Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

What is a ‘bad bank’?

|

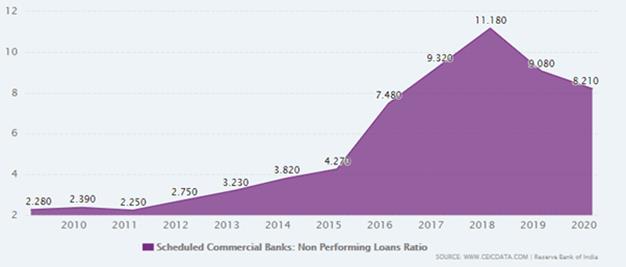

When does a loan turn 'bad'? The banking sector is the backbone of the economy as it provides credit to fund different economic activities. Sometimes these loans turn into bad loans. Bad loans, also called as non-performing assets (NPA’s) are those loans made by a bank on which the borrower has not made interest or principal repayments on time. These loans are classified as non-performing and are at the verge of or already in the state of default. These bad loans negatively impact a bank’s balance sheet. Thus, several leading economists feel “bad bank” could be a good idea to free the banks from the mounting burden of the NPAs. |

NARCL

How will the NARCL operate?

In a nutshell,

The NARCL, which will acquire the bad loans from banks, and the India Debt Resolution Company Ltd. - which will then manage these assets and seek to enhance their value - have secured necessary approvals and permissions.

With the account-wise due diligence nearing completion, the first set of accounts is expected to be transferred during July 2022.

History of Banking Sector Crisis

Steps taken

Proposal for a National Bad Bank

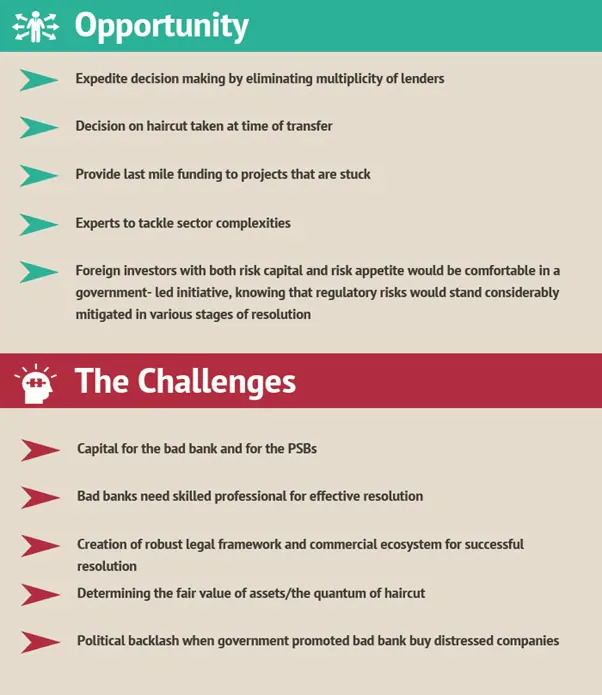

Cons of Bad Banks

Pros of Bad Banks

|

Raghuram Rajan on Bad Banks Former RBI Governor Raghuram Rajan had opposed the idea of setting up a bad bank in which banks hold a majority stake. “I just saw this (bad bank idea) as shifting loans from one government pocket (the public sector banks) to another (the bad bank) and did not see how it would improve matters. Indeed, if the bad bank were in the public sector, the reluctance to act would merely be shifted to the bad bank,” Rajan wrote in his book I Do What I Do. |

|

International Experience on Bad Banks Countries like the UK, the US, Spain, Malaysia, France, Finland, Belgium, Germany, Austria and Sweden have successfully experimented with bad asset resolution through a bad bank. The earliest case was of the Mellon Bank in 1988—to hold bad assets of $1.4 billion. The UK Asset Resolution (UKAR), a bad bank, repaid 48.7 billion pound taxpayers’ loan that it had taken, and is close to selling the last of its asset portfolio before winding down. International experience should come handy for us to model our bad bank on. |

What lies ahead for the banking industry?

Closing Thoughts

Bad bank to kick off NPA takeover in July - The Hindu

© 2024 iasgyan. All right reserved