Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Copyright infringement is not intended

Context: The United Arab Emirates (UAE) has become the latest addition to the grey list put out by the Financial Action Task Force, a global financial crime watchdog.

Implications of this move:

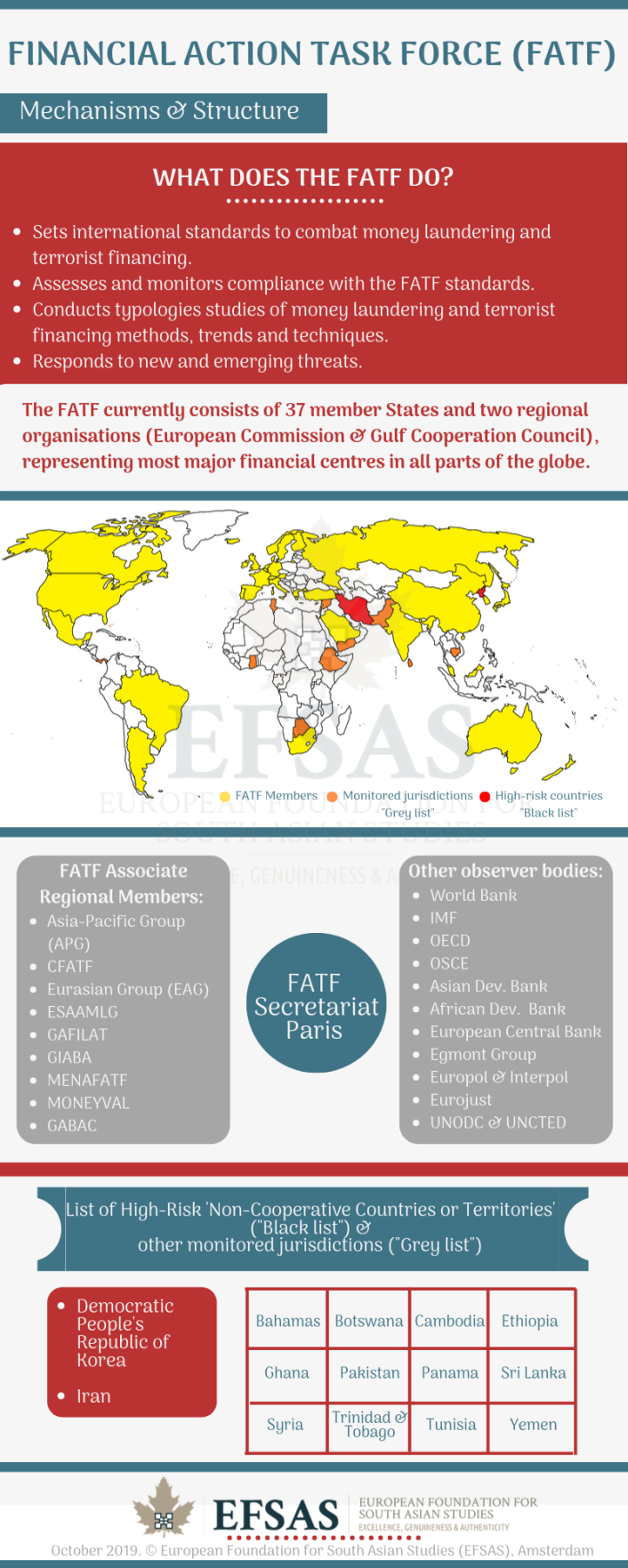

What is FATF?

What is ‘Grey List’ and ‘Black list”?

How does it Affect that country?

Greylisting affects the country in several ways:

Advantages and Disadvantages of Grey List:

Advantages of Grey List:

Disadvantages of Grey List:

Conclusion:

https://www.business-standard.com/article/economy-policy/investments-via-uae-to-face-more-scrutiny-after-fatf-grey-list-inclusion-122030700038_1.html

© 2024 iasgyan. All right reserved