months from the date of filing the application. However, this period may be extended by another 6 months in certain circumstances, making the total period 18 months, not 24 months.

|