Disclaimer: Copyright infringement not intended.

Context

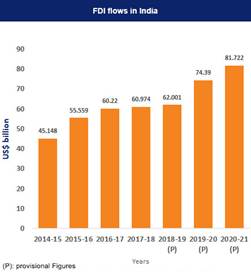

- The Foreign Direct Investment into India is continuously increasing since 2014-15. In the last seven financial years, over 443 US billion dollars worth of FDI inflows have come into the country.

What is FDI?

- Foreign direct investment (FDI) is when a company takes controlling ownership in a business entity in another country.

- With FDI, foreign companies are directly involved with day-to-day operations in the other country. This means they aren’t just bringing money with them, but also knowledge, skills and technology.

- Generally, FDI takes place when an investor establishes foreign business operations or acquires foreign business assets, including establishing ownership or controlling interest in a foreign company.

Where is FDI made?

- Foreign Direct Investments are commonly made in open economies that have skilled workforce and growth prospect. FDIs not only bring money with them but also skills, technology and knowledge.

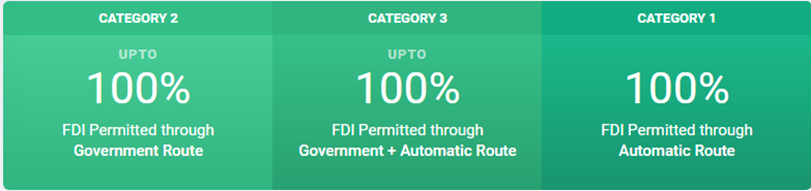

Routes through which India gets FDI

Automatic Route

- The non-resident or Indian company does not require prior nod of the RBI or government of India for FDI.

- Foreign Investment is allowed under the automatic route without prior approval of the Government or the Reserve Bank of India, in all activities/ sectors as specified in the Regulation 16 of FEMA 20 (R).

.jpg)

Government Route

- The government's prior approval is mandatory. The company will have to file an application through Foreign Investment Facilitation Portal, which facilitates single-window clearance.

- The application is then forwarded to the respective ministry, which will approve/reject the application in consultation with the Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce.

- DPIIT will issue the Standard Operating Procedure (SOP) for processing of applications under the existing FDI policy.

Sectors

Automatic Route

Sectors which come under the ' 100% Automatic Route' category are

- Agriculture & Animal Husbandry,

- Air-Transport Services (non-scheduled and other services under civil aviation sector), Airports (Greenfield + Brownfield),

- Asset Reconstruction Companies, Auto-components, Automobiles, Biotechnology (Greenfield),

- Broadcast Content Services (Up-linking & down-linking of TV channels, Broadcasting Carriage Services,

- Capital Goods,

- Cash & Carry Wholesale Trading (including sourcing from MSEs),

- Chemicals,

- Coal & Lignite,

- Construction Development,

- Construction of Hospitals,

- Credit Information Companies,

- Duty Free Shops,

- E-commerce Activities,

- Electronic Systems,

- Food Processing,

- Gems & Jewellery,

- Healthcare,

- Industrial Parks,

- IT & BPM,

- Leather,

- Manufacturing,

- Mining & Exploration of metals & non-metal ores,

- Other Financial Services,

- Services under Civil Aviation Services such as Maintenance & Repair Organizations,

- Petroleum & Natural gas,

- Pharmaceuticals,

- Plantation sector,

- Ports & Shipping,

- Railway Infrastructure,

- Renewable Energy,

- Roads & Highways,

- Single Brand Retail Trading,

- Textiles & Garments,

- Thermal Power,

- Tourism &

- Hospitality and

- White Label ATM Operations.

.jpg)

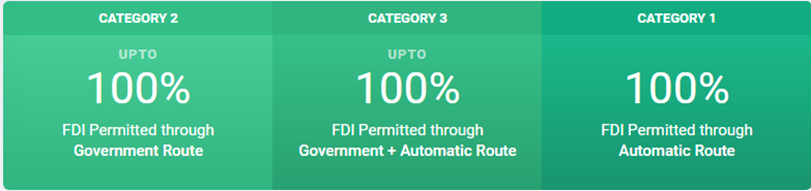

Government + Automatic Route

Sectors which come under up to 100% Automatic Route' category are

- Infrastructure Company in the Securities Market: 49%

- Insurance: up to 74%

- Medical Devices: up to 100%

- Pension: 49%

- Petroleum Refining (By PSUs): 49%

- Power Exchanges: 49%

- Telecom: 100%

Government Route

Sectors which come under the 'up to 100% Government Route' category are

- Banking & Public sector: 20%

- Broadcasting Content Services: 49%

- Core Investment Company: 100%

- Food Products Retail Trading: 100%

- Mining & Minerals separations of titanium bearing minerals and ores: 100%

- Multi-Brand Retail Trading: 51%

- Print Media (publications/ printing of scientific and technical magazines/ specialty journals/ periodicals and facsimile edition of foreign newspapers): 100%

- Print Media (publishing of newspaper, periodicals and Indian editions of foreign magazines dealing with news & current affairs): 26%

- Satellite (Establishment and operations): 100%

FDI prohibition

There are a few industries where FDI is strictly prohibited under any route. These industries are

- Atomic Energy Generation

- Any Gambling or Betting businesses

- Lotteries (online, private, government, etc)

- Investment in Chit Funds

- Nidhi Company

- Agricultural or Plantation Activities (although there are many exceptions like horticulture, fisheries, tea plantations, Pisciculture, animal husbandry, etc)

- Housing and Real Estate (except townships, commercial projects, etc)

- Trading in TDR’s

- Cigars, Cigarettes, or any related tobacco industry

|

India’s Consolidated FDI Policy, 2020

An entity of a country, which shares a land border with India or where the beneficial owner of an investment into India is situated in or is a citizen of any such country – can invest only under the Government approval route. Further, a citizen of Pakistan or an entity incorporated in Pakistan can invest, only under the Government route. No such investment is allowed from Pakistan in defense, space, atomic energy and sectors/activities that are prohibited for foreign investment.

In the event of the transfer of ownership of any existing or future FDI in an entity in India, directly or indirectly, results in the beneficial ownership falling within the restriction/purview of the above – this will also require Government approval.

|

Status of FDI flows into India

- FDI is an important monetary source for India's economic development. Economic liberalization started in India in the wake of the 1991 crisis and since then, FDI has steadily increased in the country.

- India, today is a part of top 100-club on Ease of Doing Business (EoDB) and globally ranks number 1 in the greenfield FDI ranking.

- Apart from being a critical driver of economic growth, Foreign Direct Investment (FDI) has been a major non-debt financial resource for the economic development of India.

- Foreign companies invest in India to take advantage of the relatively lower wages, special investment privileges like tax exemptions, etc. When foreign investment is being made in India, it also helps the country achieve technical know-how and generate employment.

- The Government has taken many initiatives in recent years such as relaxing FDI norms across sectors such as defence, PSU oil refineries, telecom, power exchanges, and stock exchanges, among others.

- India ranked 43rd on the Institute for Management Development’s (IMD) annual World Competitiveness Index 2021. According to the IMD, India's developments in government efficiency are primarily due to relatively stable public finances (despite COVID-19-induced challenges), and optimistic sentiments among Indian business stakeholders with respect to the funding, and subsidies offered by the government to private firms.

Market Size

- India has recorded highest ever annual FDI inflow of USD 83.57 billion in the Financial Year 2021-22.

- In 2014-2015, FDI inflow in India stood at mere 45.15 USD billion as compared to the highest ever annual FDI inflow of USD 83.57 billion reported during the financial year 2021-22.

- India’s FDI inflows have increased 20-fold since FY03-04, when the inflows were USD 4.3 billion only.

- Total FDI inflow into India in the third quarter of FY22 stood at US$ 17.93 billion, while the FDI equity inflow for the same period stood at US$ 12.02 billion.

Sectors attracting highest FDI

- Data between April-December 2021 indicates that the computer software and hardware industry attracted the highest FDI equity inflow of US$ 10.25 billion, followed by the automobile sector at US$ 5.96 billion, services sector at US$ 5.35 billion, trading sector at US$ 2.99 billion, construction activities at US$ 1.59 billion, and drugs and pharmaceuticals at US$ 1.21 billion.

Top countries with highest FDI equity inflow

- Between April-December 2021, India recorded the highest FDI equity inflow from Singapore (US$ 11.69 billion), followed by the US (US$ 7.52 billion), Mauritius (US$ 6.58 billion), the Cayman Islands (US$ 2.74 billion), the Netherlands (US$ 2.66 billion), and the UK (US$ 1.44 billion).

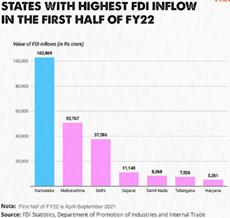

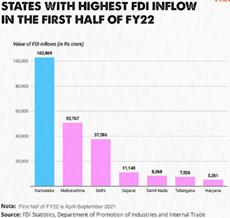

Top states with highest FDI equity inflow

- Between April-December 2021 Karnataka registered the highest FDI equity inflow of US$ 17.25 billion - 38 % Share, followed by Maharashtra (US$ 9.69 billion), Delhi (US$ 6.39 billion), Tamil Nadu (US$ 2.38 billion), Gujarat (US$ 2.06 billion), and Haryana (US$ 2.03 billion).

During the third quarter of FY22, foreign-owned assets in India stood at US$ 926.2 billion, up from US$ 852.4 billion in the third quarter of FY21.

It may be noted that FDI inflow has increased by 23% post-Covid (March, 2020 to March 2022: USD 171.84 billion) in comparison to FDI inflow reported pre-Covid (February, 2018 to February, 2020: USD 141.10 billion) in India.

Government Initiatives promoting FDI

Multipronged approach

- To boost domestic and foreign investments in India, the central government has taken various steps like – Reduced corporate tax rates, easing NBFC and bank liquidity problems, improving Ease of Doing Business, FDI policy reforms, compliance burden reduction, policy measures to boost domestic manufacturing through public procurement orders, Phased Manufacturing Program (PMP), and various Ministries’ Production Linked Incentives (PLI) schemes are among them.

- Measures such as the India Industrial Land Bank (IILB), the Industrial Park Rating System (IPRS), the soft launch of the National Single Window System (NSWS), the National Infrastructure Pipeline (NIP), the National Monetisation Pipeline (NMP), and others have been put in place to facilitate investment.

- The implementation of measures like PM Gati Shakti, single window clearance and GIS-mapped land bank are expected to push FDI inflows in 2022.

- To further liberalise and simplify FDI policy for providing Ease of doing business and attract investments, reforms have been undertaken recently across sectors such as Coal Mining, Contract Manufacturing, Digital Media, Single Brand Retail Trading, Civil Aviation, Defence, Insurance and Telecom.

Amendment of FEMA

- The government has amended rules of the Foreign Exchange Management Act (FEMA), allowing up to 20% FDI in the insurance company LIC through the automatic route. The Government of India is considering easing scrutiny on certain foreign direct investments from countries that share a border with India.

- In August 2021, the government amended the Foreign Exchange Management (non-debt instruments) Rules, 2019, to allow the 74% increase in FDI limit in the insurance sector.

- In September 2021, the Union Cabinet announced that to boost the telecom sector, they’ll allow 100% FDI via the automatic route in, up from the previous 49%.

Enhanced Trade Partnership

- In September 2021, India and the UK agreed for an investment boost to strengthen bilateral ties for an ‘Enhanced Trade Partnership’.

Empowered Group of Secretaries (EGoS) Project Development Cells (PDCs)

- The Union Cabinet approved the formation of an Empowered Group of Secretaries (EGoS) and Project Development Cells (PDCs) in Ministries to fast-track investments in coordination with state governments and thus grow the pipeline of investible projects in India to increase domestic investments and FDI inflow with a view to support, facilitate and provide investor friendly ecosystem to investors.

PLI

- Keeping in mind India’s vision of becoming ‘Atmanirbhar’ and to enhance India’s Manufacturing capabilities and exports, in the Union Budget 2021-22, an outlay of INR 1.97 lakh crore (over US$ 26 billion) for PLI schemes for 13 key manufacturing sectors, starting from fiscal year (FY) 2021-22, has been announced.

The 13 key sectors include existing 3 sectors namely-

- Mobile Manufacturing and Specified Electronic Components,

- Critical key starting materials/ Drug intermediaries & active pharmaceutical ingredients,

- Manufacturing of medical devices and 10 new key sectors which have been approved by the Union Cabinet in November 2020.

- The other 10 key sectors are: (i) Automobiles and Auto Components, (ii) Pharmaceuticals Drugs, (iii) Specialty Steel, (iv) Telecom & Networking Products, (v) Electronic/Technology Products, (vi) White Goods (ACs and LEDs), (vii) Food Products, (viii) Textile Products: MMF segment and technical textiles, (ix) High efficiency solar PV modules, and (x) Advanced Chemistry Cell (ACC) Battery.

Make in India

- It was one of the first ‘Vocal for Local’ campaigns to bring India’s manufacturing sector to the attention of the rest of the globe. Not only does the industry have the capacity to boost economic growth, but it also has the potential to employ a substantial portion of the young workforce.

Investment Clearance Cell (ICC)

- While presenting Budget 2020-21, Finance Minister Nirmala Sitharaman announced plans to set up an Investment Clearance Cell (ICC) that will provide “end to end” facilitation and support to investors, including pre-investment advisory, land bank information and facilitate clearances at centre and state levels. An online digital interface was proposed for the cell’s operation.

One District One Product (ODOP)

- The One District One Product (ODOP) programme aims to identify and promote the manufacture of one-of-a-kind products in each of India’s districts that can be globally marketed.

- This will help in realizing the district’s genuine potential, fueling economic growth, job creation, and rural entrepreneurship. 106 products have been identified from 103 districts around the country as part of the ODOP’s initial phase. Considerable success has been achieved for boosting exports under the ODOP initiative.

Conclusion

- India is expected to attract FDI worth US$ 120-160 billion per year by 2025, according to a CII and EY report.

- Further, as per a Deloitte report published in September 2021, India remains an attractive market for international investors both in terms of short-term and long-term prospects.

- FDI is important as India would require huge investments in the coming years to overhaul its infrastructure sector to boost growth. Healthy growth in foreign inflows helps maintain the balance of payments and the value of the rupee.

- However, foreign direct investment also carries risks, and it is highly important to evaluate the economic climate thoroughly before doing it.

- With the instruments of public policy in its hands, the government can try to ensure that the domestic and foreign players are approximately on an equal footing and that the domestic traders are not at an especial disadvantage. Japan has done this quite effectively.

https://newsonair.gov.in/News?title=FDI-into-India-continuously-on-rise-since-2014-15&id=451956

.jpg)