Disclaimer: Copyright infringement not intended.

Context

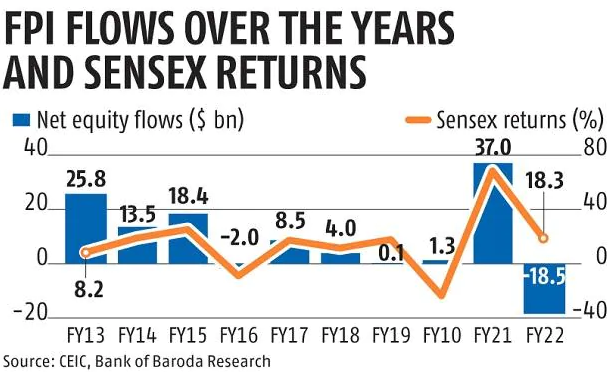

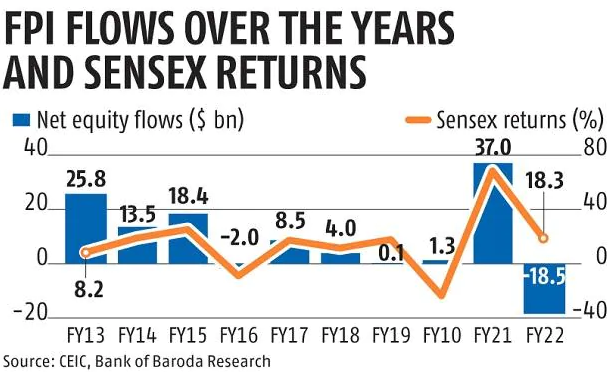

- FPIs have pull out over Rs 1.81 lakh cr from equities in 2022 so far.

Background

- Foreign investors pulled out nearly Rs 40,000 crore from the Indian equity market in May on fears of an aggressive rate hike by US Federal Reserve that dented investor sentiments.

- In the first two months of FY23 (April and May), FPIs have removed a whopping Rs 57,137 crore from the equities market.

- The selling pressure is expected to continue even in June.

Reasons behind recent outflow of FPI from India

- Rising geo-political risk,

- Rising inflation,

- Tightening of monetary policy by central banks

- Supply Chain Disruption due to the ongoing war between Russia and Ukraine.

- Impact on crude oil prices amid uncertainty due to Russia-Ukraine war.

- On the domestic front, the concerns over surging inflation as well as further rate hikes by the RBI, and its impact on the economic growth, loomed large.

- Globally, the rate hikes by US Federal Reserve, tightening of monetary policy by the global central banks and appreciation of the foreign currency dollar rate has triggered the offshore investors to withdraw the equities from sensitive markets.

- Investors are also cautious due to the fear that high inflation could hamper corporate profits and also impact consumer spending.

Foreign investors have been taking out money from equities in the last eight months (from October 2021 to May 2022), withdrawing a massive net amount of Rs 2.07-lakh crore.

FPI equity outflows touch $15 bn in Jan-March 2022, highest in last 15 years.

With geopolitical factors impacting the market currently, FPIs flows are expected to remain volatile in the near term.

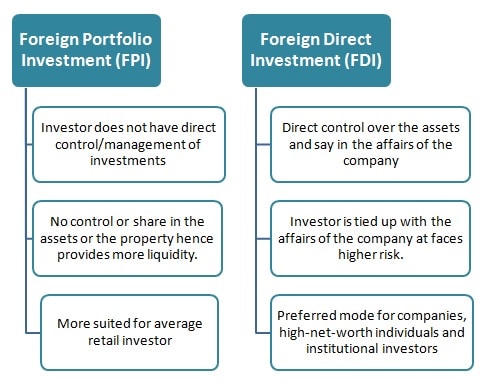

What is Foreign Portfolio Investment?

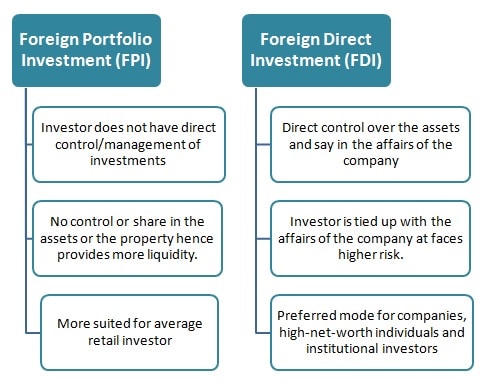

- FPI is an investment by non-residents in Indian securities including shares, government bonds, corporate bonds, convertible securities, units of business trusts, etc. The class of investors who make an investment in these securities is known as Foreign Portfolio Investors.

What are the major laws/regulations applicable to an FPI in India?

- FPIs are primarily governed by The Securities and Exchange Board of India (SEBI).

- SEBI has recently introduced the SEBI (Foreign Portfolio Investors) Regulations, 2019, repealing the erstwhile 2014 Regulations.

- Further, FPIs are also required to comply with the Foreign Exchange Management Act, 1999and the Income-tax Act, 1961.

Foreign Portfolio Investment Eligibility Criteria

To become an FPI, an individual must meet the following requirements:

- The petitioner must not be a non-resident Indian, according to the Income Tax Act of 1961.

- Should not be a citizen of a country that is subject to the FATF's public statement.

- If the bank is the applicant, it must be from a country whose central bank is a Bank for International Settlements member.

Compliances applicable to an FPI under the Income Tax Act, 1961

- Since FPIs invest in securities such as shares, bonds, debentures, units of business trust, etc., they earn income in the nature of dividend, interest, and capital gains. FPIs would also need to remit such incomes (along with capital investment) out of India at regular intervals.

- As a pre-condition to remittance of funds, the applicable income tax on such income needs to be deposited with the government treasury. The taxes are deposited either in the form of withholding taxes or payment of taxes in a self-assess mode or a combination of both depending upon the nature of income.

- The custodian/banker would also require a certificate from a professional tax advisor prior to remitting the funds.

- Moreover, after the end of the financial year (April 1st to March 31st in India), the FPI is required to file an annual tax return.

What is the impact of new SEBI (FPI) Regulations, 2019?

- The new regulations have been drafted based on the recommendation of a committee headed by former RBI deputy governor H R Khan.

- The significant impact of SEBI easing the regulatory framework for foreign portfolio investors under new regulation can be understood from the following changes that came into effect along with the 2019 regulation. These changes include:

Re-Categorization for FPIs

- Under the newly amended SEBI (FPI) Regulations, 2019, two categories remain instead of three as previously. Category I has been expanded to include certain regulated funds previously registered under Category II while Category III has been abolished completely and its entities moved to Category II.

- Simplifying the categories has heavily eased the KYC requirements, exempted applicability of Indirect Share Transfer provisions and allowed higher position limits in derivatives.

Previous Categories:

|

FPI Category

|

Type of Entity

|

|

Category I (Sovereign and International Entities)

|

Government and Government Agencies, Central Banks, Sovereign Wealth Funds, International or Multilateral Organizations/Agencies

|

|

Category II (Regulated Entities)

|

Assets Management Companies, Investment Portfolio Managers, Swap Dealers, Broker-Dealers, Broad-based investment funds such as Mutual-funds and Investment trusts.

|

|

Category III (Unregulated Entities)

|

It includes investors not covered under Category I & II such as Non-broad-based funds, Hedge funds, family offices, pension funds, university funds, individuals etc.

|

New Categories

- An applicant can obtain FPI license under SEBI regulations, in one of the two categories mentioned below:

“Category I FPI” which mainly include:

- Government and Government related investors;

- Pension funds and university funds;

- Appropriately regulated entities such as asset management companies, banks, investment managers, investment advisors, portfolio managers;

- Eligible entities from the Financial Action Task Force (FATF) member countries;

“Category II FPI” which include all investors not eligible under Category I such as:

- Appropriately regulated funds not eligible as Category-I foreign portfolio investor;

- Endowments and foundations;

- Charitable organizations;

- Corporate bodies;

- Family offices;

- Individuals;

- Unregulated funds in the form of limited partnership and trusts.

Advantages of being registered as a Category I FPI as opposed to Category II

- The main advantages of category I am as under:

- Eligibility to issue Offshore Derivative Instruments (odis);

- Ease of compliance of certain know your client (KYC) norms as compared to Category II fpis; an

- Enhanced position limits in case of stock and currency derivatives.

- Apart from the above, Category I FPIs are exempted from the applicability of “Indirect Transfer” provisions under the Indian Income-tax Act, which are otherwise applicable to an overseas investor upon transfer of shares/interest in an overseas entity with assets in India.

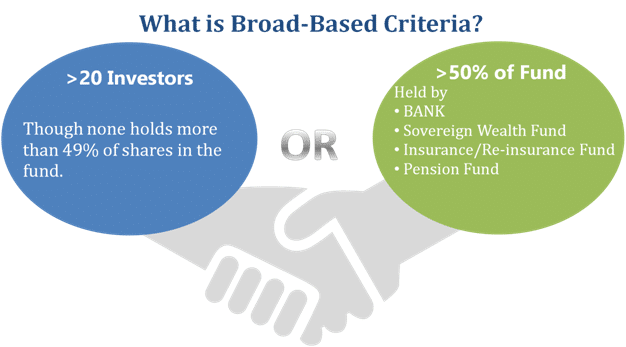

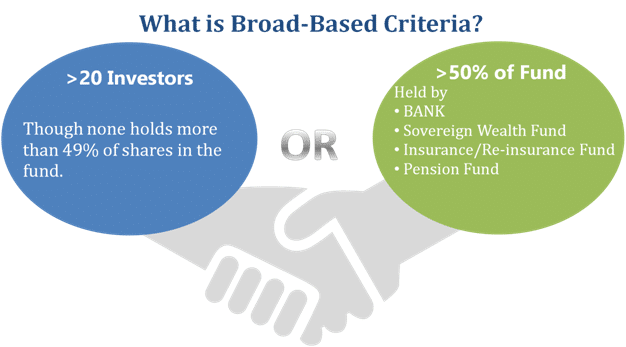

Removal of Broad-Based Criteria

Previously Category II registration required fulfillment of Broad-Based Criteria which has been removed in the new regime. This, apart from giving relief to newly established funds, serves dual advantage for existing funds

First, Non-Broad Funds of The Financial Action Task Force (FATF) countries which are regulated have become eligible for Category II registration, and

Secondly, no more declarations/undertakings or other compliance obligations regarding Broad-Based fund is required hence easing the registration procedure.

Restriction of ODI (Offshore Derivative Instruments) to Category-I FPIs

Offshore Derivative Instruments include Participatory Notes (P-Notes), Total Return Swaps and such instruments.

The new regulation has restricted the use of ODIs to Category-I registered FPIs only. Hence regulated funds which are not from FATF member countries and not registered in India under Category-I FPI have been prohibited from issuing/subscribing ODIs. This includes various funds from Cayman Island, Mauritius and Taiwan.

Eliminated ‘Opaque Structure Removal’ Mandate

Under previous regulation designated depository participants (DDPs) were supposed to ensure that FPIs did not have “opaque structure”. This condition has been removed to prevent unnecessary regulatory requirements and simplify compliance framework as ‘SEBI KYC circular issued on 21 September 2018’ already ensured that FPIs provide in for their beneficial owners – be it on ownership or control basis.

International Financial Services Centre (IIFC) can register as FPI

Investment managers who want to invest in India through FPI route can do so to benefit from direct and indirect tax incentives available to IFSC entities

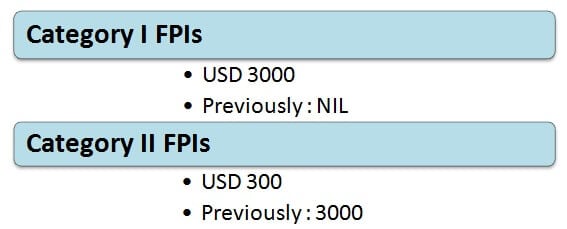

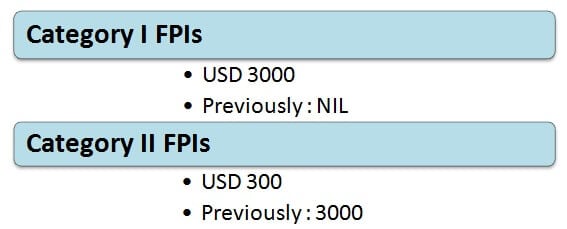

Revised Registration Fee

FPIs (Foreign Portfolio Investors) registering with SEBI need to pay a one-time registration fee for a validity of 3 years. The revised structure is as follows

Foreign Portfolio Investors registered after 23rd September 2019 (date when the new regulation came into effect) have to pay as per revised fee structure.

Other Amendments

- Registration of Foreign Central Banks as FPIs: Foreign Central Banks can now directly register themselves as FPI in India. They don’t need to be resident of a country whose Central Bank is BIS (Bank for International Settlement) member. This change aims to attract more overseas funds.

- Offshore Mutual Funds to be FPIs: Existing offshore funds which have been established by Indian mutual fund houses have been instructed to register themselves as FPIs by the end of March 22, 2020.

- Surrender of Registration: FPI is deemed to have surrendered its registration to SEBI if

- FPI doesn’t pay the requisite fee to SEBI after expiration of 3 years post-registration, or

- Does not hold any securities or cash balance

Designated Depository Participant (DDP) will proceed to implement the surrender of registration after obtaining the SEBI approval in such cases.

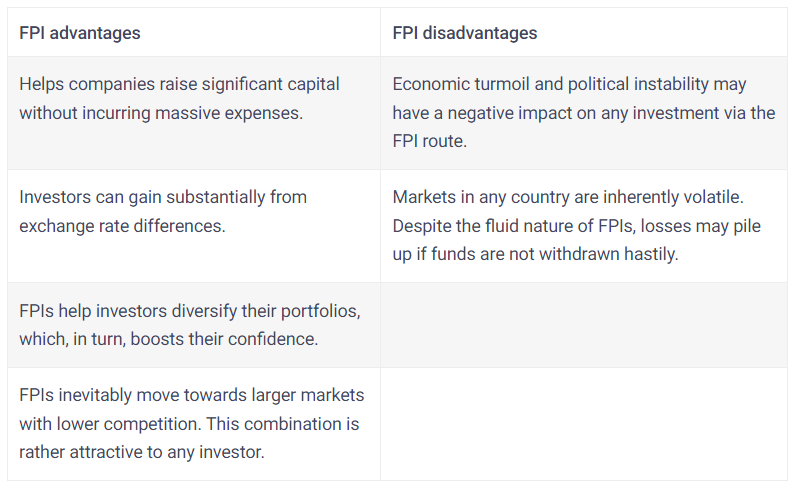

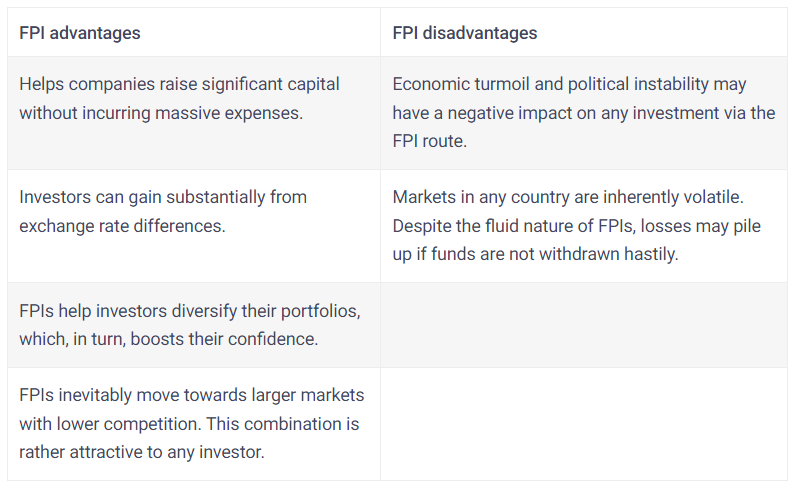

Pros and Cons of FPIs

Conclusion

- Foreign Portfolio Investment is one the most accessible routes for small and retail investors living outside India, to invest in India and take benefit from its economic growth.

- Indian market also capitalizes on this influx of fund and hence it is beneficial for economy too. Keeping this aspect in mind the Government of India through the market regulatory body SEBI has made the process of investment via FPI route easier and more streamlined.

- The regulatory framework is now more investment friendly and offers various advantages to any foreign individual/entity investing as Foreign Portfolio Investor in India.

Retail investors acting like shock absorbers in stock market: FM - The Hindu BusinessLine

1.png)