Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

What constitutes the divisible pool of taxes?

How is the Finance Commission formed?

What is the basis for allocation?

What is the basis for allocation?

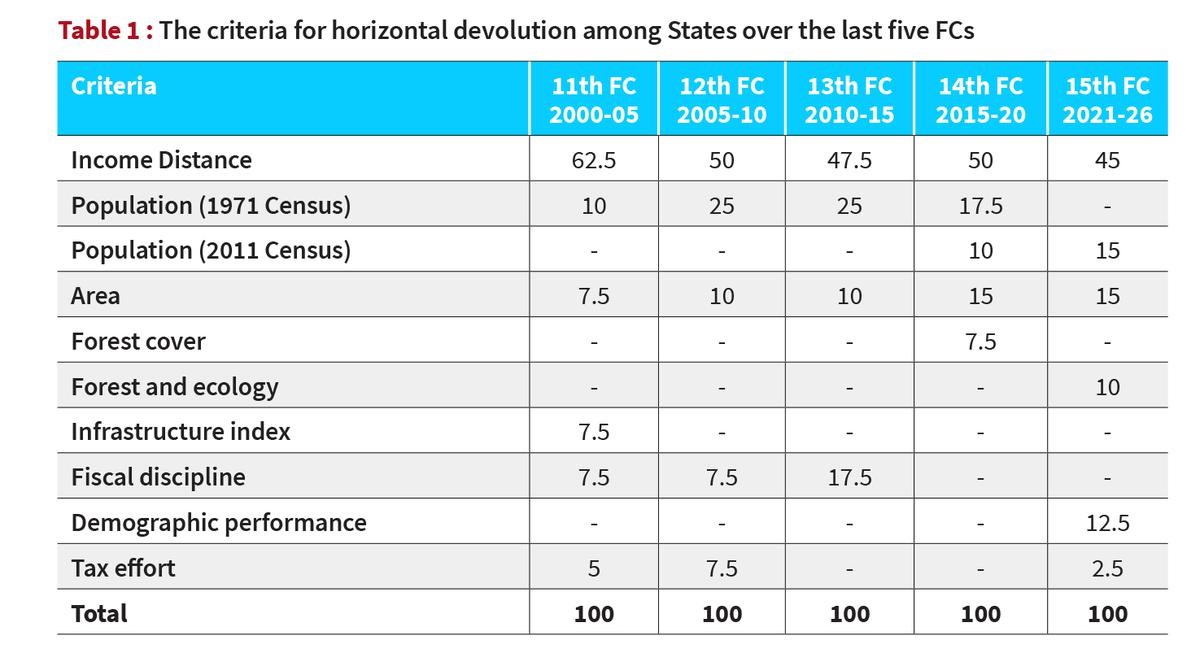

The criteria under the 15th FC are explained as follows:

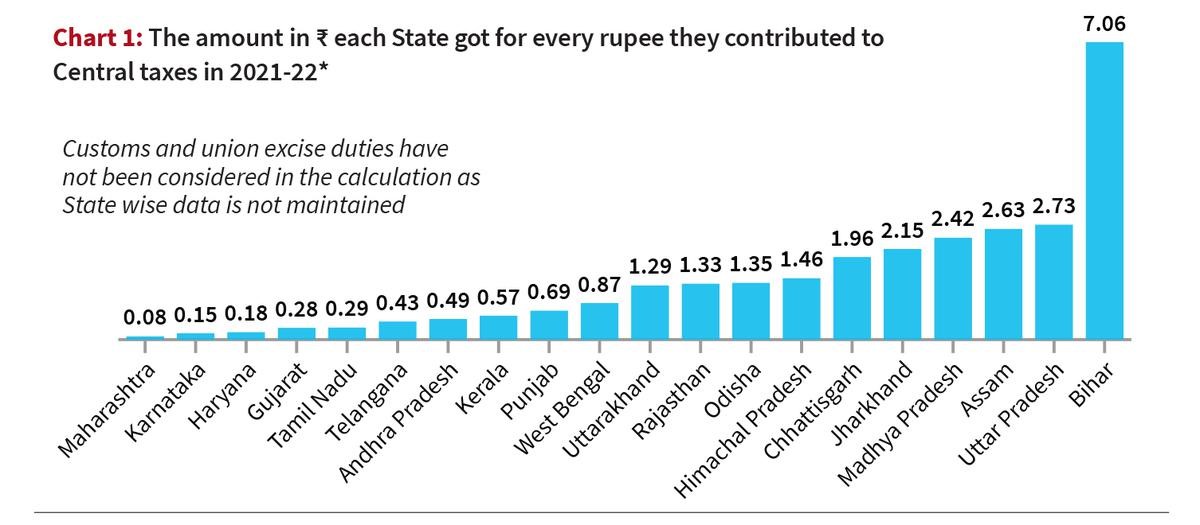

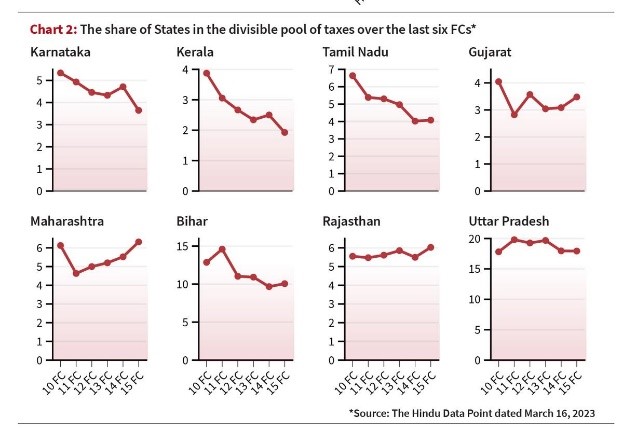

What are the concerns?

The Way Forward

|

PRACTICE QUESTIONS Q. What constitutes the divisible pool of taxes shared between the Centre and the States? A. Income tax and property tax B. Corporation tax and Central GST C. Customs duty and excise duty D. Stamp duty and entertainment tax Answer: B. Corporation tax and Central GST Q. Consider the following statements regarding the Finance Commission in India:

Which of the statements above is/are incorrect? A. 1 and 2 B. 1 and 3 C. 2 and 3 D. 1, 2, and 3 Answer: A. 1 and 2 The Finance Commission is indeed a constitutional body, and the Chairman of the Finance Commission is appointed by the President of India, not the Prime Minister. Therefore, statement 1 is correct, and statement 2 is incorrect. The Finance Commission is responsible for recommending the sharing of tax revenues between the Union government and the states, but it is not directly responsible for the implementation of GST in states. So, statement 3 is also incorrect. The correct answer is B. 2 and 3. |

© 2024 iasgyan. All right reserved