Disclaimer: Copyright infringement not intended.

Context

- Recently, the International Monetary Fund (IMF) issued a statement on the use of cryptocurrency in the Latin America and Caribbean market, and about the rising interest in blockchain-based central bank digital currencies (CBDCs).

Definition Of Cryptocurrency

- Cryptocurrency is a digital asset designed as a medium of exchange using cryptography to secure financial transactions without going through a third party.

- Such a type of currency does not have the regulatory authority to log transactions.

- The storage of Cryptocurrency transactions is done on Blockchain, which is a public distributed ledger. This distributed ledger contains all the transactions' details that are made on the network.

- All the participants have to access this ledger to view the transactions stored within it.

- The most famous cryptocurrency is Bitcoin.

- Apart from Bitcoin, there are thousands of cryptocurrencies available in the market, and some of the best known are Ethereum, Litecoin, Ripple, etc.

ALL ABOUT CRYPTOCURRENCY: https://www.iasgyan.in/daily-current-affairs/cryptocurrency-8

Definition Of Central Bank Digital Currency (CBDC)

- Digital currency is a digital version of the official currency issued by the government.

- CBDCs are issued and regulated by a country’s central bank and use blockchain technology to speed up and increase the security of digital transaction processes.

- Issued by a central bank, the currency is accessible universally.

- For the verification and storage of transaction data, CBDCs use Blockchain technology. In the verification process, the nodes are selected by the Central Bank and are likely to refer to the banks and financial institutions that facilitate quick transactions in the system.

Note: Not all CBDCs use blockchain technology, for example, e-CNY (China’s CBDC). Unlike Bitcoin and other cryptocurrencies, e-CNY does not operate via a blockchain-based decentralized ledger.

Benefits Of Central Bank Digital Currency (CBDC)

Expanding Access to Finance

- Digital currencies can connect customers and central banks directly as they are distributed on mobile devices.

- CBDC can also be a solution for people who are far from bank branches and cannot access cash.

Free From Liquidity and Credit Risk

- CBDC eliminates third-party risk from events such as a banking crisis or collapse.

Improving Monetary Policy

- The CBDC gives the central bank direct influence over the money supply, thereby increasing control over transactions for tax control.

CBDCs will work seamlessly where the transactions won’t have to pass through multiple banks, like the UPI. The CBDC transaction can happen nearly instantaneously on one digital ledger. For those who are unbanked, CBDCs would provide a way to transfer money digitally, which is not possible at present with UPI or a wallet.

Risk Of Central Bank Digital Currency (CBDC)

Changes In Financial Structure

- The financial system can undergo significant transformations. It is still being determined what effect these changes have.

- It might affect consumer spending, investment, the financial services industry, interest rates, bank reserves, or the economy as a whole.

Financial System Stability

- Regarding financial system stability, the impact of switching to CBDC is still uncertain. In a financial crisis, for example, there may not be enough central bank liquidity to support withdrawals.

Cyber Security

- Weak banking security controls are subject to cyber-attacks. The same types of thieves may flock to central banks issuing digital money. So great efforts must be made to thwart system infiltration and theft of assets or information.

CBDC Adoption

- Globally, many nations, such as China, Ghana, Jamaica, and some European countries are exploring their CBDC products. Some have even launched their digital currencies.

- There are nine countries that have fully launched their CBDCs. Eight of the nine countries are located in the Caribbean. The Sand Dollar of the Bahamas was the first CBDC in the world, which was launched in 2019.

Similarities Between the CBDCs & Cryptocurrencies

- If we consider the similarities between CBDCs and cryptocurrencies, they both are virtual assets that reduce the need for physical cash.

- Their existence streamlines the process of making payments for goods and services.

- Another similarity they both hold is the basic concept of blockchain technology, allowing the storage of transaction data in blocks.

- Cryptocurrencies and CBDCs are both blockchain-based digital currencies.

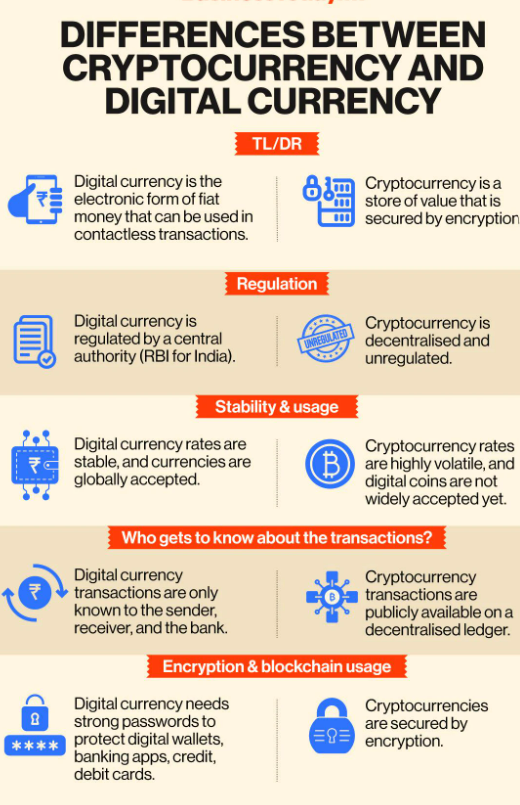

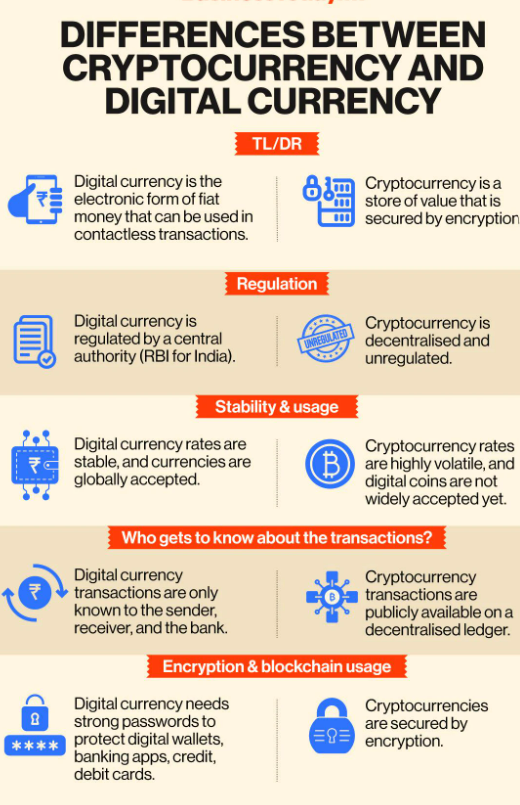

What is the difference between cryptocurrency and CBDCs?

- Cryptocurrencies are generally run by private companies or individuals, a CBDC is controlled and tracked by a country’s central bank and corresponds to that country’s fiat currency.

- CBDCs are fully regulated by a central authority or bank instead of decentralized like cryptocurrencies. As we know, the ownership and authority of crypto can be entirely in the hands of its users, unlike CBDC.

- CBDC acts as a digital version of fiat money, where personal details and transactions will be attached to the CBDC assets of its users. However, transaction details will only be available to the sender, recipient, and bank. It is what makes CBDC different from crypto. As we know, crypto transaction details are publicly available, but without disclosing personal data, such as users’ real names.

- CBDC and cryptocurrencies have different values. CBDC is used as a means of payment and is operated by a central bank. It means that specific financial institutions can only access their blockchain network with the necessary privileges. Meanwhile, cryptocurrency is a decentralized digital asset hosted by a public blockchain network and can be accessed by anyone.

In a nutshell,

Decentralization

- One thing that differentiates the CBDC from the cryptocurrency is decentralization. It refers to the transfer of control and decision-making from an individual to a distributed network.

- On the networks of CBDC, all the rules and regulations are decided by the central bank. In comparison, the authority is delegated to the user on the crypto networks.

In Terms of Use Cases

- Considering the use cases, the use of CBDCs is only for performing payments and monetary transactions.

- In comparison, cryptocurrencies can be used more than just for payments and transactions. They can be used for certain purposes.

Anonymity

- Anonymity is a situation in which a person is known by name. If we discuss this in digital currencies, the user with cryptocurrency enjoys more anonymity than the CBDC user.

- In comparison, CBDC users have their identities tied up with existing bank accounts, so they don't enjoy anonymity.

Data Privacy & Security

- Another point of comparison between cryptocurrencies and CBDC is security and privacy.

- CBDC is less likely to focus on the privacy and security area.

- As long as no illegal activities are performed, there is no need to worry about blockchain-based CBDCs. In comparison, security is not a concern when it comes to cryptocurrencies as they are proven effective from all sides, whether it is about the security of transactions or information.

|

PRACTICE QUESTION

Q. Consider the following statements:

1.Crypto Transaction Details are publicly available, disclosing personal data, such as users’ real names.

2.Central Bank Digital Currencies (CBDCs) are both blockchain-based digital currencies.

3.Central Bank Digital Currencies (CBDCs) correspond to a country’s fiat currency.

4.Sand Dollar of the Bahamas was the first CBDC in the world, which was launched in 2019.

Which of the above statements is/are correct?

(a) 1 and 3 only

(b) 2, 3, and 4 only

(c) 3 and 4 only

(d) None of the above.

Correct Answer: (b) 2, 3, and 4 only

|

https://www.thehindu.com/sci-tech/technology/explained-imf-view-cryptocurrency-latin-america/article67022885.ece