Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE)

Eligibility:

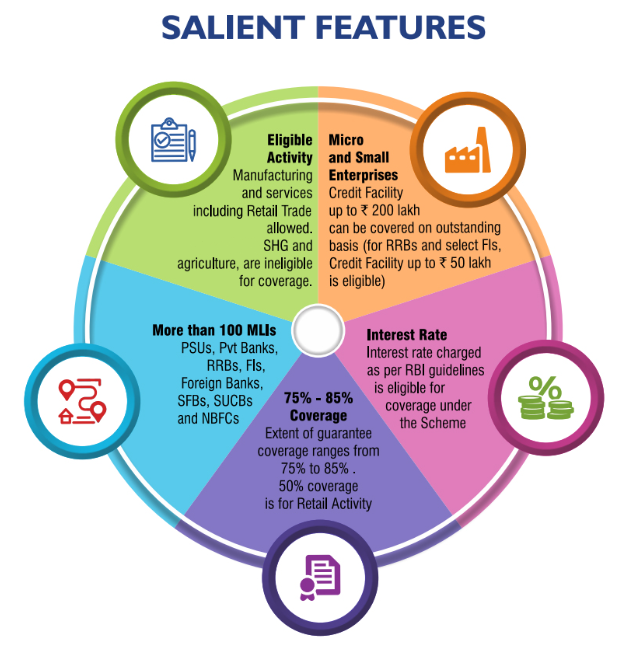

Loans sanctioned under Agriculture segment and SHGs are also not eligible to cover under CGTMSE.

Extent of guarantee:

The extent of guarantee provided by the trust is based on the category of the borrowers/location of the unit and amount of credit facility being covered under guarantee. The same is as under:

|

Category |

Maximum extent of guarantee where credit facility is |

||

|

|

Upto Rs 5 lakh |

Above Rs 5 lakh & upto Rs 50 lakh |

Above Rs 50 lakh & upto Rs 200 lakh |

|

Micro Enterprise |

85% of the amount in default subject to a maximum of Rs 4.25 lakh |

75% of the amount in default subject to a maximum of Rs 37.50 lakh |

75% of the amount in default subject to a maximum of Rs 150 lakh |

|

Women Entrepreneurs/ Units located in NE region(incl. Sikkim) {other than credit facilities upto Rs 5 lakh to Micro Enterprises} |

80% of the amount in default subject to a maximum of Rs 40 lakh |

||

|

All other categories of borrowers |

75% of the amount in default subject to a maximum of Rs 37.50 lakh |

||

|

Retail Trade Activity [Max of Rs 1.00 Cr] |

50% of the amount in default subject to maximum of Rs 50 lakh |

||

Recent steps taken and changes made in CGTMSE

Note: CGTMSE created a new landmark by touching the milestone figure of approving guarantees worth Rs. 1 lakh crore during FY 2022 - 23.

Importance of providing Credit Guarantees to MSMEs

Significance of CGTMSE Scheme in this respect

Way Ahead

Important Article: https://www.iasgyan.in/daily-current-affairs/eclgs

|

PRACTICE QUESTION Q. Providing credit guarantees to lending institutions can play an increasingly important role in bridging the credit gap faced by Indian MSMEs and facilitating the growth of credit to the MSME sector. Elucidate. |

https://www.pib.gov.in/PressReleasePage.aspx?PRID=1912500

© 2024 iasgyan. All right reserved