Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Copyright infringement not intended

Picture Courtesy: https://www.fatf-gafi.org/en/publications/Fatfgeneral/outcomes-fatf-plenary-february-2023.html

Context: The Financial Action Task Force (FATF) finalized modifications to its assessment methodology, particularly concerning the protection of non-profit organizations (NPOs) from potential abuse for terrorist financing.

Details

Changes to Assessment Methodology:

Protection of Non-Profit Organizations (NPOs)

Recommendation 8

Understanding Degrees of Terrorist Financing Risk

Risk-Based Approach

|

Other Outcomes of the Plenary Besides addressing NPO-related issues, the FATF plenary resulted in new risk-based guidance for implementing Recommendation 25 on beneficial ownership and transparency of legal arrangements. Additionally, the identification of jurisdictions with materially important virtual asset activity was emphasized to assist in implementing FATF requirements in the context of evolving financial technologies. |

|

FATF Plenary Outcomes Summary |

||

|

Outcome |

Description |

Significance |

|

Changes to NPO Assessment Methodology |

Emphasizes risk-based approach to assessing terrorist financing (TF) risk for NPOs. Encourages proportionate measures based on identified risk. Aims to avoid hindering legitimate NPO activities. |

Balances security needs by protecting NPOs' ability to operate freely and provide essential services. |

|

Revision of Recommendation 8 |

Updated in October 2023 to guide countries on applying proportional measures based on NPO-specific TF risks. Focuses on preventing excessive restrictions and protecting legitimate NPO operations. |

Addresses concerns raised about potential harm to NPOs due to overly restrictive measures. |

|

New Guidance for Recommendation 25 |

Provides guidance on implementing Recommendation 25, which focuses on beneficial ownership and transparency of legal structures. Aims to combat money laundering and terrorist financing facilitated by such structures. |

Strengthens efforts to prevent the misuse of legal structures for financial crimes. |

|

Identification of Jurisdictions with Significant Virtual Asset Activity |

Identifies jurisdictions with high levels of virtual asset activity. Targets these jurisdictions for specific support in implementing FATF's standards to prevent abuse of virtual assets for financial crimes. |

Focuses resources to combat emerging financial crime risks associated with virtual assets. |

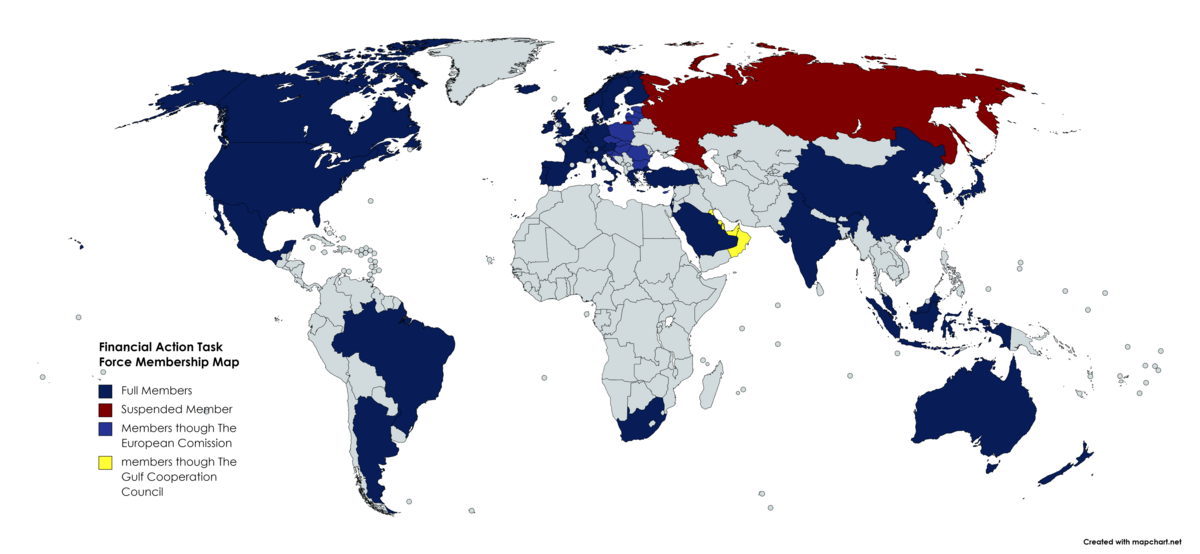

Financial Action Task Force (FATF)

FATF Recommendations

Compliance Mechanism

Black or Greylisting of Non-Compliant Nations

Members and Affiliate Organizations

Conclusion

|

PRACTICE QUESTION Q. The Financial Action Task Force (FATF) sets global standards, but countries have varying legal and political systems. How can the FATF balance the need for robust global standards with respect for national sovereignty and diverse legal frameworks? Can a "one-size-fits-all" approach be truly effective in such a diverse environment? |

© 2024 iasgyan. All right reserved