Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

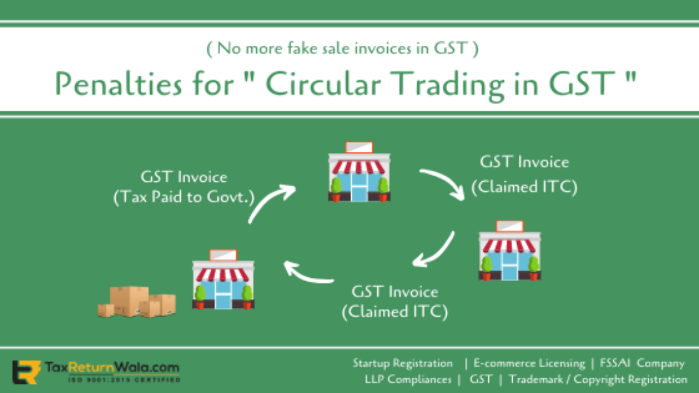

What is Circular Trading?

Example of circular trading

.jpg)

The objective of circular trading

Circular Trading: It’s ill- effects

Issue

Tax Experts on Circular trading

Consequence of Circular Trading in India

Conclusion

© 2024 iasgyan. All right reserved