Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

|

Direct Taxes |

Indirect Taxes |

|

It is levied on income and activities conducted. |

It is levied on product or services. |

|

The burden of tax cannot be shifted in case of direct tax. |

The burden of tax shifted for indirect taxes. |

|

It is paid directly by person concerned. |

It is paid by one person but he recovers the same from another person i.e. person who actually bear the tax ultimate consumer. |

|

It is paid after the income reaches in the hands of the taxpayer |

It is paid before goods/service reaches the taxpayer. |

|

Tax collection is difficult. |

Tax collection is relatively easier. |

|

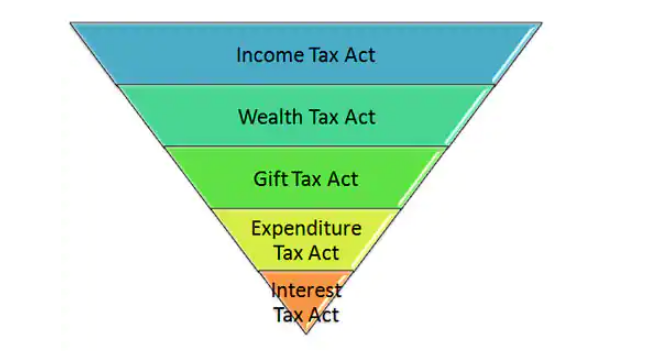

Example Income tax, wealth tax etc. |

Example GST, excise duty custom duty sale tax service tax |

© 2024 iasgyan. All right reserved