Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

Details

Digital Banking

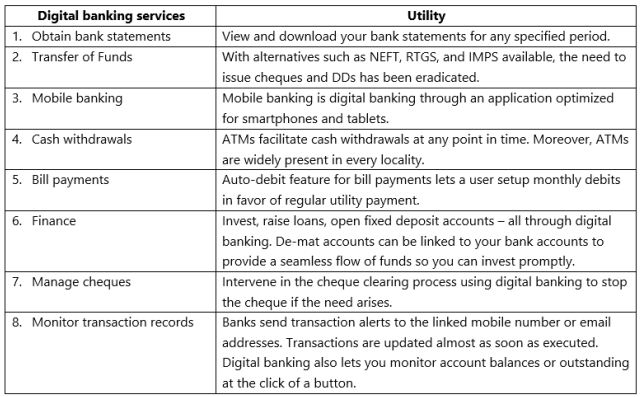

Digital Product services

Benefits of Digital Banking

Digital banking aims to make life easier for the customers of a bank. Some of its benefits are

Digital bank license roadmap in India

https://www.financialexpress.com/industry/banking-finance/niti-aayog-suggests-three-step-process-for-full-stack-digital-banks/2600859/

© 2024 iasgyan. All right reserved