Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Copyright infringement not intended

Picture Courtesy: razorpay.com

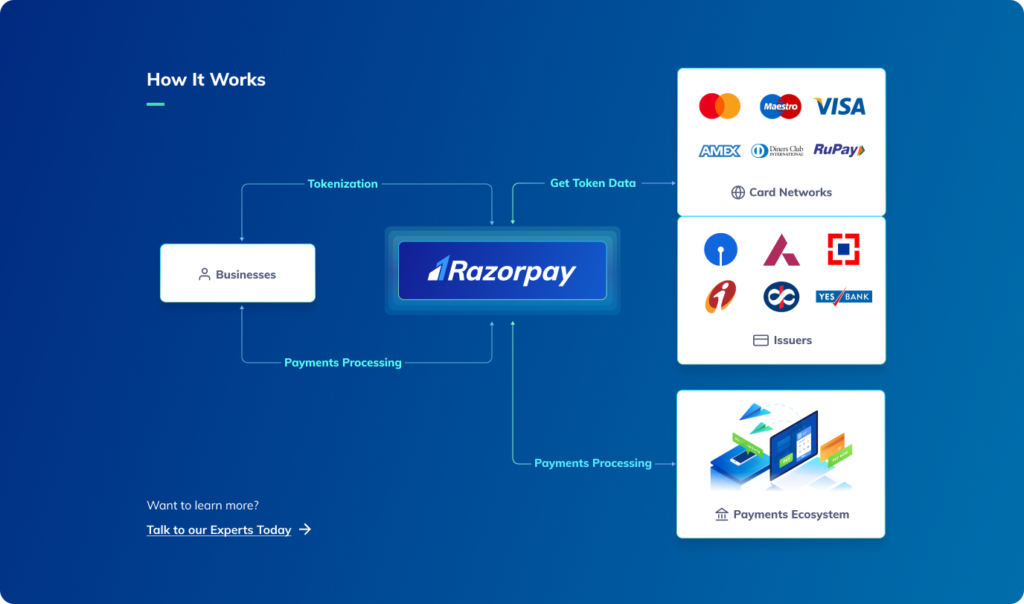

Context: The Reserve Bank of India (RBI) has proposed to introduce Card-on-File Tokenization (CoFT) as a measure to enhance convenience for cardholders. This initiative aims to provide cardholders with an easier way to create and link tokens to their existing accounts when using various e-commerce applications.

Key Highlights

Card-on-File Tokenisation (CoFT) offers several advantages

Conclusion

Must Read Articles:

Card Tokenization: https://www.iasgyan.in/daily-current-affairs/card-tokenization

|

PRACTICE QUESTION Q. What is Card-on-File Tokenization, and how does it enhance the security of online transactions? Provide examples of industries or scenarios where Card-on-File Tokenization is particularly beneficial. |

© 2024 iasgyan. All right reserved