Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Copyright infringement not intended

Context: With the approval of the Finance Bill 2023 by both Houses of Parliament, the government completed its 2023–2024 budget exercise.

Finance Bill

Characteristics of the Finance Bill

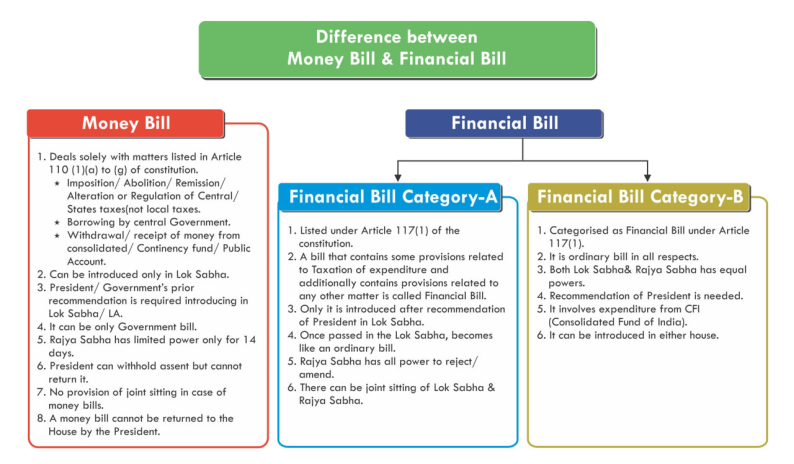

More about Money Bill

More about Financial Bills

Financial Bills (I)

Financial Bills (II)

Union Budget for 2023-24

https://www.iasgyan.in/daily-current-affairs/union-budget-for-2023-24

|

PRACTICE QUESTION Q. Q. Consider the following Statement; 1. A Money Bill will always be a Finance Bill. However, a Finance Bill need not necessarily be a Money Bill. 2. The Finance Bill must be enacted within 75 days of the Introduction. 3. The Speaker’s decision over the classification of the Money bill can be challenged before the court. Which of the following Statement is/are correct? (A) 1 and 2 only (B) 2 and 3 only (C) 1 and 3 only (D) 1, 2 and 3 Answer: A Explanation: Statement 1 is correct: A Money Bill will always be a Finance Bill. However, a Finance Bill need not necessarily be a Money Bill. Statement 2 is correct: The Finance Bill must be enacted (passed by the Parliament and assented to by the president) within 75 days of Introduction. Statement 3 is incorrect: The Speaker of the Lok Sabha has the last say in any disputes over whether a bill qualifies as a money bill or not. No court, the House of Representatives, or even the president has the authority to overrule his judgment in this case. |

© 2024 iasgyan. All right reserved