Disclaimer: Copyright infringement not intended.

Context

- A predominant part of the outstanding External Commercial Borrowings (ECB) of India are effectively hedged- RBI.

About

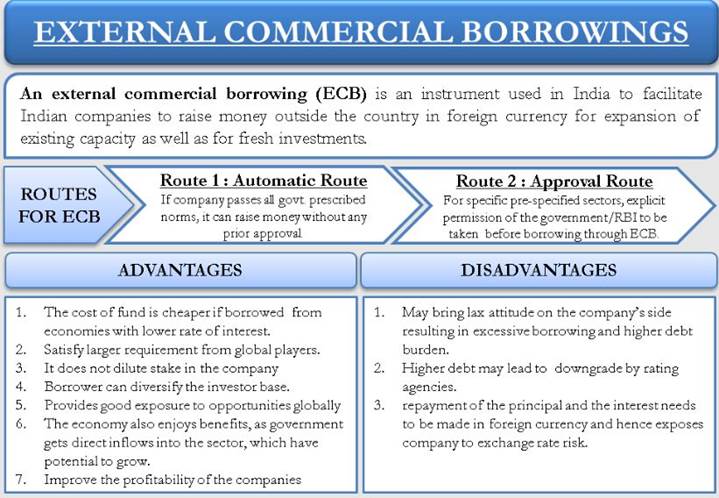

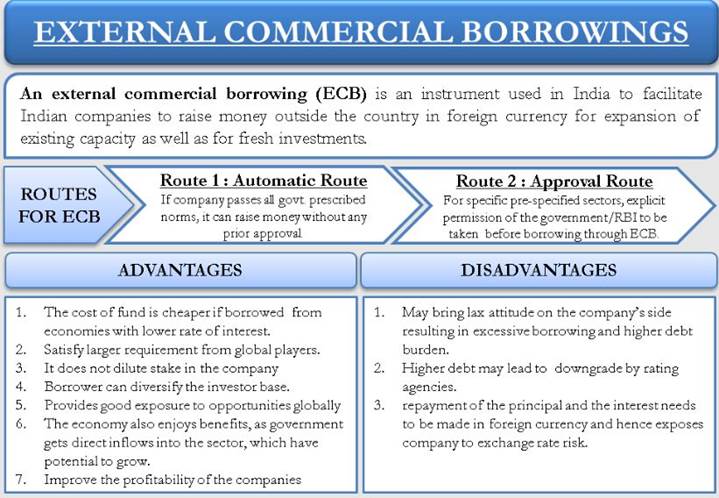

- External commercial borrowings (ECBs) are loans in India made by non-resident lenders in foreign currency to Indian borrowers. They are used widely in India to facilitate access to foreign money by Indian corporations and PSUs (public sector undertakings).

- ECBs include commercial bank loans, buyers' credit, suppliers' credit, securitized instruments such as floating rate notes and fixed rate bonds etc., credit from official export credit agencies and commercial borrowings from the private sector window of multilateral financial Institutions such as International Finance Corporation (Washington), ADB, AFIC, CDC, etc.

- ECBs cannot be used for investment in stock market or speculation in real estate. The DEA (Department of Economic Affairs), Ministry of Finance, Government of India along with Reserve Bank of India, monitors and regulates ECB guidelines and policies.

Types of ECBs

ECBs can be broadly classified into foreign currency denominated ECB (FCY denominated ECB) and rupee-denominated ECB (INR denominated ECB).

FCY denominated ECB

Here, ECB is raised in any freely convertible foreign currency. FCY denominated ECB includes Foreign Currency Convertible Bonds (FCCBs), Foreign Currency Exchangeable Bond (FCEB), loans including bank loans, trade credits beyond three years, floating/ fixed-rate notes/ bonds/ debentures (other than fully and compulsorily convertible instruments), and financial lease.

INR denominated ECB

Here, ECB is raised in Indian Rupee. It includes trade credits beyond three years, floating/ fixed-rate notes/ bonds/ debentures (other than fully and compulsorily convertible instruments), loans including bank loans, financial lease, and plain vanilla Rupee denominated bonds issued overseas.

Currency of borrowing

- ECB can be raised in any freely convertible foreign currency as well as in Indian Rupees or any other currency as specified by the Reserve Bank of India in consultation with the Government of India.

Eligibility of borrowers

- This has been expanded to include all entities eligible to receive FDI. Additionally, Port Trusts, Units in SEZ, SIDBI, EXIM Bank, registered entities engaged in micro-finance activities, viz., registered not for profit companies, registered societies/trusts/ cooperatives and non-government organizations/Start-ups can also borrow under this framework.

- Further, Reserve Bank, in consultation with the Government of India may specify any other entity/sector eligible to raise ECBs or amend the existing eligibility norms.

Thus, Eligible resident entities include:

- Entities eligible for Foreign Direct Investment (FDI),

- Port trusts

- Units in Special Economic Zone (SEZ)

- Small Industries Development Bank of India (SIDBI)

- EXIM Bank

- Registered entities engaged in micro-finance namely NGOs, not-for-profit companies, trusts, societies. However, entities listed in the last category (point 6) are only allowed to raise INR ECBs.

Eligible Lenders

- The lender should be resident of FATF or IOSCO compliant country as defined in the ECB policy, including on transfer of ECBs. However, Multilateral and Regional Financial Institutions where India is a member country will also be considered as recognized lenders.

In a nutshell, to be an eligible lender, any of the following conditions should be satisfied

- A resident of the Financial Action Task Force (FATF) or International Organization of Securities Commissions (IOSCO) compliant country.

- Regional and multilateral financial institutions where India is a member.

- Individuals who are foreign equity holders.

- Individuals subscribed to bonds/debentures listed abroad.

- Foreign branches or subsidiaries of Indian banks (subjected to certain conditions).

Foreign Equity Holder

- It means (a) direct foreign equity holder with minimum 25% direct equity holding in the borrowing entity, (b) indirect equity holder with minimum indirect equity holding of 51%, or (c) group company with common overseas parent

Sources of ECB

External Commercial Borrowings can be availed through;

- Automatic Route-Through Authorized Dealers, AD Category -I banks;

- Approval Route-Perspective borrower should send its proposal for ECB to RBI through AD-Category-I bank for examination.

Maturity

- Minimum average maturity will be 5 years for ECB raised from foreign equity holder for working capital purposes, general corporate purposes or for repayment of Rupee loans. (Except for manufacturing companies for which 1 year is prescribed).

- There are no specific guidelines for maximum period.

All-in-cost

- Benchmark rate in case of Rupee denominated ECB (INR ECB) will be prevailing yield of the Government of India securities of corresponding maturity.

Individual limits of borrowing

- All eligible borrowers/category of borrowers may raise ECB of up to USD 750 million or equivalent per financial year. For Startups the amount would be limited to USD 3 million or equivalent per financial year.

Advantages of External Commercial Borrowing

- Low Interest Rate: To begin with, the value of funds borrowed from external sources is generally lower.

For example, there are numerous economies with lower interest rates; if Indian firms and organisations could borrow at lower interest rates from Europe and the United States, they would undoubtedly benefit.

- Borrowing without giving control: Another advantage is that ECB is, at their most fundamental level, simple loans. The company's stakes shall not be diluted, despite the fact that they do not have to be of an equity nature. Because debtors will not have voting rights in the company, the borrowers will be able to raise funds without relinquishing control.

- Global Exposure: While ECBs allow borrowers to diversify their investor base, they also provide borrowers with greater exposure to global markets, which is not to say that ECBs do not feed the local economy.

- Economic Growth: The government of India can direct inflows into the sector, increasing the sector's potential for growth. For example, the government can allow a higher percentage of ECB funding for the SME and infrastructure industries, thereby contributing to the country's growth.

- Boosts economy: The government can regulate the flow of funds more towards a particular sector of the economy which will boost the economy as a whole.

Disadvantages of External Commercial Borrowing

- Reckless Borrowing: One could speculate that the company's attitude may soften as they increasingly come across funds available at lower rates. This could lead to companies borrowing recklessly, resulting in higher debt on the company's balance sheet and a negative impact on financial ratios.

- Low Creditworthiness: The fact is that rating agencies view companies with more debt on their balance sheets negatively, which could result in a market downgrade for such companies.

- Stock Decline: Furthermore, the company's stock may experience a decline in market value over time.

- Currency Swap: Because funds are raised through External Commercial Borrowing in foreign currencies, the principal and interest must also be paid in foreign currencies. As a result, the company exposes itself to the risks associated with currency exchange rates.

- Restrictions to Borrowing: Although it is established that ECBs can be obtained at lower rates, there are several guidelines and restrictions that must be followed.

Sahoo Committee Report on ECBs

- It has recommended a complete liberalization of external commercial borrowing (ECB) regulations, including permitting all Indian companies to borrow in foreign currency without any upper ceiling, subject to specific hedging requirements.

- The committee has also recommended doing away with restrictions on lenders, the maturity of the loan, the cost of borrowing and restriction in terms of end uses arguing that these do not serve any economic purpose in the current environment.

- It also suggests completely doing away with the requirement of seeking prior approval of the Reserve Bank of India (RBI) for such borrowings. At present, ECB borrowings can be done under the automatic and the approval routes but are subject to an upper limit, maturity period and specified end-use requirements like import of capital goods.

- It has recommended that the objective of the ECB framework should be to allow Indian firms an effective option to borrow in foreign currency provided that sufficient safeguards are put in place to avoid a systemic risk that may arise from a large number of firms having un-hedged foreign currency exposure.

- While admitting that firms are exposed to balance-sheet risks due to exchange rate fluctuations, the Sahoo committee has made a strong pitch to allow firms to take such risks.

Changes in ECB Rules brought in 2020

- Funding of up to 50% (through ECB) is authorised for telecom, infrastructure, and greenfield projects.

- The RBI has issued a rule indicating that through the automated route, all qualifying borrowers can raise ECB up to USD 750 million or equivalent per financial year (earlier it was applicable only to corporate companies).

- The Ministry of Finance's Department of Economic Affairs, in collaboration with the Reserve Bank of India, supervises and regulates ECB guidelines and regulations.

Conclusion

- External Commercial Borrowings is one of the emerging sources for bringing foreign capital to India. With the introduction of a new framework i.e. Master Directions issued by the RBI, the norms have been relaxed substantially which has improved the ease of doing business in India.

- Provisions of the automatic route, increased scope for eligible borrowers and lenders, simpler classification of ECBs, regularising delays by submitting late fee reduced hedging requirements, etc. will hopefully prove to be a boon for the economy in the years to come. This will help to develop resident entities which will boost the economy as a whole.

https://www.business-standard.com/article/economy-policy/bulk-of-ecbs-effectively-hedged-external-sector-well-buffered-rbi-s-das-122072200514_1.html