Disclaimer: Copyright infringement not intended.

Context:

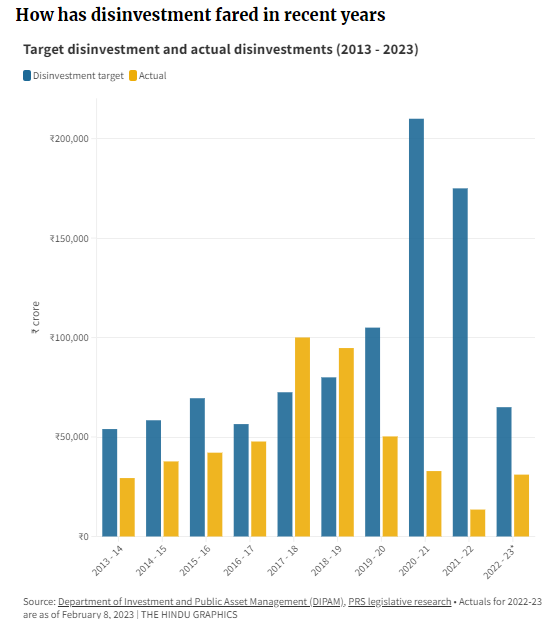

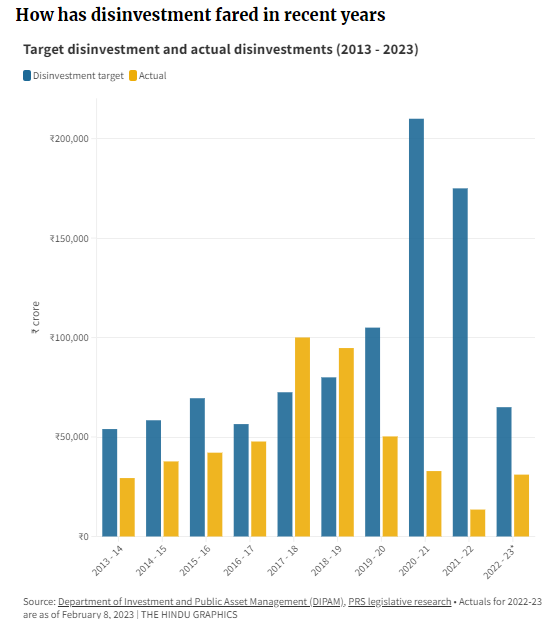

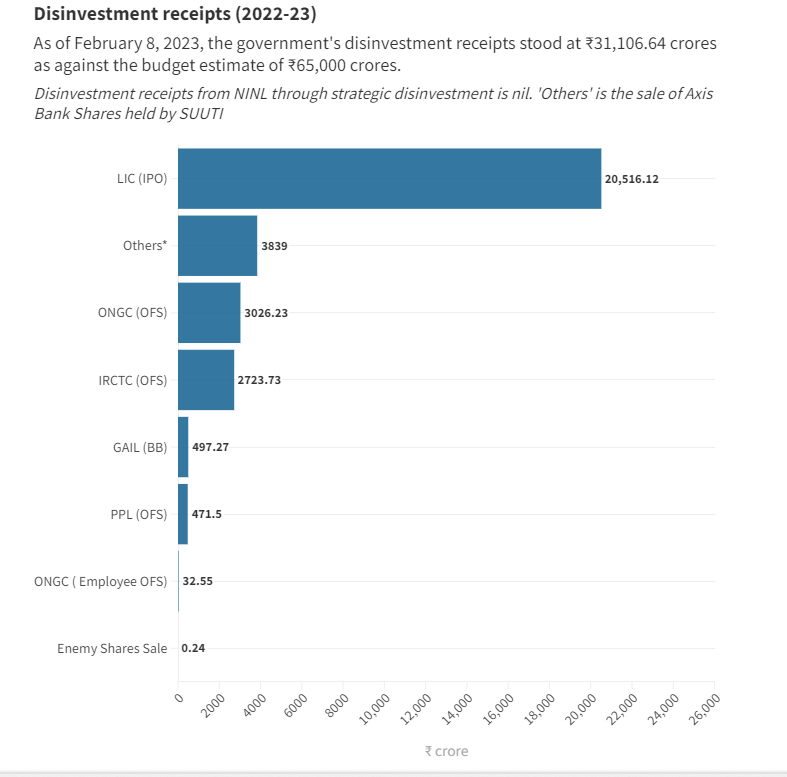

- In the Union Budget for 2023-24, the government has set a disinvestment target of ₹51,000 crore, down nearly 21% from the budget estimate for the current year and just ₹1,000 crore more than the revised estimate.

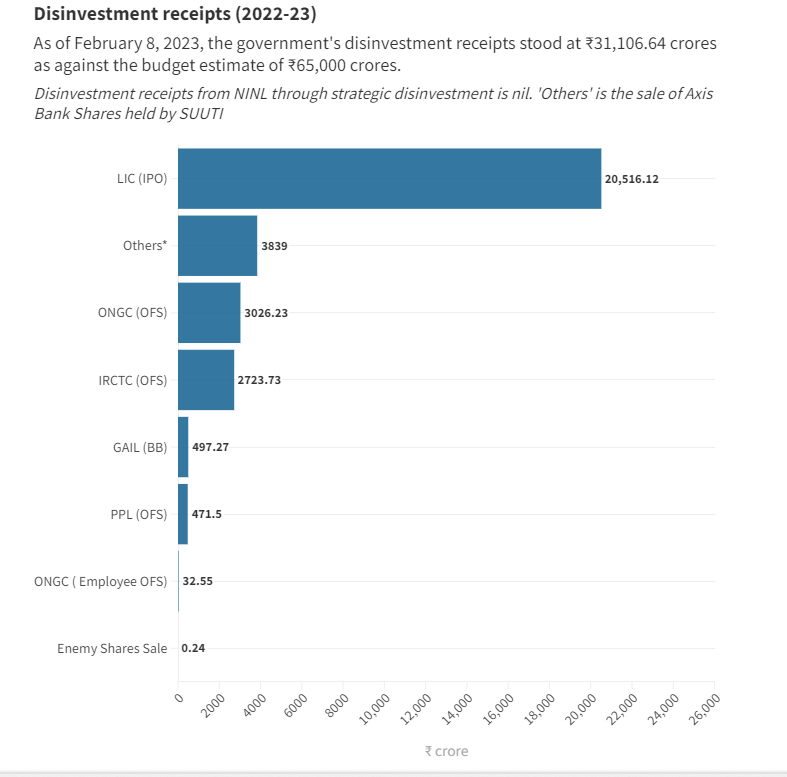

- It is also the lowest target in seven years. Moreover, the Centre has not met the disinvestment target for 2022-23 so far, having realised ₹31,106 crore to date, of which, ₹20,516 crore or close to a third of the budgeted estimate came.

Disinvestment:

- Disinvestment means sale or liquidation of assets by the government, usually Central and state public sector enterprises, projects, or other fixed assets. Disinvesting is an exit strategy that means taking out an existing investment. Disinvestment policies are commonly followed by governments to allocate resources more efficiently.

- For example: The Government of India will sell 30.48% of its stake in the IDBI bank, and Life Insurance Corporation of India (LIC) shall sell 30.24%, aggregating to 60.72% of IDBI Bank’s share capital, along with transfer of management control in the lender.

- In a nutshell, Disinvestment by the government means the market activity through which the Government conducts sale or liquidation of Government-owned assets. Such assets usually refer to the Government’s ownership stake in Central Public Sector Enterprises (CPSEs) and state public sector enterprises (SPSEs), but are not limited to that. Government assets also include project undertakings and other fixed assets.

Disinvestment in India:

Why Disinvestment is done?

- Reducing the financial burden on the Government finances

- Opening up markets for private firms, which eventually leads to better capital markets and efficient allocation of resources

- Supporting the liquidity measures in the market by aiding to consumption and demand as the need arises

- Raise money to facilitate long-term Government goals of growth and development in the country

- Channelize resources to more productive avenues and projects by reducing the capital expenditures on existing non-performing assets or loss-making firms

- Improve the Return on Investment (ROI) of underperforming firms.

.jpeg)

In a nutshell,

Main objectives of Disinvestment in India:

- Reducing the fiscal burden on the exchequer.

- Improving public finances.

- Encouraging private ownership.

- Funding growth and development programmes.

- Maintaining and promoting competition in the market.

- Reducing the financial burden on the government.

- Improving public finances.

- Encouraging an open share of ownership.

- Introduction, competition, and market discipline.

- Depoliticizing essential services.

- Upgrading the technology used by public enterprises to become competitive.

- Rationalizing and retraining the workforce.

- Building competence and strength in R&D.

- Initiating the diversification and expansion programmes.

Importance of Disinvestment

The importance of disinvestment lies in utilisation of funds for:

- Financing the increasing fiscal deficit,

- Financing large-scale infrastructure development,

- For investing in the economy to encourage spending,

- For retiring Government debt- Almost 40-45% of the Centre’s revenue receipts go towards repaying public debt/interest,

- For social programs like health and education.

Types of Disinvestments

From a general point of view, the disinvestment in India can be categorized in the following manner:

- Organizing the market segment: A company may disinvest in one of its underperforming divisions, as other divisions continue to deliver higher profitability while demanding similar resources and expenditure. Such a disinvestment strategy is to shift the focus of the company on the divisions performing well and to scale them up.

- Offloading unnecessary assets: A company is cornered into adopting this strategy when the acquisition of an asset does not fit its long-term strategy. Companies post-merger are stuck with assets they do not intend to use. A company may choose to disinvest in acquired assets and instead focus on their competitive abilities.

- Social and legal considerations: A company may have to disinvest if they cross a certain threshold limit in the market holding to enable fair competition. Another example is of an endowment fund pulling out of investments in energy companies given environmental concerns.

From a government point of view, the disinvestment strategy can be of the following types:

- Minority Disinvestment: The Government wishes to retain managerial control over the company by maintaining the majority stake (equal to or more than 51 percent). Because public sector enterprises cater to the citizens, the Government needs to be able to influence company policies to further the interests of the general public. The Government generally auctions the minority stake to potential institutional investors or announces an offer for sale (OFS) inviting participation by the public.

- Majority Disinvestment: The Government gives up the majority stake in a government-held company. After the disinvestment, the government is left holding a minority stake in the company. Such a decision is based on strategic grounds and policies of the Government. Typically, majority disinvestments are done in the favor of other public sector enterprises. For example, Chennai Petroleum Corporation Limited, formerly known as Madras Refineries Limited is a group company of Indian Oil Corporation after disinvestment by the Government. The idea is the consolidation of resources in a company which ultimately leads to operational efficiency.

- Strategic Disinvestment: The government sells off a PSU to usually a non-government, private entity. The intention is to transfer the ownership of a non-performing organization to more efficient private players in the market and reduce on the financial burden on the government balance sheet. Selling minority shares of Public Enterprises, to another entity be it public or private is disinvestment. In this the government retains ownership of the enterprise. On the other hand, when the government sells majority shares in an enterprise, that is strategic disinvestment/sale. Here, the government gives up the ownership of the entity as well. Government carefully choses enterprises to be put up for sale.

- Complete Disinvestment/Privatization: 100 percent sale of Government stake in a PSU leads to the privatization of the company, wherein complete ownership and control are passed onto the buyer.

Means of Disinvestment

Disinvestment of a minority stake in a Government-owned entity is done in one of the following ways:

- Initial Public Offering(IPO)

- Follow On Public Offer (FPO)

- Offer For Sale (OFS)

- Institutional Placement – Government stake is auctioned off to select financial institutions

- Exchange-Traded Funds(ETFs) – Monetize shareholding simultaneously across multiple sectors and companies that form a constituent of the ETF. For example, Bharat-22 is an ETF comprising of 22 companies (19 PSUs) with a Government stake in them.

- Cross-holding – Listed PSUs are allowed to buy a Government stake in another PSU.

Disinvestment v/s Divestment

- Divestment and disinvestment are terms used interchangeably. However, there is a slight point of difference between the two.

- Disinvestment in an asset, or division, or stake is typically carried out without the intent of reinvesting capital back into the same entity. Divestment, on the other hand, is generally done temporarily to deal with say, tight finances, or social/political pressures that may arise as a result of certain business activities. While disinvestment might also mean selling off the entity in its entirety, divestment only means the reduction of investment.

Disinvestment v/s Privatization

Privatization is the partial or complete sale of Government-owned assets to a privately held firm or a group of individuals where the Government gives up majority control to the buyer of assets. Privatization can be done by:

- Stake sale of Government-owned equity in PSUs.

- Lifting regulations restricting private participation in Government-regulated industries.

- Offering public services contracts to private corporations.

- Offering subsidies on various business activities.

|

Point of Difference

|

Disinvestment

|

Privatization

|

|

Control

|

Dilution of ownership, Government retains control

|

Transfer of ownership, control changes hands

|

|

Shareholding threshold

|

More than 50 percent

|

Less than 50 percent

|

|

Purpose

|

To ease public finances and increase productivity of Government capital

|

Strategic in terms of achieving operational efficiency

|

What are the advantages of Disinvestment?

Some of the benefits of disinvestment, irrespective of the approach are as follows:

For the Government:

- Reduce the burden on the government by raising valuable resources for the government, which could be used to bridge the fiscal deficit and also can be used for various social infrastructure projects or invest towards profit-making PSUs

- The government can focus more on core activities such as infrastructure, defense, education, healthcare, and law and order.

- A leaner government.

For the Markets and Economy

- Brings about greater efficiencies for the economy and markets as whole increasing competitiveness.

For the Employees:

- Monetary gains through ESOPs and preferential issue of shares.

For the PSUs:

- Greater autonomy and introduction of corporate governance that may lead to higher efficiency.

For retail investors:

- Unlocking of shares from disinvestment through various means like IPO allows retail investors to invest.

Drawbacks of IPO:

- Fear of price rise due to monopoly

- Fear of foreign control when a foreign company buys the major stake of the disinvested company

- Loss of employment due to privatization

- Loss of public interest, etc.

Important Stats:

What have been the challenges to disinvestment?

- Observers point out that disinvestment should ideally be driven by the long-term vision of the government on the extent to which it wants to privatise the economy and the sectors where it needs to retain a presence — and not by the need to raise revenues.

- However, of late, the government’s reliance on disinvestment proceeds to bridge the gap in the Budget has been increasing. It had introduced a new strategic disinvestment policy in 2021 to maintain ‘bare minimum’ presence in strategic sectors like atomic energy, defence etc., and exit non-strategic sector enterprises.

Way Ahead:

- Disinvestment planning calls for a consistent and long-term rationale.

- The key to revive the economy is to have short term as well as long term objective in place so that the economy rebounds and continues to grow.

- For India to transition from a developing to a developed nation, the key is to have world-class infrastructure. In order to build this infrastructure in terms of roads, ports, urban infrastructure, healthcare infrastructure the Government needs to play the key role and fund its growth. One of the best ways to do so is by strategic disinvestment and privatization.

- The large disinvestment and privatization exercised by the Government would result in more foreign capital coming into India, thereby adding depth to the overall capital markets and help India shine on a world stage.

https://www.thehindu.com/business/Economy/explained-the-status-and-proceeds-of-disinvestment/article66485958.ece