Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Copyright infringement not intended

Picture Courtesy: www.moneycontrol.com

Context: The First Advance Estimates (FAEs) of Gross Domestic Product (GDP) released at the beginning of January each year serve as an essential snapshot of the country's economic growth for the ongoing financial year.

Details

Timing and Methodology

Significance

Insights from FAEs

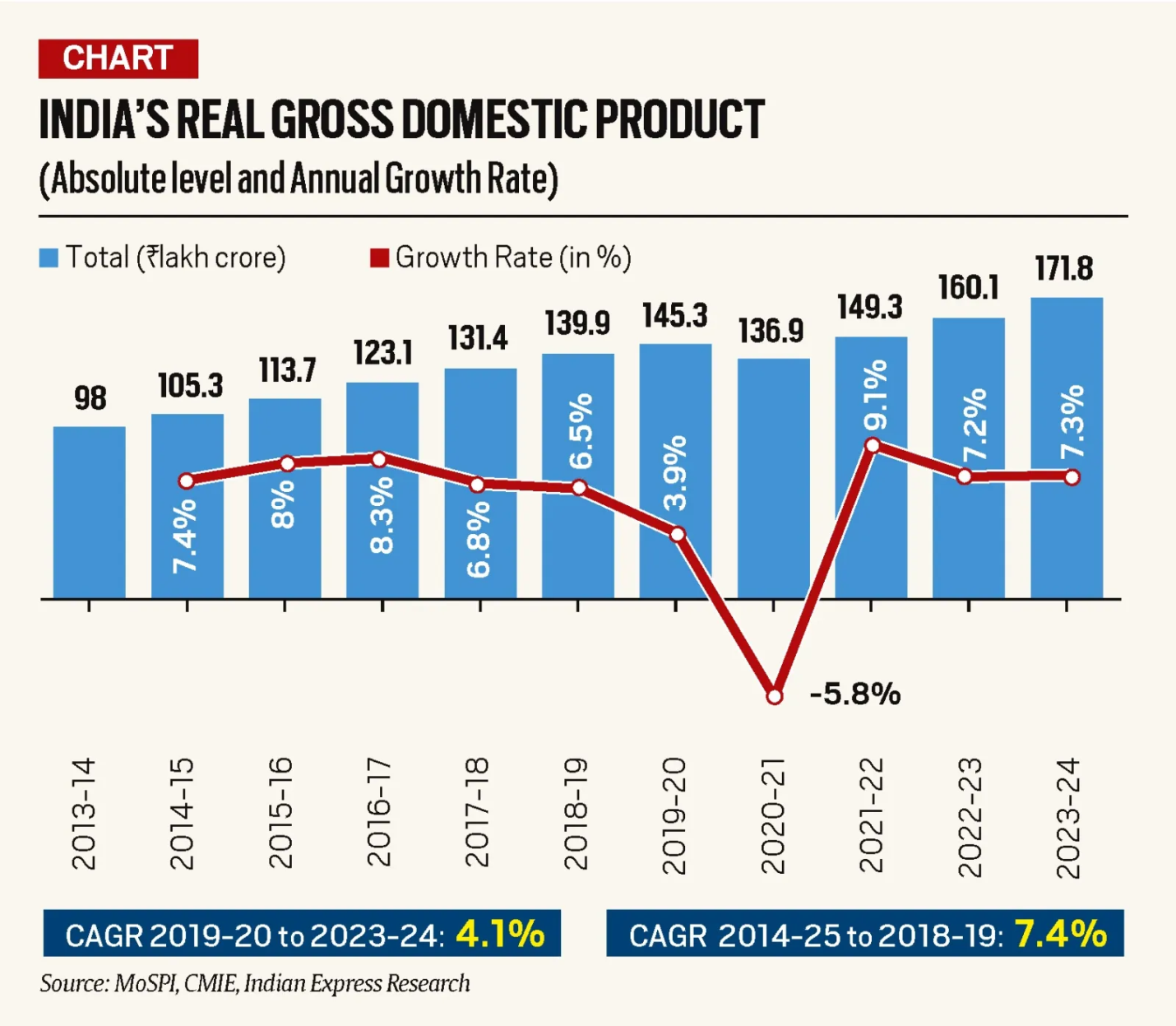

First Available Estimate data indicate the state of India's real GDP

GDP Trends

Growth Rate Surprise

Deceleration in Growth

Impact of First Two Years of Current Term

Optimistic Outlook

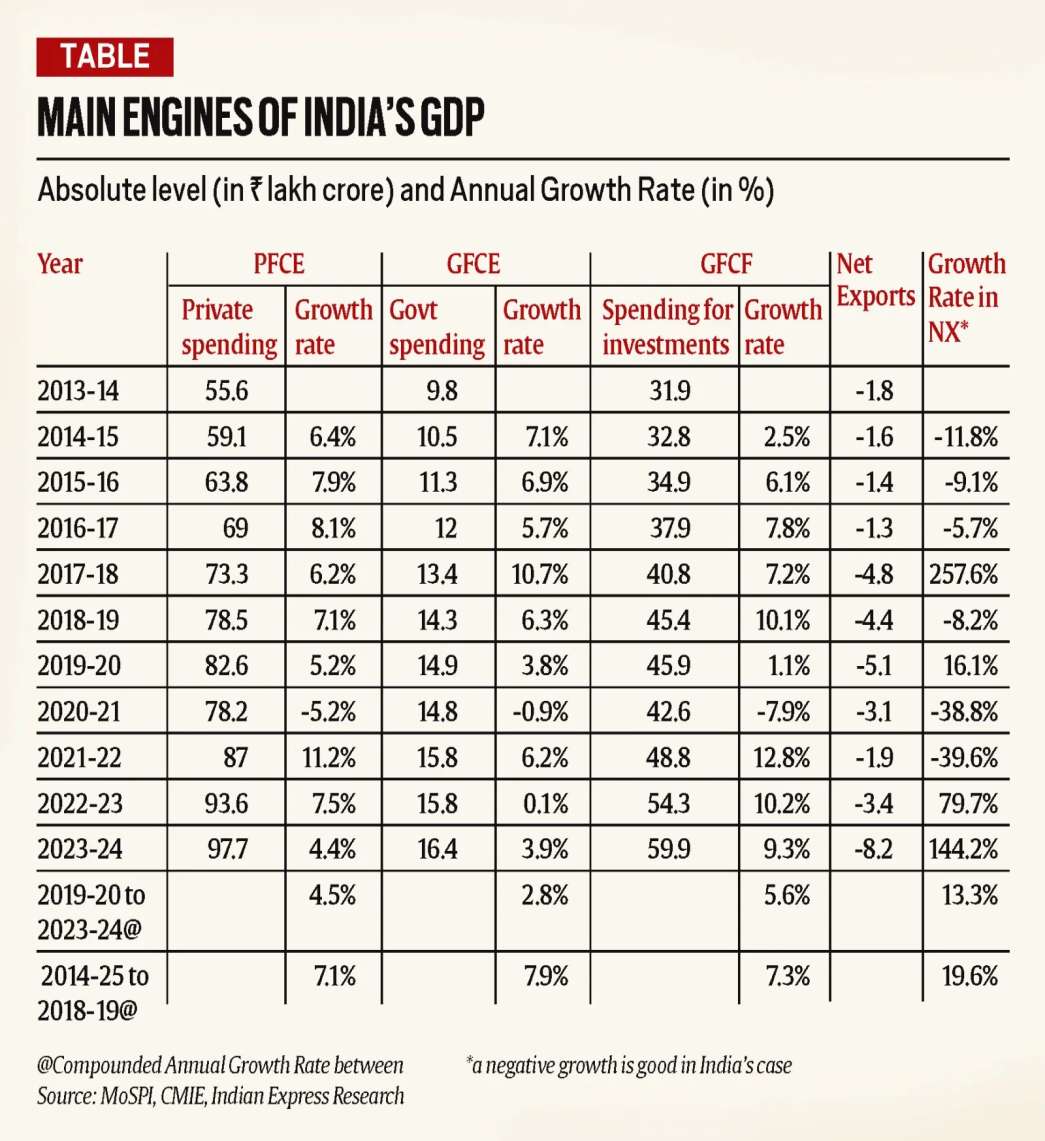

India's GDP growth is influenced by four key components:

Private Final Consumption Expenditure (PFCE)

Gross Fixed Capital Formation (GFCF - Investment Spending)

Government Final Consumption Expenditure (GFCE - Government Spending)

Net Exports

|

Overall, while investment spending shows positive growth and net exports display a mild improvement, concerns arise from the muted growth in private consumption, slow growth in government spending, and a persistent imbalance in consumption patterns between different sectors of the economy. These factors collectively impact India's GDP growth. |

Conclusion

Must Read Articles:

|

PRACTICE QUESTION Q. What factors have contributed to the recent low GDP growth rate in India, and what strategies could be implemented to stimulate and sustain higher economic growth in the country? |

© 2024 iasgyan. All right reserved