Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

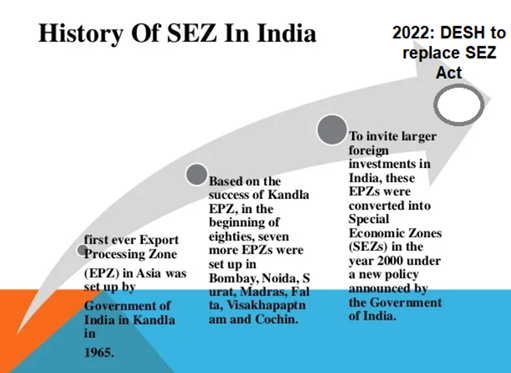

Context

About Special Economic Zone

SEZ can be set up by

Types of SEZ

What were the shortcomings of the SEZ Act?

What is Development of Enterprise and Service Hubs (DESH)?

Significance of DESH

© 2024 iasgyan. All right reserved