Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Copyright infringement not intended

Picture Courtesy: moneycontrol.com

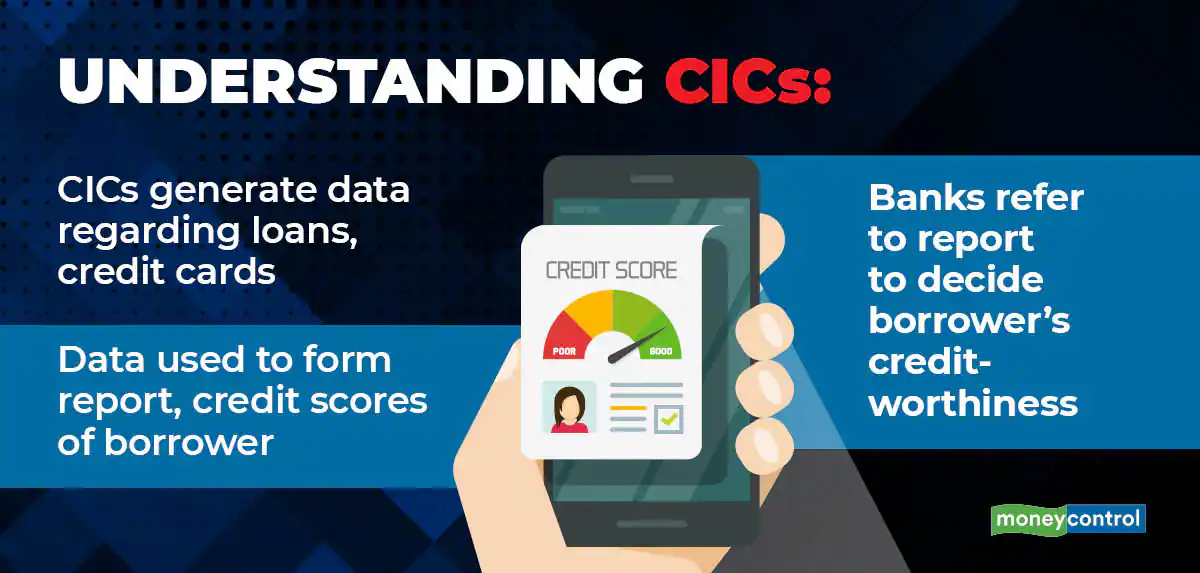

Context: The Reserve Bank of India (RBI) issued a directive instructing credit information companies (CICs) to develop a common Data Quality Index (DQI) specifically for the commercial and microfinance segments. This directive comes as part of the central bank's efforts to enhance the quality of data submissions made by credit institutions (CIs) to CICs, with the ultimate goal of improving data quality over time.

Details

Credit Information Company (CIC)

Summary

|

PRACTICE QUESTION Q. Consider the following statements: Statement 1: The primary function of a Credit Information Company (CIC) is to grant loans to individuals and businesses. Statement 2: The Data Quality Index (DQI) is used by CICs to evaluate the accuracy of data provided by credit institutions. Which one of the following is correct in respect of the above statements? A) Both Statement-1 and Statement-2 are correct and Statement-2 is the correct explanation for Statement-1 B) Both Statement-1 and Statement-2 are correct and Statement-2 is not the correct explanation for Statement-1 C) Statement-1 is correct but Statement-2 is· incorrect D) Statement-1 is incorrect but Statement-2 is correct Answer: D Explanation: Statement-1 is incorrect because CICs do not grant loans; they collect and manage financial data. Statement-2 is correct; the DQI is indeed used by CICs to assess data accuracy. |

© 2024 iasgyan. All right reserved