Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

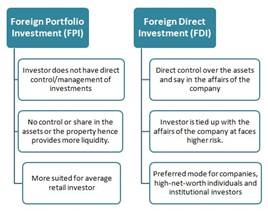

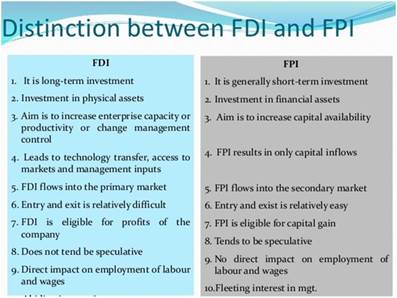

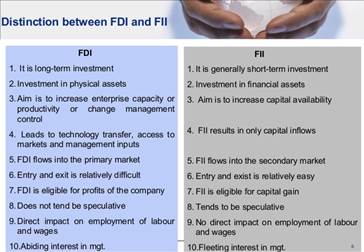

What is Foreign Portfolio Investment?

What are the major laws/regulations applicable to an FPI in India?

Foreign Portfolio Investment Eligibility Criteria

To become an FPI, an individual must meet the following requirements:

Reasons behind recent outflow of FPI from India

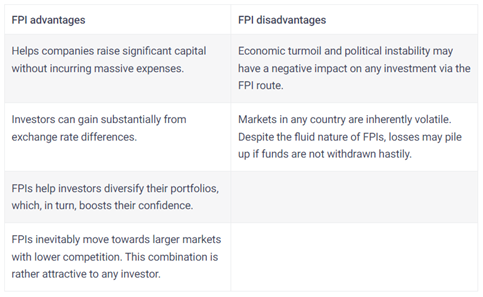

Pros and Cons of FPIs

Conclusion

© 2024 iasgyan. All right reserved