Disclaimer: Copyright infringement not intended.

Context

- To curb a surge in gold imports and check ‘windfall gains’ being made by producers of crude oil and petroleum products, the Centre has raised the import duty on the Gold to 15%, from 10.75%.

Link between gold and economy

- Gold was used as the world's reserve currency for most of the 20th

- The United States used the gold standard until 1971.

- Demand for gold increases during inflation because of its intrinsic value and limited supply.

- Gold cannot be diluted, so it can maintain its value much more than other currencies.

Gold in the context of the Indian economy

- Jewelery and Jewelery Industry: India's jewelry and jewelery sector is one of the largest in the world, accounting for about 29% of the world's consumption. Almost 65% of jewelry made in India is handmade

- Gold Mine: It brings important sustainable socio-economic development to India. The gold mining industry was of little importance in the country.

- Gold Refining: The refining sector has seen a surge in new capabilities in recent years. India's total refining capacity now exceeds 1,450 tonnes.

Gold imports

- Despite being an impoverished country with low per capita income, India tops the world in buying gold.

- Gold imports were worth USD 34.62 billion in 2020-21. India's gold imports, which have a bearing on the country's current account deficit (CAD), rose by 33.34 per cent to USD 46.14 billion during the 2021-22 fiscal on account of higher demand, according to official data. Gold is looked upon as one of the best options when it comes to security and savings.

- There are certain qualities of gold that make it a desirable investment option. Some of these being

- The ability of gold to insure against instability and protect against risk.

- Has universal acceptance.

- Provides liquidity.

- Deep cultural affinity with gold purchase

- In addition, the cultural importance of gold is responsible for India’s fascination for gold jewellery.

Gold-not a productive asset

- India’s domestic production of gold is very limited; the rising demand has to be sourced from outside the country.

- Moreover, Gold as a commodity on its own does not add much to the productive capacity of the economy. When one buys gold, it either is stored in lockers or gets converted into jewellery. In both the cases, money spent on purchasing gold gets blocked since gold is not a productive asset.

Gold imports and Current Account Deficit (CAD)

- Gold imports directly affect the current account deficit (CAD) of India. As a thumb rule, the larger the CAD with respect to GDP, the riskier it is for the overall economy.

- The country is presently the largest importer of gold on the planet, consuming one-third of the planet’s supply on an annual basis. In fact gold is the second-most purchased overseas commodity after oil.

- Gold imports is partly attributable to high level of inflation as well.

- The Current Account Deficit could be reduced by boosting exports and curbing non-essential imports such as gold.

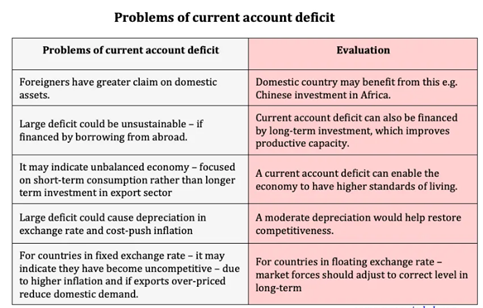

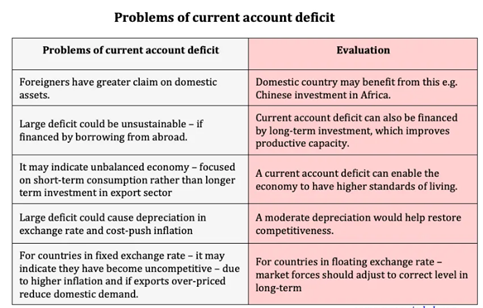

Current Account Deficit

- Current Account Deficit or CAD is the shortfall between the money flowing in on exports, and the money flowing out on imports.

- Current Account Deficit (or Surplus) measures the gap between the money received into and sent out of the country on the trade of goods and services and also the transfer of money from domestically-owned factors of production abroad.

Calculating Current Account Deficit

- The current account constitutes net income, interest and dividends and transfers such as foreign aid, remittances, donations among others. Although these components make up only a small percentage of the total current account.

- Current Account Deficit is measured as a percentage of GDP.

- Trade gap = Exports – Imports

- Current Account = Trade gap + Net current transfers + Net income abroad

- A country with rising CAD shows that it has become uncompetitive, and investors are not willing to invest there.They may withdraw their investments.

Gold imports and Currency Impact

- When a country imports more than it exports, the value of that currency declines. On the other hand, if a country is a net exporter, the value of that currency will increase.

- For example, as the price of gold rises, the strength of the currency increases in countries that export gold or have access to gold reserves, as the country's total exports increase.

Impact of gold imports on India’s external sector stability

- In order to examine the impact of gold imports on India’s external sector performance in general and trade deficit in particular, five alternative scenarios are assumed based on growth in quantity of gold imports, international gold prices and export content of imports. For estimating India’s Nominal GDP in terms of US dollar, IMF’s projections of growth for GDP at current prices (in US$) have been used.

- High gold import growth and gold prices, the net gold imports as ratio to GDP adversely affects India’s trade deficit and current account deficit.

- Unless gold imports are converted into re-exports or volume of gold import does not moderate, increasing quantum of gold imports not only stresses India’s CAD but would also be a drag on India’s foreign exchange reserves.

Impact of high Gold Import on Current Account and Balance of Payments

- Since, India is the largest importer of gold in the world; yet the imports of gold by India have been rising unabated in recent years notwithstanding the sustained increase in gold prices.

- Such large import of gold, when the gold prices are ruling high is one major source of bulging trade deficit. The deterioration in Current Account Deficit (CAD) due to large gold imports has implications for financing the same, which would reduce the foreign exchange reserves and could become a drag on the external debt. In this context, a major concern emerged is the impact of huge gold imports on external stability.

Some steps taken by Government to curb Gold imports

Gold Monetization Scheme:

- This was introduced to mobilize fallow gold in homes and institutions, use it productively, and lower import prices.

Sovereign Gold Bond (SGB) Scheme:

- Bonds are issued by the Reserve Bank of Indiaon behalf of the Government of India.

- The bond has a term of 8 years and has an option to terminatefrom the 5th year.

- Its objective is to reduce demand for physical goldby shifting a part of the gold purchase by people to invest in gold bonds.

Possible Way Out

- What is required is to address the larger issue which is to encourage the substitution gold purchases with alternate investment options available in the financial sector which shall also help in increasing the productive capacity of the economy. In order to achieve this objective some of the initiatives that can be taken are:

- Increase the reach of Banks - growing demand for gold purchases in the country is an indication that households with high levels of savings are looking at options available to invest their savings. As per a World Gold Council Report[24] India has one of the highest saving rates in the world; estimated at around 30% of total income, of which 10% is invested in gold. Therefore it is important that the financial sector taps into this huge saving reserve.This is particularly true for the rural areas where according to the same World Gold Council Report only 21% of rural India had access to formal financial sources. Therefore lack of availability of alternate avenues of investment that might be resulting in heavy gold purchases.

- Innovative means of alternate investments must be considered - It must be understood that it is easier for a rural person to buy gold jewellery than opening a deposit account in a bank, due to various documentary formalities that are required. In the competitive environment, banks have to contend with the transaction cost associated with servicing retail deposits and credit accounts.The government can make use of its vast network of post offices in order to delivering financial services to the otherwise excluded sections.

- Liquidity quotient of alternate investment instruments - a prime reason behind increased gold purchase is its liquidity aspect, which is in case an individual requires money he can immediately sell his gold for cash. This is usually not the case with other financial products as redeeming them usually takes time. Information technology could play an important role in facilitating retail banking in rural areas. However, in rural areas low level of technology penetration coupled with low levels of literacy are a major obstacle for enhancing the outreach of IT enabled banking services. In this context, there is a need to recognize the role of fiscal empowerment relating to spending on social sector such as education.The government can also consider introducing highly liquid across the counter instruments with the government guaranting buybacks.

- Massive education campaign must be launched – to create awareness amongst the public at large as to how unnecessary piling of gold stocks with households is not only adversely impacting the current account position of the economy but also what it is doing is increasing the level of black money circulation in the economy. This is happening because the purchase and sale of gold is being done in cash thereby hurting the government on two fronts. Firstly, the purchasing gold against cash gives an individual an opportunity to convert his black money into white. Secondly, the cash received by the seller also remains undeclared and thereby no tax will be paid. On top of this the gold imports are being financed by the hard earned foreign exchange. Therefore it is imperative for the government to educate the citizens of the country about the adverse impact of rising gold imports.

https://epaper.thehindu.com/Home/ShareArticle?OrgId=GFVA04A0J.1&imageview=0