Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Copyright infringement not intended

Context: The Reserve Bank of India (RBI) has recently issued a circular to all banks and card issuers, asking them to enable customers to choose among different card networks such as Visa, Mastercard, RuPay, etc. when they apply for a credit or debit card. This move is aimed at enhancing customer convenience and promoting competition among card networks.

Details

Present Situation

Credit card network

Credit Card market in India

Draft Proposal

Significance of this proposal

Challenges

Conclusion

|

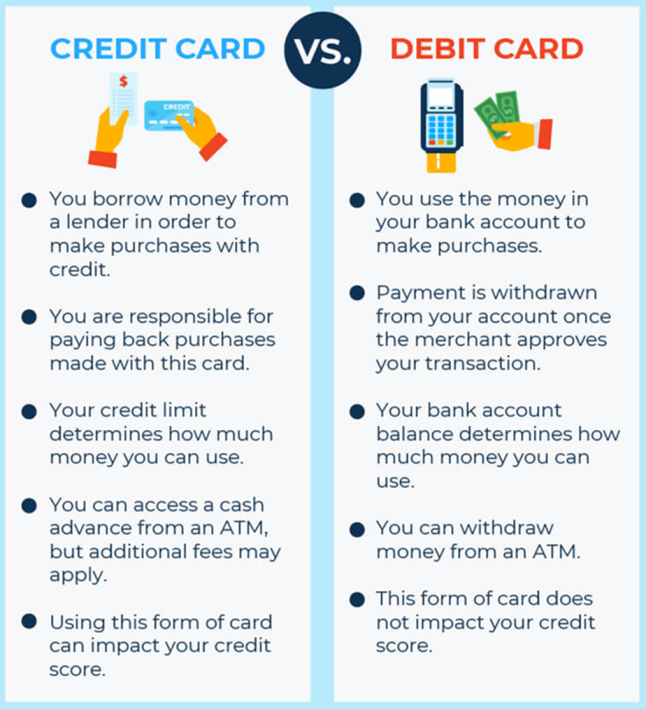

PRACTICE QUESTION Q. Which of the following is/are true about credit cards and debit cards? 1. They both require you to pay interest on your purchases 2. They both affect your credit score 3. They both have expiration dates and security codes 4. They both have unlimited spending limits How many of the above statements is/are correct? A) Only 1 B) Only 2 C) Only 3 D) All Answer: A Explanation: They both have expiration dates and security codes. Credit cards and debit cards are both plastic cards that have a magnetic stripe and a chip that contains your account information. They also have expiration dates and security codes that are used to verify your identity and prevent fraud. The other statements are false. Credit cards charge interest on your purchases if you carry a balance, but debit cards do not. Credit cards affect your credit score, but debit cards do not. Credit cards and debit cards both have spending limits, but they vary depending on the issuer and your account. |

© 2024 iasgyan. All right reserved