Disclaimer: Copyright infringement not intended.

Context

- There are three key terms that one is likely to hear repeatedly in the coming days and weeks: Yield inversion, soft-landing and reverse currency war. Here’s a quick look at what they mean and why they are significant at present.

CONCEPT: BOND YIELD

What is Bond Yield?

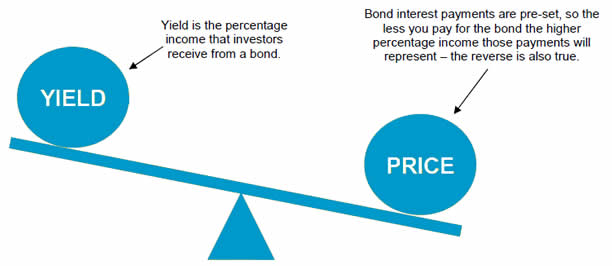

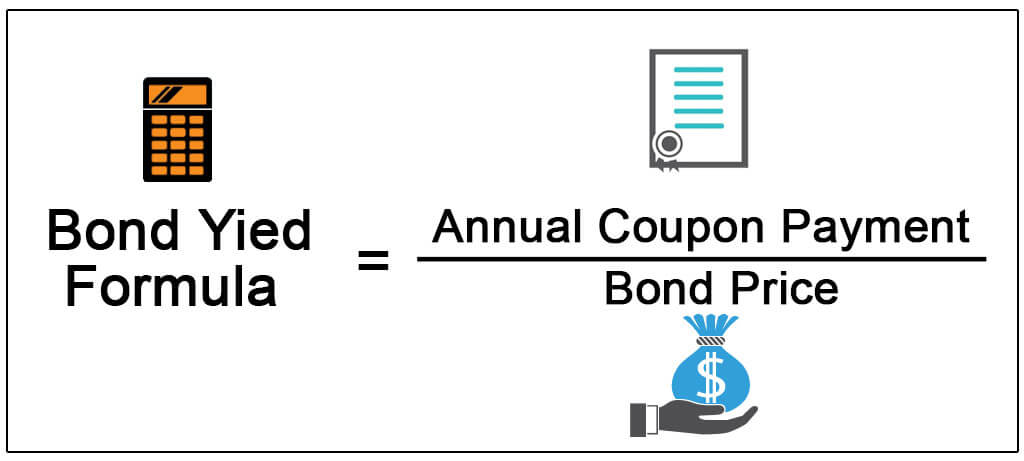

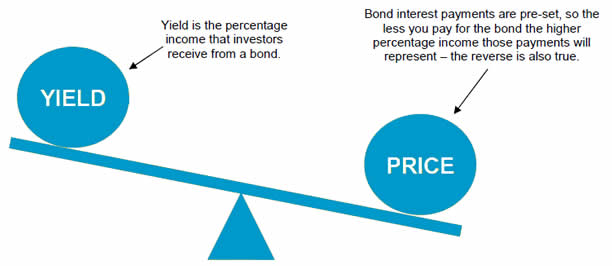

Bond yield is the amount of return an investor realizes on a bond. Required yield refers to the amount of yield a bond issuer must offer to attract investors.

Details of Bond Yield

When investors buy Bonds, they essentially lend bond issuers money. In return, bond issuers agree to pay investors interest on bonds throughout their lifetime and to repay the face value of bonds upon maturity. The money that investors earn is called yield. Investors do not have to hold bonds to maturity. Instead, they may sell them for a higher or lower price to other investors, and if an investor makes money on the sale of a bond, that is also part of its yield.

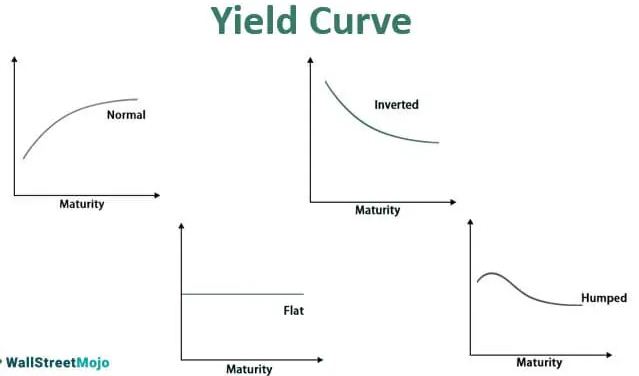

What Is a Yield Curve?

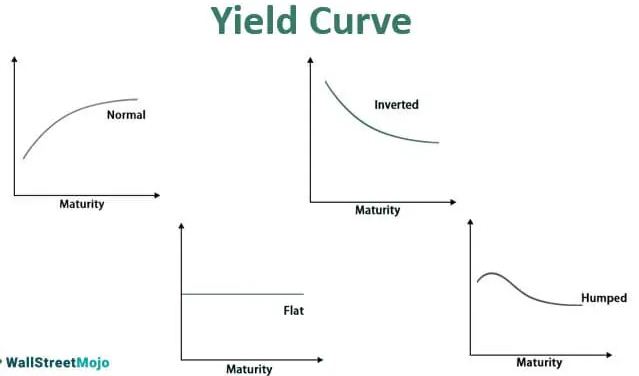

- A yield curve is a graphical presentation of the term structure of interest rates, the relationship between short-term and long-term bond yields. It is plotted with bond yield on the vertical axis and the years to maturity on the horizontal axis.

- The slope of the yield curve provides an estimate of expected interest rate fluctuations in the future and the level of economic activity.

- A yield curve tells us about the relative cost of short-term and long-term debt.

Types of yield curves

Yield curves differ primarily based on their underlying type of yield i.e. treasury yield, corporate bond yield, etc.

There are four classifications of yield curves depending on their shape: the normal yield curve, the steep yield curve, the flat yield curve, and the inverted yield curve.

Normal yield curve

- In general, long-term yields are typically higher than short-term yield due to the higher risk involved in long-term investment. Since this is the most common shape of the yield curve, it is called the normal yield curve.

- The short-term yields are heavily influenced by central banks such as US Federal Reserve and the long-term yields are a function of the expected short-term interest rates in future and the market’s assessment of the inherent risk.

- Normal yield curve typically exist when an economy is neither in a recession nor there is any major risk of overheating.

- The normal shape of the yield curve is upward sloping, i.e. short term yields (yields of short term bonds) are lower than long term yields.

Steep yield curve

- A steep yield curve is the one in which the short-term yields are at normal level, but the long-term yields are higher.

- A steep yield curve signals that the interest rates are expected to be increase in future. This is represented by the black line corresponding to a period in 2013.

Flat yield curve

- A flat curve is one in which there is no significant difference between yields on short-term and long-term debt. Since the long-term yield is lower than normal, a flat yield curve signals a slow-down in the economy and a decrease in interest rates.

Inverted yield curve

- An inverted yield curve is just opposite of the normal yield curve (therefore, it is also called abnormal yield curve).

- When the yield for shorter maturities is higher than the yield for longer maturities, the yield curve slopes downward and the graph looks inverted.

- An inverted yield curve is unusual; it reflects bond investors' expectations for a decline in longer-term interest rates, typically associated with recessions.

- As evident by the blue curve in the chart above, it occurred in 2000 during the dot com bubble.

CONCEPT- SOFT LANDING

- When inflation is high a central bank often intervenes to stop stabilizes prices. If the central bank is able to stabilize prices without causing a recession, it is known as a soft landing.

- Thus, a soft landing is a cyclical downturn that prevents recession.

- The term "soft landing" is derived from aviation. It refers to the type of landing that goes smoothly and without a hitch or any bumps or crashes.

- Soft landing usually defines efforts by the central banks to raise interest rates just enough to prevent an economy from overheating and experiencing high inflation, without triggering a massive increase in unemployment, or a hard landing.

- It can also refer to a sector of the economy that may have a slow down without crashing. A soft landing implies the cooling down of the economy after a period of rapid expansion which happens smoothly.

- A smooth landing ensures that an economic contraction is mild and does not lead to recession, as can happen with a hard landing outcome.

Comparison with Hard Landing

- A hard landing is often seen as a result of tightening economic policies that bring high-flying economies to a sudden, sharp check of their growth. It can be seen in the case of monetary-policy intervention intended to curb inflation.

- Economies suffering a hard landing often fall into a period of stagnation or even recession.

Application of Soft Landing

- Several countries have taken soft landing measures in the past to prevent a recession in their economy. Countries such as India and the USA have been part of the exercise.

- In 2013, Indian Central Bank, i.e. the Reserve Bank of India, had announced rate reduction to boost consumption and in turn help in economic recovery.

CONCEPT: CURRENCY WAR

- Currency war, also known as competitive devaluations, is a condition in international affairs where countries seek to gain a trade advantage over other countries by causing the exchange rate of their currency to fall in relation to other currencies.

- If a country’s currency falls in relation to other currencies that can help its economy. Its exports become cheaper relative to competitors, boosting demand from abroad, while higher import prices spur domestic consumption of more homegrown products and services. And both of these benefit the domestic industry, and thus employment, which receives a boost in demand from both domestic and foreign markets.

- However, the price increases for import goods (as well as in the cost of foreign travel) are unpopular as they harm citizens' purchasing power; and when all countries adopt a similar strategy, it can lead to a general decline in international trade, harming all countries.

- Example: a currency war broke out in the 1930s when countries abandoned the gold standard during the Great Depression and used currency devaluations in an attempt to stimulate their economies.

What’s a reverse currency war?

- A reverse currency war, on the other hand, involves competitive appreciation. Here, countries think their trading partners are deliberately trying to strengthen their currencies in order to rein in inflation. This could describe the period that began in 2021, when inflation returned as a serious problem in most countries.

- In reverse currency war countries work to make their currency stronger. Rather than boosting growth, the goal of any such move is to help tame inflation, since a stronger currency means that imports are relatively cheaper.

In both cases, it is impossible for all countries to pursue such strategies, because they cannot all move their exchange rates in the same direction at the same time. Both competitive depreciation and competitive appreciation are often perceived as evidence of a lack of international cooperation to achieve exchange-rate stability, and sometimes lead to calls for a new Bretton Woods-type arrangement to promote greater policy coordination.

Must Read Concepts

Bond Yield

https://www.iasgyan.in/blogs/bond-yield

Inflation

https://www.iasgyan.in/daily-current-affairs/inflation-29#:~:text=Inflation%20refers%20to%20a%20sustained,transport%2C%20consumer%20staples%2C%20etc.

Managing Inflation

https://www.iasgyan.in/rstv/perspective-managing-inflation