Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

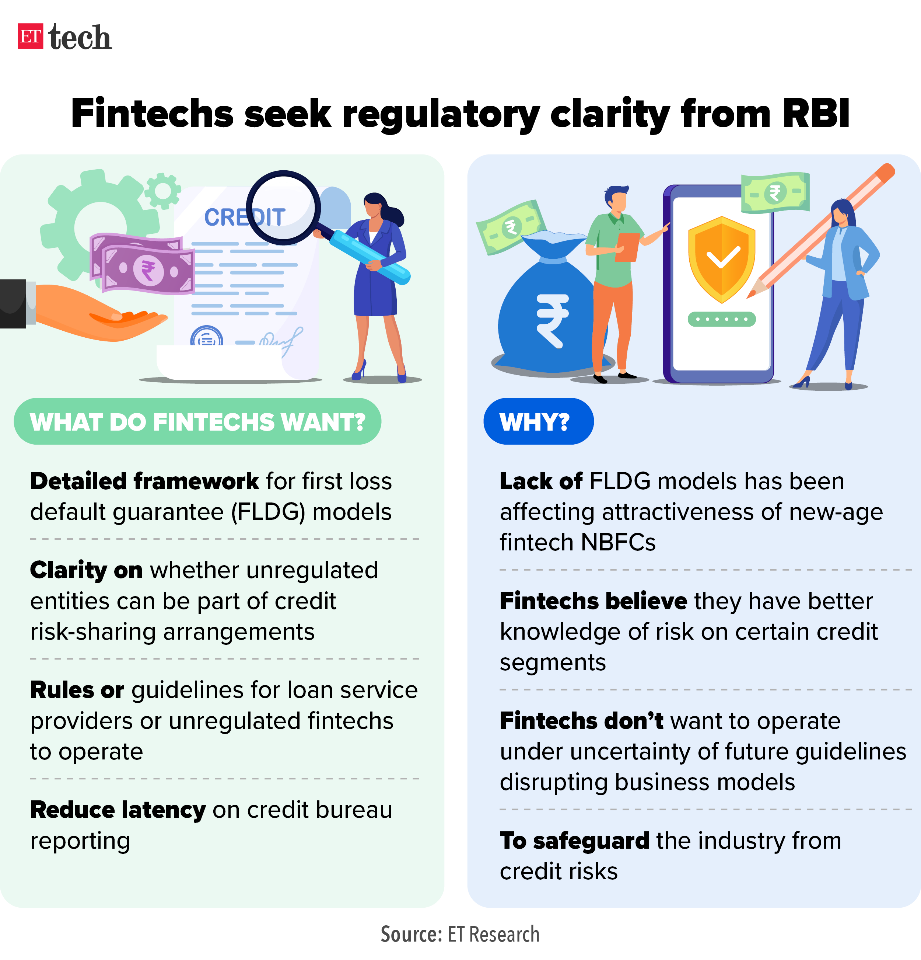

Context

What is FLDG?

Lack of clarity (Previously)

Current Scenario

Collection Efficiency Model

Revenue-Sharing Model

Closing Remarks

The trust between the fintech and bank for such arrangements will come only when the relationship becomes seasoned.

© 2024 iasgyan. All right reserved