Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Copyright infringement not intended

In News

Direct Benefit Transfer

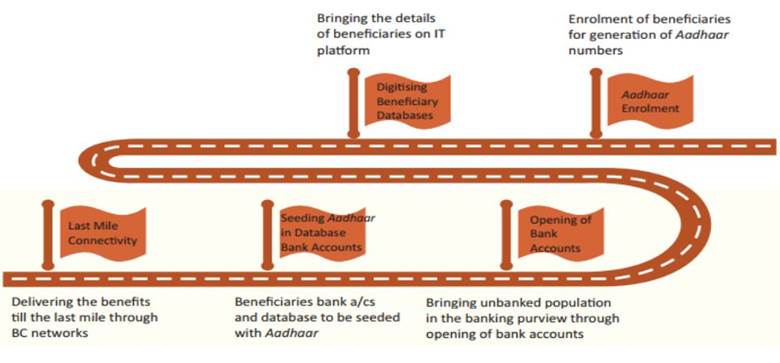

Pre-Requisites for DBT

Benefits of the DBT scheme

Present Status of Union Government subsidy and to what extent is it under DBT?

In the 2014-15 edition of the Economic Survey, the chapter titled, ‘Wiping every tear from every eye: The JAM Number Trinity Solution’, used the term leakage to describe subsidized goods that do not reach households. Leakages, it said, not only have the direct costs of wastage, but also the opportunity cost of how the government could otherwise have deployed those fiscal resources. Converting all subsidies into direct benefit transfers is therefore a laudable goal of government policy.

For More Information: https://www.iasgyan.in/daily-current-affairs/international-monetary-fund-imf

https://t.me/+hJqMV1O0se03Njk9

© 2024 iasgyan. All right reserved