Disclaimer: Copyright infringement not intended.

Context

- The Central Bureau of Investigation has arrested officials of the Foreign Contribution (Regulation) Act (FCRA) division of the Union Home Ministry for allegedly facilitating illegal clearances to non-governmental organisations (NGOs) under the Act, in lieu of bribes.

About FCRA

- The Foreign Contribution (Regulation) Act regulates the receipt of foreign contribution or aid from outside India for use in the country. It ensures that such contributions do not adversely affect internal security.

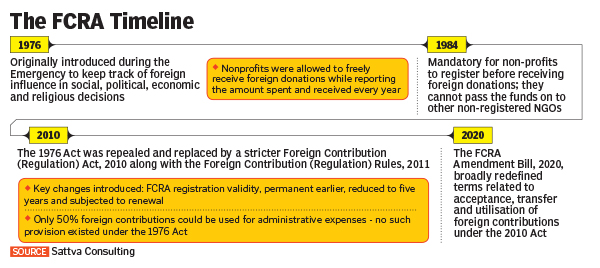

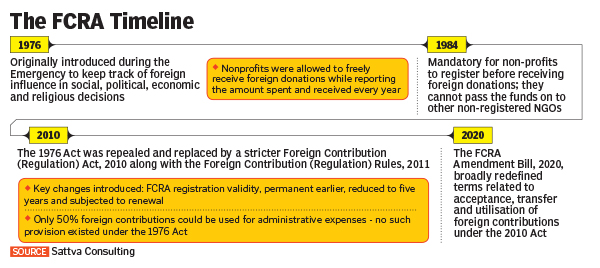

- First enacted in 1976, it was amended in 2010 when a slew of new measures were adopted to regulate foreign donations.

- This law is enforced by the Ministry of Home Affairs (MHA).

Applicability of the law

- The FCRA is applicable to all associations, groups and NGOs which intend to receive foreign donations.

- The provisions of the Act apply to the territory of India, to citizens of India who may be outside India and to companies or their branches outside India that are registered or incorporated in India. The entities covered by the Act include an individual, a Hindu undivided family, an association, or a registered company.

- It is mandatory for all such NGOs to register themselves under the FCRA.

- The registration is initially valid for five years and it can be renewed subsequently if they comply with all norms.

- Registered associations can receive foreign contribution for social, educational, religious, economic and cultural purposes.

- Filing of annual returns, on the lines of Income Tax, is compulsory.

FCRA says that any entity, or “person", can receive foreign funds as long as it has “a definite cultural, economic, educational, religious or social programme" and has obtained a nod under FCRA rules from the Centre, among other things.

What is a Foreign Contribution under FCRA?

- “Foreign contribution" under FCRA covers any “donation, delivery or transfer made by any foreign source of any article" as long as it is not given as a gift for personal use.

- Any currency or security can fall under the ambit of the Act .

- The Act excludes any money received “by way of fee or towards cost in lieu of trade or commerce whether within India or outside India as foreign contribution.

- Donations made by Non-Resident Indians (NRIs) are not considered to be “foreign contribution".

- A donation from a person of Indian origin who has assumed foreign nationality is treated as as “foreign contribution".

|

FOREIGN FUNDING AND SECURITY CONCERN

The Government found that while “the annual inflow of foreign contribution has almost doubled between the years 2010 and 2019… many recipients of foreign contribution have not utilized the same for the purpose for which they were registered. Dozens of NGOs are indulged in outright misappropriation or misutilization of foreign contribution". Criminal activities and violations had led the ministry to cancel the registration of more than 19,000 recipient organisations, including NGOs, between 2011 and 2019.

|

Amendments

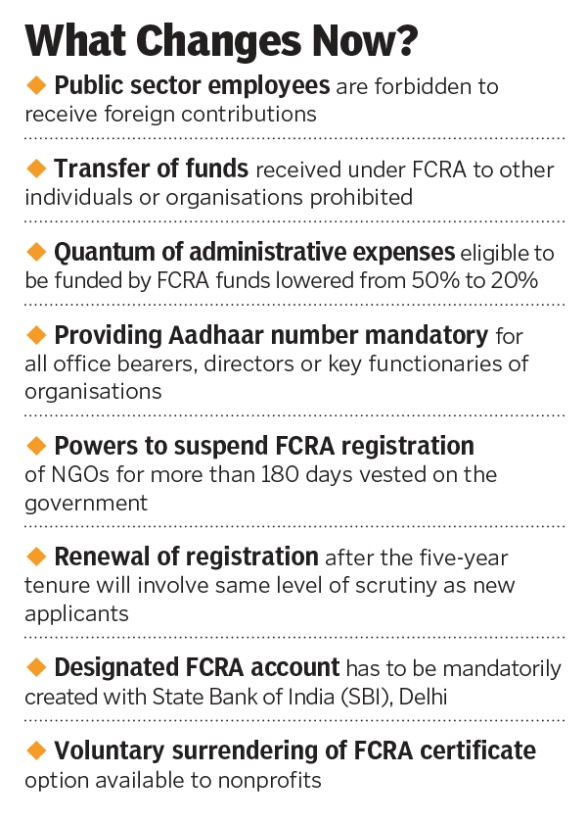

- Several changes were made in the FCRA Rules through amendments in 2015, 2018 and 2020. The new Rules have tightened the existing bolts.

- In 2015, the MHA notified new rules, which required NGOs to give an undertaking that the acceptance of foreign funds is not likely to –

- prejudicially affect the sovereignty and integrity of India or

- impact friendly relations with any foreign state and

- does not disrupt communal harmony.

- It also said all such NGOs would have to operate accounts in either nationalised or private banks which have core banking facilities to allow security agencies access on a real time basis.

Provisions under the FCRA and new rules post amendments

Regarding acceptance of foreign contribution:

- Under the Act, certain persons are prohibited to accept any foreign contribution. These include: election candidates, editor or publisher of a newspaper, judges, government servants, members of any legislature, and political parties, among others.

[New Rules]

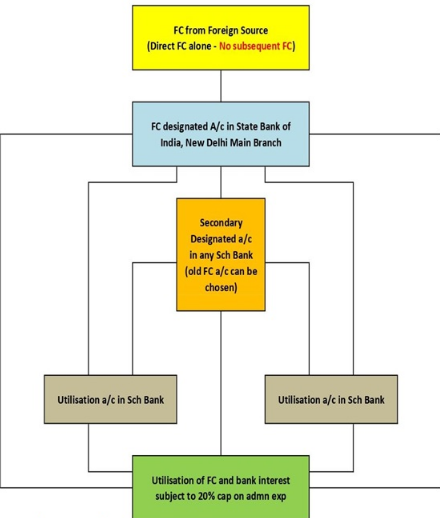

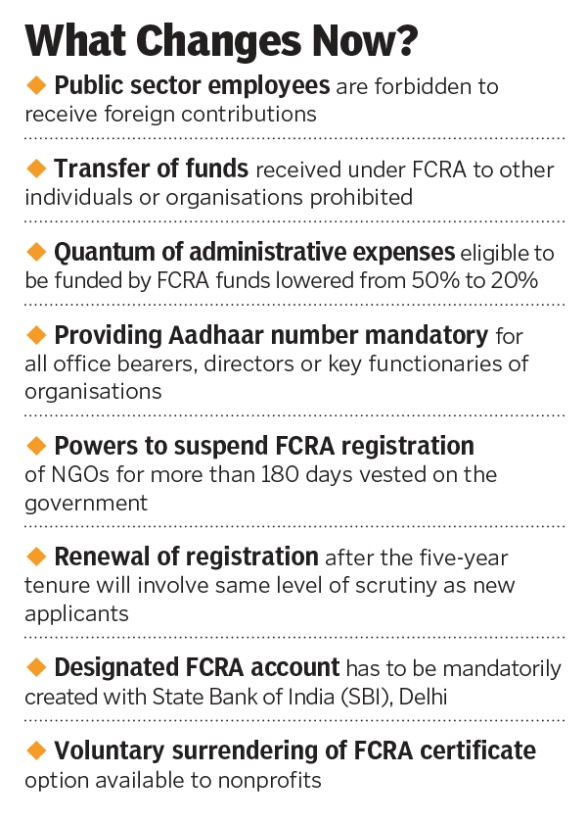

- Amendments added public servants (as defined under the Indian Penal Code) to this list.

- Public servant includes any person who is in service or pays of the government, or remunerated by the government for the performance of any public duty.

|

Note: Political parties can receive funds from the Indian subsidiary of a foreign company or a foreign company in which an Indian holds 50% or more shares.

|

Transfer of foreign contribution:

- Under the Act, foreign contribution cannot be transferred to any other person unless such person is also registered to accept foreign contribution (or has obtained prior permission under the Act to obtain foreign contribution).

[New Rules]

- Amendments prohibited the transfer of foreign contribution to “any other person”. The term ‘person’ under the Act includes an individual, an association, or a registered company.

Aadhaar for registration:

- The Act states that a person may accept foreign contribution if they have:

- obtained a certificate of registration from central government, or

- not registered, but obtained prior permission from the government to accept foreign contribution.

- Any person seeking registration (or renewal of such registration) or prior permission for receiving foreign contribution must make an application to the central government in the prescribed manner.

[New Rules]

- Amendments adds that any person seeking prior permission, registration or renewal of registration must provide the Aadhaar number of all its office bearers, directors or key functionaries, as an identification document. In case of a foreigner, they must provide a copy of the passport or the Overseas Citizen of India card for identification.

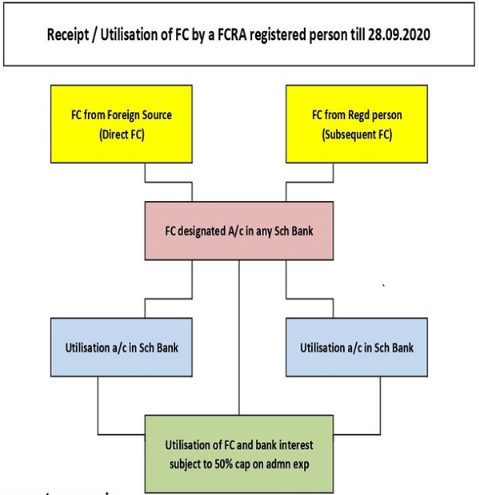

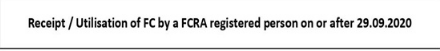

FCRA account:

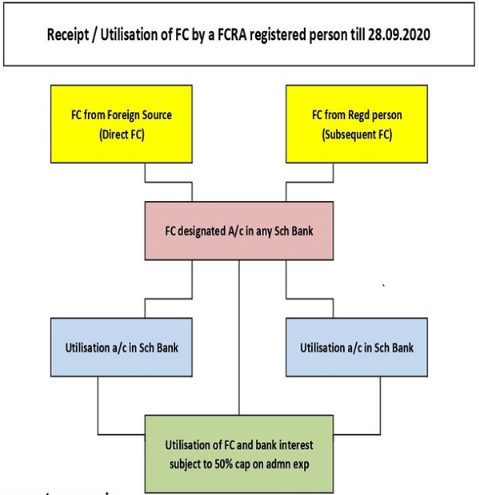

- Under the Act, a registered person must accept foreign contribution only in a single branch of a scheduled bank specified by them. However, they may open more accounts in other banks for utilisation of the contribution.

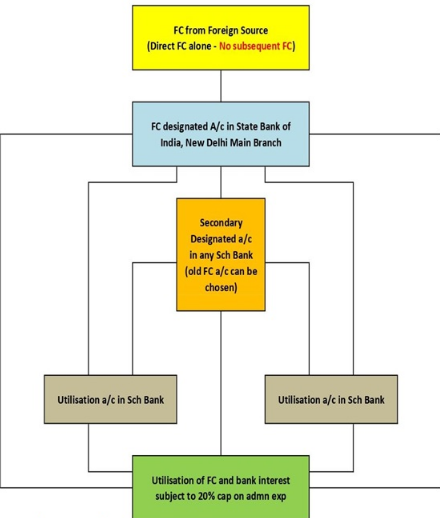

[New Rules]

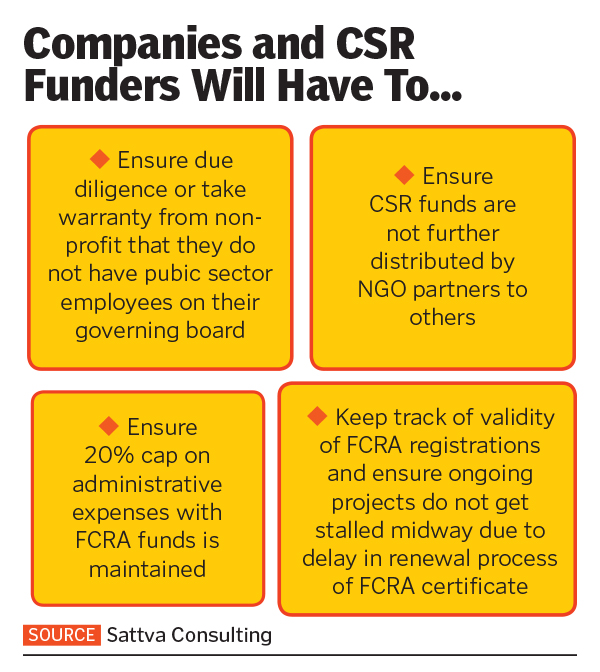

- Amendments state that foreign contribution must be received only in an account designated by the bank as “FCRA account” in such branch of the State Bank of India, New Delhi, as notified by the central government.

- No funds other than the foreign contribution should be received or deposited in this account.

- The person may open another FCRA account in any scheduled bank of their choice for keeping or utilising the received contribution.

Restriction in utilization of foreign contribution:

- Under the Act, if a person accepting foreign contribution is found guilty of violating any provisions of the Act or the Foreign Contribution (Regulation) Act, 1976, the unutilised or unreceived foreign contribution may be utilised or received, only with the prior approval of the central government.

[New Rules]

- Amendments add that the government may also restrict usage of unutilised foreign contribution for persons who have been granted prior permission to receive such contribution.

- This may be done if, based on a summary inquiry, and pending any further inquiry, the government believes that such person has contravened provisions of the Act.

Renewal of license:

- Under the Act, every person who has been given a certificate of registration must renew the certificate within six months of expiration.

[New Rules]

- Amendments provides that the government may conduct an inquiry before renewing the certificate to ensure that the person making the application:

- is not fictitious or benami,

- has not been prosecuted or convicted for creating communal tension or indulging in activities aimed at religious conversion, and

- has not been found guilty of diversion or misutilisation of funds, among others conditions.

Reduction in use of foreign contribution for administrative purposes:

- Under the Act, a person who receives foreign contribution must use it only for the purpose for which the contribution is received. Further, they must not use more than 50% of the contribution for meeting administrative expenses.

[New Rules]

- Amendments reduce this limit to 20%.

Suspension of registration:

- Under the Act, the government may suspend the registration of a person for a period not exceeding 180 days.

[New Rules]

- Amendments add that such suspension may be extended up to an additional 180 days.

Eligibility criteria for registration

- Earlier the eligibility criteria for registering under FCRA was existence for three years and spending a minimum sum of Rupees ten lakh on core activities for the benefit of society during the last three financial years.

[New Rules]

- The sum of Rupees ten lakhs has been raised to Rupees Fifteen lakhs.

Eligibility criteria for prior permission

[New Rules]

- It is granted for receipt of a specific amount from a specific donor for carrying out specific activities or projects.

- But the association should be registered under statutes such as the Societies Registration Act, 1860, the Indian Trusts Act, 1882, or Section 25 of the Companies Act, 1956. A letter of commitment from the foreign donor specifying the amount and purpose is also required.

Renewal requirement

[New Rules]

- The amendment Rules make it clear that on the expiry of the validity of the FCRA certificate the organization can neither receive further contributions nor utilize balance funds in the FCRA Bank account until the registration is renewed.

- If application for renewal is not received by MHA before the expiry date, the FCRA registration shall be deemed to have ceased.

- The amount of foreign contribution lying unutilized in the FCRA Account is also deemed to have ceased.

- Assets, if any, created out of the foreign contribution, shall vest with the prescribed government authority under the Act until the certificate is renewed or fresh registration is granted.

Challenges associated with FCRA

- Ambiguity in the act: Issues lies with ambiguity in words such as Public interest.

- Detrimental for Small NGOs: Recent amendments would restrict those small NGOs that are unable to get registeredyet require funds.

- Biasness in Government Functioning: By allowing only some political groups to receive foreign donations and disallowing some others, can induce biases in favor of the government.

- No Proper Explanation: Many NGOs have been de-registered by the security agencies on public interestwithout clear explanation.

- Delay in funding: It would also cause delayed functioning to those subsidiary NGOs which aredependent on other Large NGOs for funds.

- Affect People’s Rights: The FCRA restrictions have serious consequences on both the rights to free speech and freedom of association under Articles 19(1)(a) and 19(1)(c) enshrined in the Constitution.

- Affected functioning of Civil Societies: Without the registration under FCRA, no NGO can receive funds over rupees 25000 at one time. This has restricted smooth functioning of many NGOs.

Benefits of FCRA Registration in India

- An entity registered under the system of FCRA Registration would hold a good reputation in the society.

- FCRA Registration helps those organizations which work for the benefit and better of the public and are involved in the social work.

- The FCRA Registrations helps the organization to receive lawfully the foreign contribution and government aids.

- The applicant may get the benefit of having full government support as FCRA Registration is a Government Registration and is prescribed by the regulatory authority.

- An entity registered under FCRA can receive donations from foreign bodies as well as continuous support and investment from entities.

Way Forward

- The regulations should not stifle the functioning of genuine non-governmental organizations or associations, who are working for the welfare of society.

- The Government must give a more transparent account of its actions against NGOs.

- It is important for NGOs to achieve and maintain a high degree of transparency in not just their work but also their financials. NGOs need to keep their income and expenditure open to public scrutiny.

https://epaper.thehindu.com/Home/ShareArticle?OrgId=GV29Q7N7F.1&imageview=0