Disclaimer: Copyright infringement.

Context

- The rupee has fallen today as the US Dollar Index has risen to around 114.36.

Currency volatility

- Currency volatility is the frequency and extent of changes in a currency's value. It is measured by calculating the dispersion of exchange rate changes around the mean, expressed in terms of daily, weekly, monthly or annual standard deviations. The larger the number, the greater the volatility over a period of time.

What causes currency volatility?

- Currency volatility occurs when there are rapid changes to the exchange rate of a currency pair in a short period of time. So, if the US Dollar began to rise and drop in value compared to Rupee, this would be classed as currency pair volatility.

- Currency volatility, like normal fluctuations in exchange rates, can be caused by a number of different factors. These are three causes of currency volatility that we most commonly see.

Inflation

- Inflation in a particular country is one of the most common causes of fluctuations in exchange rates. Shortages of things like fuel, labour, or raw materials can cause production to slow down, which means that prices for goods and services are likely to rise for consumers. This is known as Cost-pull inflation.

- Demand-pull inflation can also have an effect on exchange rates. Demand-pull inflation occurs when high rates of purchasing and demand from consumers enables companies to sell their products for a higher price. Inflation can also be driven by changes to the housing market, changes to government policy and taxation, and a range of other things.

Demand: buying and selling

- Trading within the forex market can also have an impact on exchange rates. When a particular currency comes into high demand among traders, there is less of that currency in circulation as traders purchase it en-masse.

- When forex traders buy a currency at high enough rates, it can have an impact on those hoping to borrow money in that country. Interest rates of loans and mortgages may rise for local people, due to the value of the currency being driven up by trading. Therefore, although the currency itself is stronger on the global forex market, higher exchange rates can also affect the local population.

Political and economic conditions

- Political and economic conditions can also have a considerable bearing on a currency’s exchange rate, and therefore its volatility.

- For instance, political unrest or an unstable government are both likely to deter foreign investors from purchasing property or starting businesses in a particular region. This means fewer jobs are created, and the local economy will have fewer opportunities to thrive.

- Economic collapse, or extreme economic phenomena like hyperinflation, can also have a startling effect on exchange rates, as it demonstrates how the value of a country’s currency can drop suddenly and dramatically.

Implications of High Currency Volatility

- A currency might be described as having high volatility or low volatility depending on how far its value deviates from the average – volatility is a measure of standard deviation. More volatility means more trading risk, but also more opportunity for traders as the price moves are larger.

Prices of everyday goods

- Whereas it’s common for businesses to feel the effects of currency volatility, these effects can often be felt at a personal level too. Imported goods, in particular, will frequently be subject to price rises when a country’s currency has suffered. This is due to businesses paying more for these goods – therefore, they must sell them at an increased cost to ensure they still turn a profit.

Employment

- When businesses are faced with higher prices on imported goods, in order to maintain international trade relationships, they may choose to recoup those costs by making cuts to their workforce. People losing jobs in areas that have few big employers can cause a localised economic depression, with less disposable income meaning that the local economy will suffer.

Investments

- Currency volatility can also have a devastating impact on things like investments. When a country’s currency becomes weaker, this means that many people’s liquid assets, such as pensions and long-term savings accounts, will now be worth less on the world stage.

Upsides of Currency Volatility

- When a country’s currency becomes weaker, they can gain a larger market share in terms of exports. Foreign buyers are likely to take advantage of the relatively low prices to buy more stock than they otherwise would, which can stimulate the country’s economy. As exchange rates level out, countries and international businesses can also benefit from the trade relations that were built during a time when the currency was weak.

- Some economists have even suggested that currency volatility, on a long enough timeline, can be self-correcting. Foreign buyers taking advantage of low prices will increase a country’s exports, stimulating the economy and helping the value of the currency to increase – perhaps to a better position than before.

In September 2022 the rupee suffered its worst monthly drop against the dollar in 36 months. The recent volatility in the rupee contributed to raising the average daily turnover of currency derivatives by 47% to a record high of ₹1.29 trillion in the six months to 28 September from ₹87,495 crore in FY22. The rupee has depreciated 8% against the dollar in the fiscal year to date.

Why does Rupee Depreciates?

- The value of Indian currency or any other currency depends on its demand.

- If demand for any currency increases, its value also goes up (it is termed appreciation).

- And if the demand for a currency declines, its value also goes down (depreciation).

- The demand for Indian currency goes up when more and more foreign investors make investments in India.

- That is because when foreign investors or companies invest in India or buy any products from India, they first convert their currency into rupees as they can invest only in rupees in Indian markets.

- As a result, demand for the Indian currency increases, and its value strengthens against the US dollar and other currencies.

- On the other hand, when Indian individuals and companies import something (like crude oil, gold, etc.), they have to make the payment in dollars (the de facto global currency).

- So Indians sell rupees to buy dollars because the US dollar is the currency to make payments for international trades. Consequently, demand for the dollar goes up, and the rupee weakens against the US currency.

- Since India has been a net importer (we import more than we export), the rupee has gradually depreciated over time.

- Given that India has been a net importer, the Indian currency’s gradual decline is never a huge concern. However, if the pace of the rupee’s fall is sudden, it is an alarming situation.

What Controls The Supply And Demand Of A Currency?

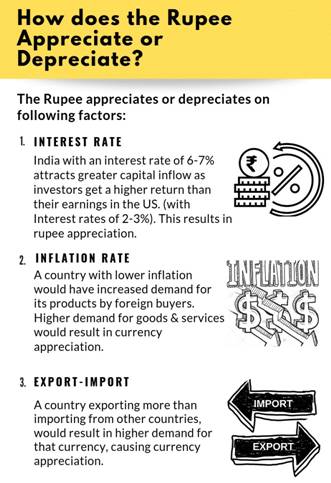

Monetary Policy

Monetary policy is a powerful tool used by the central banks to control the supply and demand of the currency and thus influencing the exchange rate.

One of the ways the RBI controls the movement of the rupee is by changing the interest rates. For example, When RBI allowed the banks to increase interest rates on Non-Resident Indians (NRI) rupee accounts and brought them on par with the domestic term deposit rates, the inflow of funds from NRIs went up, which raised the demand for rupees and ultimately led to the appreciation of the currency. Similarly, depreciation of the rupee is caused by the decrease in interest rates.

RBI also buys and sells US dollars in the open market to control the value of the currency. Some other ways through which RBI control the availability of money in circulation, thus impacting the value of the currency is by regulating the following:

- Cash Reserve Ratio: minimum deposits amount that a bank needs to keep as a reserve

- Statutory Liquidity Ratio: minimum percentage of deposits that a bank has to maintain in form of liquid cash, gold, or securities.

- Repo Rate: the rate at which the RBI lends money to banks against securities.

Inflation

Inflation also impacts the value of a currency. When there is too much supply of money but no economic growth, prices of goods and services inflate. The central bank can counteract the situation by increasing the interest rate of borrowing money. High-interest rates discourage people to spend money. Instead, it encourages them to save money.

Inflation essentially is a measure of the degree of economic stability. A low and stable inflation rate is desirable for attracting foreign investment.

Rupee depreciated against the USD from 55.48 INR to 57.07 per 1 USD within 15 days in 2013 as a consequence of increased demand in the dollar from imports and due to foreign institutional investors pulling out capital from the debt market.

This happened despite RBI's effort to stabilize the value of the rupee by selling US dollars from its foreign exchange reserves.

Political and Economic Situation

A country with stable economic conditions and political situations generally has a higher exchange rate because it is in high demand in the currency market as investors are confident with their investments. Key economic indicators like the gross domestic product (GDP), unemployment rate, trade balance, inflation rates, interest rates determine the value of the currency exchange rates.

Political tensions can also negatively impact the value of the currency. As the demand decreases, the rupee will depreciate.

|

In a nutshell,

The value of a nation's currency fluctuates primarily because it is based on supply and demand. The money supply is the total amount of a currency in circulation. An increase in demand for a currency or insufficient supply of it appreciates its exchange rate value. In the foreign exchange market, most of the world's currencies are bought and sold based on exchange rates. The value of the exchange rates fluctuates depending on the supply and demand of the currencies in the foreign exchange market.

Bigger trends in USDINR are primarily a function of three kinds of forces:

- Foreign capital flows.

- RBI intervention.

- Carry trade.

Reasons which cause the rupee to fall in comparison to dollar are:

|

•

|

Demand Supply Rule: The value of rupee follows the simple demand and supply rule of economics. If the demand for the dollar in India is more than its supply, dollar appreciates and rupee depreciates. Similarly, when the supply of dollars in India increases its demand, the value of dollar decreases in terms of rupees. Demand for dollars may be created by importers requiring more dollars to pay for their imports or by FII’s withdrawing their investments and taking the dollars outside India, thus creating a shortage of dollar supply, which in turn can also increase the demand for dollar. On the other hand, supply can be created by exporters bringing in more dollars from their revenues or FIIs bringing more dollars in India to spur their investments.

|

|

|

|

•

|

Dollar gaining strength against the other currencies: The central banks of Eurozone and Japan are printing excessive money due to which their currency is devalued. On the other hand, US Fed has shown signs to end their stimulus. Hence, making the US dollar stronger against the other currencies including the Indian rupee, at least in the short term. One doesn’t really know when Helicopter Ben will shut the door and stop the printing of money, though one doubts whether the door will be shut anytime soon.

|

|

|

|

•

|

Oil prices: Oil price is one of the most important factors that puts stress on the Indian Rupee. India is in the unhappy situation where it has to import a bulk of its oil requirements to satisfy local demand, which is rising year-on-year. In International markets, prices of oil are quoted in dollars. Therefore, as the domestic demand for oil increases or the price of oil increases in the international market, the demand for dollars also increases to pay our suppliers from whom we import oil. This, increase in demand for dollar weakens the rupee further.

|

|

•

|

Volatile domestic equity market: Our equity market has been volatile for some time now. So, the FII’s are in a dilemma whether to invest in India or not. Even though they have brought in record inflows to the country in this year chances are they may be thinking of taking their money out of the equity market which might again results in less inflow of dollars in India. Therefore, decrease in supply and increase in demand of dollars results in the weakening of the rupee against the dollar.

|

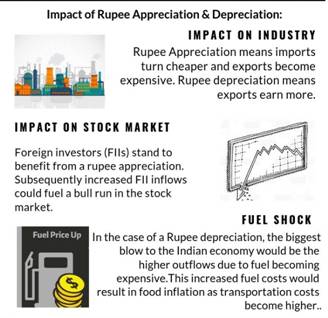

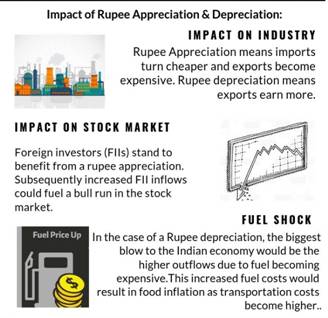

Impact of Depreciation of Rupee

Inflation May Go Up

- When Indian companies import something, they need to buy dollars to complete their payment, as we explained above. If the rupee weakens against the dollar, importing crude oil will be more expensive. Similarly, imported products like electrical machinery, mechanical appliances, precious metals (like gold), etc., that India imports will also become more expensive.

- Consequently, by-products of these imported materials are also likely to be more expensive. Companies may not be able to absorb this increase in cost and may pass on this to consumers. As a result, the overall inflation in India may accelerate at a faster pace than expected.

Possible Increase In Interest Rates – Higher FD rates and Loans

- In a healthy economy, a moderate level of inflation is good because it does not pinch the consumers and encourages business activity. However, a sudden spike in inflation is never ideal for the economy.

- In India, the government has given RBI the responsibility to keep inflation in check. If the RBI expects that inflation will rise beyond its tolerance limit for some reason, it increases the repo rate to tackle inflation.

- When RBI raises interest rates in the economy, the cost of borrowing for banks also increases. Consequently, banks pass it to their account holders by increasing the interest rate on loans and deposit rates.

Investment Portfolio May Witness a Decline

- As foreign investors are pulling out of Indian equities, it is leading to rupee depreciation. The exit of foreign investors has caused a sharp fall in the equity markets. As a result, people’s investments in stocks and equity mutual funds are also likely to witness a decline.

- Not just equities, even returns in Debt Funds could also shrink. That is because if rupee depreciation leads to a sharp rise in inflation, then RBI will increase interest rates. And Debt Funds perform poorly during increasing interest rate scenarios.

Foreign Travel and Studies to Become More Expensive

- One of the most apparent impacts of the decline in the rupee is that foreign travel and foreign education expenses are likely to rise. As explained earlier, people will have to give more rupees for every dollar following the fall in the rupee. So costs will inevitably shoot up.

- Benefits of Rupee Depreciation

|

•

|

Advantage to Exporters: Weakening of rupee gives up a huge advantage to the exporters. Let’s take up an example to understand this point. Suppose, an exporter exported goods to US and his receivable payment is 100 USD. Let’s take the value of 1 USD = Rs. 55 at the time of trade. So, his net receivable will be Rs. 5500. Suddenly, at the time of payment if the rupee declines sharply in terms of dollar and let’s takes 1USD at that time becomes Rs. 57. So, at the time of payment the exporter will get Rupees 5700 of the same trade due to the currency fluctuation. Therefore, his net profit due to depreciation of rupee becomes Rs. 200. This is how the exporters are benefited when rupee declines in terms of dollar.

|

|

•

|

Boom to tourism industry: Travel and tourism is a sector which will benefit from the depreciation of the rupee. Let’s take up an example again to understand how this industry will benefit. Suppose, if a trip to India costs Rs. 1,00,000 to a foreigner and the dollar is quoting 1USD = Rs.50 at that time. So, the trip would cost the foreigner 2000 USD. If the rupee declines in front of dollar and suppose it quotes at 1USD = Rs. 60. Then the same trip would cost the foreigner approx. 1666 USD. This will entice foreigners to visit India and help increase revenues through the travel and tourism industry.

|

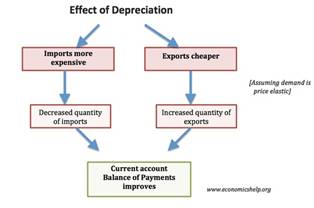

Disadvantages of Rupee Depreciation

|

•

|

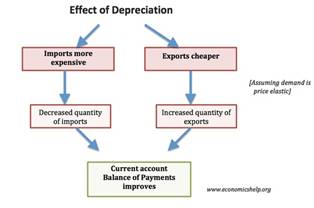

Imports become extremely expensive: A depreciating rupee would mean that the importers would have to pay more for their imports as every dollar will constitute more rupees. So, this means that price of the goods or commodity which is being imported to India increases substantially.

|

|

•

|

Reduction in Purchasing Power Parity: One of the outcomes of a depreciating rupee will be the rise in inflation in the economy. When the inflation rises, prices of goods and commodities shoots up. Therefore, the purchasing power of the rupee falls down.

|

In a nutshell,

Advantages of Depreciation:

- Exports become cheaper and more competitive to foreign buyers. Therefore, it provides a boost for domestic demand and could lead to job creation in the export sector.

- Higher level of exports should lead to an improvement in the current account deficit. This is important if the country has a large current account deficit due to a lack of competitiveness.

- A week currency could help foreign investment through secondary or primary market; as a stronger dollar would give the investor more rupees in his hand and thus an opportunity to buy more shares.

- The domestic products which gets competition from imported products gets an indirect advantage as import gets costlier which gives local product a cost benefit.

- A number of Indian companies now have sizeable international presence apart from direct exports. A stronger foreign currency helps boost their consolidated numbers.

Disadvantages of Depreciation:

- India being the third largest oil importing country could have an adverse impact of currency depreciation. Rising imports will increase the current account deficit.

- Currency depreciation could lead to inflation as cost of imported goods would go up e.g. rising fuel prices would push prices of commodities higher.

- Students looking to study abroad are severely hit as they have to shell out more rupees to meet the cost.

- It affects those companies who have raised debt abroad and have not fully-hedged their position.

Depreciation vs Devaluation

https://economictimes.indiatimes.com/markets/stocks/news/why-it-would-be-challenging-for-rbi-to-contain-volatility-in-rupee/articleshow/94447433.cms?from=mdr