Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

What is ESG and why is it important?

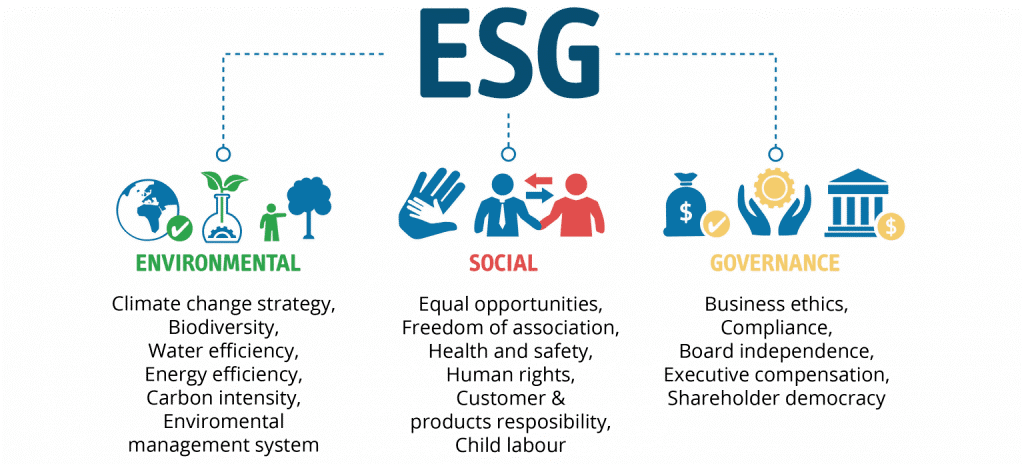

Pillars of ESG

The three main pillars of ESG include:

ESG Legal Regime in India

Need for legislation on ESG

Why is ESG relevant in India?

What are the implications for Indian companies?

https://www.thehindu.com/opinion/op-ed/explained-the-rise-of-the-esg-regulations/article66610907.ece

© 2024 iasgyan. All right reserved