Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

MUST READ ARTICLE:

RBI’S SURPLUS TRANSFER TO GOVERNMENT: https://www.iasgyan.in/daily-current-affairs/rbis-surplus-transfer

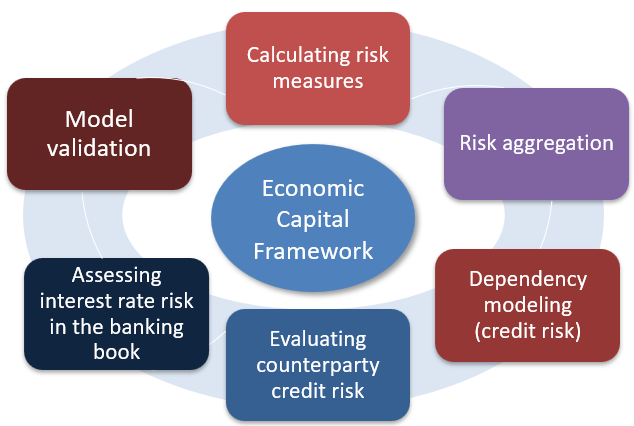

Economic Capital Framework

These risks could be things like:

Why is it Important?

What Happened in 2015?

Learning from Other Countries

Revision of ECF

Key Recommendations:

Acceptance of Recommendations:

|

PRACTICE QUESTION Q. What do you understand by the term Economic Capital Framework (ECF)? Evaluate its importance in managing risks and maintaining financial stability, citing recent RBI actions regarding surplus transfers to the government. |

SOURCE: BUSINESS STANDARD

© 2024 iasgyan. All right reserved