Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

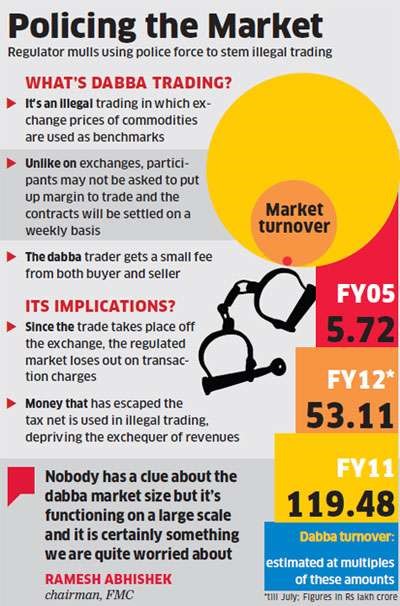

What is ‘dabba trading’?

Understanding through an example

Motive

Dabba Trading: Key pointers

Concerns

Conclusion

|

PRACTICE QUESTION Q. What do you understand by the term “Dabba Trading”? What are the concerns associated with Dabba Trading in India? Critically examine. |

© 2024 iasgyan. All right reserved