Disclaimer: Copyright infringement not intended.

Context

- Chief Economic Advisor (CEA) V. Anantha Nageswaran recently stressed that policy stability and transparency are critical to ensure the success of the government’s asset monetisation programme.

Asset monetisation explained

- Asset monetisation is the process of creating new sources of revenue for the government and its entities by unlocking the economic value of unutilised or underutilised public assets. A public asset can be any property owned by a public body, roads, airports, railways, stations, pipelines, mobile towers, transmission lines, etc., or even land that remains unutilised.

- As a concept, asset monetisation implies offering public infrastructure to the institutional investors or private sector through structured mechanisms. Monetisation is different from ‘privatisation’, in fact, it signifies ‘structured partnerships’ with the private sector under certain contractual frameworks.

- Asset monetisation has two important motives: Firstly, it unlocks value from the public investment in infrastructure, and secondly, it utilises productivity in the private sector. Asset monetisation aims to tap the private sector investment for new infrastructure creation.

- Asset monetisation does not involve the selling of land, but it is about monetising brownfield assets.

- In India, the idea of asset monetisation was first suggested by a committee led by economist Vijay Kelkar in 2012 on the roadmap for fiscal consolidation.

- The committee had recommended that the government should start monetisation to raise resources for further development and financing infrastructure needs.

|

Department of Investment and Public Asset Management (DIPAM) deals with all matters relating to management of Central Government investments in equity including disinvestment of equity in Central Public Sector Undertakings. The Four major areas of its work relates to Strategic Disinvestment, Minority Stake Sales, Asset Monetisation and Capital Restructuring. It also deals with all matters relating to sale of Central Government equity through offer for sale or private placement or any other mode in the erstwhile Central Public Sector Undertakings. DIPAM is working as one of the Departments under the Ministry of Finance.

|

India’s Asset Monetization Strategy

The framework of the asset monetization strategy includes:

Provision of “rights” but not “ownership”

- The asset monetizing program aims to provide rights to various private investors and monetize on those “rights” rather than selling those assets. The idea was to lease the assets and realize their value.

De-risked assets with steady revenue

- The program would provide stable and adequate revenue streams for the government and help it de-risk brownfield assets and deleverage the balance sheets.

Structured partnerships

- There will be a structured partnership with well-defined contracts, stringent performance standards, and key performance indicators (KPIs).

National Monetisation Pipeline

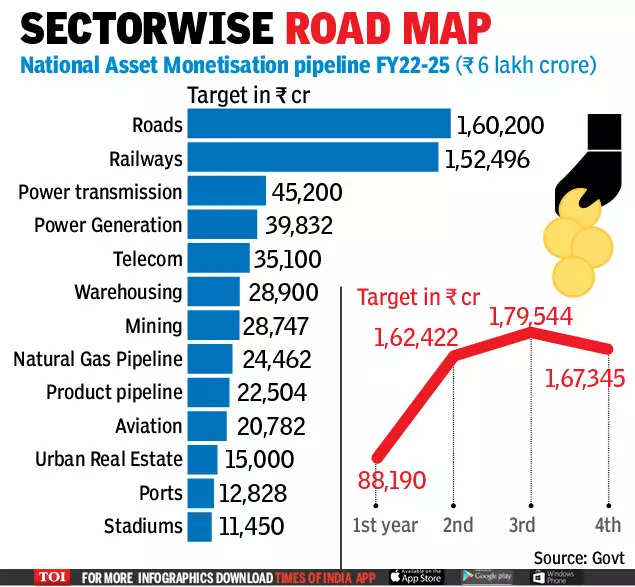

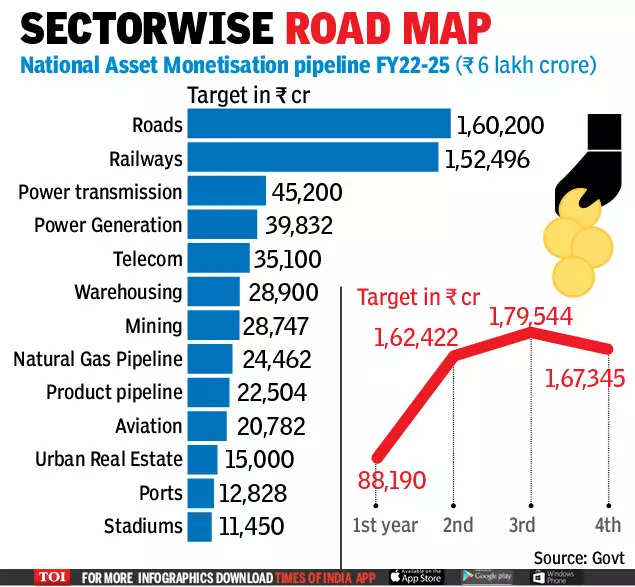

- The government of India announced the National Monetisation Pipeline (NMP) worth Rs 6 trillion on August 23 in 2021. This scheme aims to serve as a roadmap for the asset monetisation of several brownfield infrastructure assets across sectors including roads, railways, aviation, power, oil and gas, and warehousing.

- NMP is a central portal that could act as a land bank housing information about all assets that have been lined up for utilisation by strategic investors or private sector companies. It will also assess the potential value of unused and underutilised government assets.

- The NMP targets to raise Rs 6 trillion through asset monetisation of the central government, over a four-year period, from FY22 to FY25. However, the ownership of the assets will be retained by the Centre. NMP focuses on brownfield assets in which investments have already been made but are underutilised.

- The underutilised brownfield assets are in sectors such as roads, railways, airports, mines, and power. This initiative is necessary for bringing in private capital which will be used for infra creation.

- According to an official communique, the top five sectors in terms of contribution to NMP are roads (27%) followed by railways (25%), power (15%), oil and gas pipelines (8%), and telecom (6%).

Importance

- Government finances are stretched, especially post the massive economic jolt dealt by Covid.

- Public welfare measures require funding. With the fiscal deficit already stretched to its limits, the government needs to come up with alternative ways to generate revenue.

- NMP helps realize value from idle assets, without the Government transferring ownership of public sector assets to private parties for good.

- Primary ownership of assets under NMP will continue to be with the government. Funds from NMP will be used for infrastructure creation under the National Infrastructure Pipeline.

- Private entities will use the asset for a said tenure, at the end of which they will be handed back to the public authority.

Monetization Benefits

✅ Enhanced capex spending and building world class infrastructure

✅ Multiplier effect on growth and employment

✅ Revival of credit flow

✅ Upgradation of Assets

✅Underused assets will be now utilized fully creating new job opportunities

Revenue generation

The monetization program helps create new revenue sources for the government. This revenue generation from underutilized public sector units (PSU) owned assets can assist the government to use the additional revenue for more practical purposes. The Indian government has already planned to use this additional set of revenue for the national infrastructure program to help India build state-of-the-art infrastructure in the next five years.

Increase in productivity and efficiency

Privatization will increase productivity and efficiency and also has a multiplier effect on the economy. Assets will be used at their maximum production capacity, which will help to create jobs and supply chains. Utilization of these brownfield assets will facilitate economic growth.

Improved quality of services

The National Monetization Program includes key infrastructure projects that are vital for the economy to grow. These existing public infrastructure projects will be used efficiently and improve the quality of goods and services, further helping the consumers.

Window for global institutional investors

The National Monetization Program will provide a window for global institutional investors, such as sovereign wealth funds (SWFs), pension funds (PFs), and insurance funds, to establish their presence in India and invest in infrastructure. Due to the inherent risk in greenfield assets, investors prefer brownfield assets. These large institutional investors collectively manage a wealth of more than US$ 30 trillion.

Final Thoughts

- Asset monetisation is not just about garnering revenues for the government but also ensuring the economic efficiency of these assets by bringing them back to productive use.

- Regulatory consistency, clarity and predictability and a certain sense of stability in the regulatory framework are very important. Policy Stability, consistency and transparency would have to spill over into the regulatory framework that would govern asset monetisation moving forward and that is what would make Asset Monetisation a successful programme.

|

What are brownfield investments?

Brownfield investments are those in which a private company or investor purchases or leases an existing infrastructure project or production facility to carry out new production activity. In the case of the National Monetization Program, the government intends to lease rather than sell brownfield assets. The government’s motto is to monetize these assets, which are either underutilized or not fully monetized, through private participation. To put this in perspective, in 1998, India completed a 756-kilometre Kokan Railway network. In terms of freight usage, which generates the most revenue, this rail network was underutilized. Hence, through the National Monetization Program, the government intends to monetize Rs. 3,600 crore.

|

Outlook

- The asset monetization program is considered to have caused a paradigm shift in the way the government treats brownfield assets.

- It will significantly improve the utilization of these assets and infrastructure efficiency. Furthermore, the program will generate revenue streams and deleverage the government’s balance sheets.

- This will trigger credit growth in the economy and help India achieve a new investment cycle.

- Additionally, the program plans to leverage revenue earned from these monetized assets to establish additional greenfield investments, which will assist India in developing world-class infrastructure and creating more economic opportunities.

- The National Monetization Program is an ambitious program that is expected to help India achieve its goal of a US$ 5 trillion economy.

1.png)

Policy certainty, transparency critical for asset monetisation: CEA - The Hindu