Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

What is Foreign Portfolio Investment?

What are the major laws/regulations applicable to an FPI in India?

Foreign Portfolio Investment Eligibility Criteria

To become an FPI, an individual must meet the following requirements:

Compliances applicable to an FPI under the Income Tax Act, 1961

What is the impact of new SEBI (FPI) Regulations, 2019?

Re-Categorization for FPIs

Previous Categories:

|

FPI Category |

Type of Entity |

|

Category I (Sovereign and International Entities) |

Government and Government Agencies, Central Banks, Sovereign Wealth Funds, International or Multilateral Organizations/Agencies |

|

Category II (Regulated Entities) |

Assets Management Companies, Investment Portfolio Managers, Swap Dealers, Broker-Dealers, Broad-based investment funds such as Mutual-funds and Investment trusts. |

|

Category III (Unregulated Entities) |

It includes investors not covered under Category I & II such as Non-broad-based funds, Hedge funds, family offices, pension funds, university funds, individuals etc. |

New Categories

“Category I FPI” which mainly include:

“Category II FPI” which include all investors not eligible under Category I such as:

Advantages of being registered as a Category I FPI as opposed to Category II

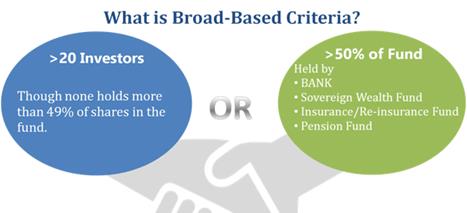

Removal of Broad-Based Criteria

Previously Category II registration required fulfillment of Broad-Based Criteria which has been removed in the new regime. This, apart from giving relief to newly established funds, serves dual advantage for existing funds

First, Non-Broad Funds of The Financial Action Task Force (FATF) countries which are regulated have become eligible for Category II registration, and

Secondly, no more declarations/undertakings or other compliance obligations regarding Broad-Based fund is required hence easing the registration procedure.

Restriction of ODI (Offshore Derivative Instruments) to Category-I FPIs

Offshore Derivative Instruments include Participatory Notes (P-Notes), Total Return Swaps and such instruments.

The new regulation has restricted the use of ODIs to Category-I registered FPIs only. Hence regulated funds which are not from FATF member countries and not registered in India under Category-I FPI have been prohibited from issuing/subscribing ODIs. This includes various funds from Cayman Island, Mauritius and Taiwan.

Eliminated ‘Opaque Structure Removal’ Mandate

Under previous regulation designated depository participants (DDPs) were supposed to ensure that FPIs did not have “opaque structure”. This condition has been removed to prevent unnecessary regulatory requirements and simplify compliance framework as ‘SEBI KYC circular issued on 21 September 2018’ already ensured that FPIs provideinfo ontheir beneficial owners – be it on ownership or control basis.

International Financial Services Centre (IIFC) can register as FPI

Investment managers who want to invest in India through FPI route can do so to benefit from direct and indirect tax incentives available to IFSC entities

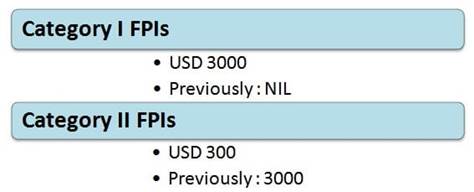

Revised Registration Fee

FPIs (Foreign Portfolio Investors) registering with SEBI need to pay a one-time registration fee for a validity of 3 years. The revised structure is as follows

Foreign Portfolio Investors registered after 23rd September 2019 (date when the new regulation came into effect) have to pay as per revised fee structure.

Other Amendments

Designated Depository Participant (DDP) will proceed to implement the surrender of registration after obtaining the SEBI approval in such cases.

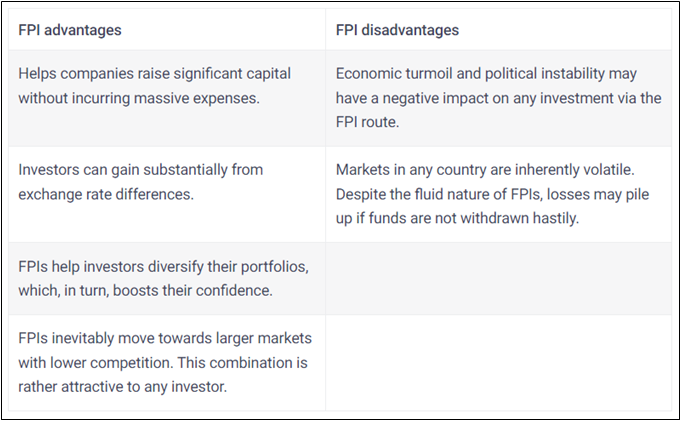

Pros and Cons of FPIs

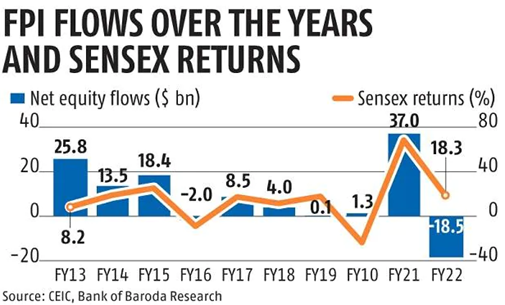

FPI equity outflows touch $15 bn in Jan-March 2022, highest in last 15 years.

With geopolitical factors impacting the market currently, FPIs flows are expected to remain volatile in the near term

Why have FPIs been selling India holdings?

FPIs sold assets worth about Rs 50,000 crore in June 2022. This is the second highest sell-off in a month since 1993, after March 2020.

Uneven post pandemic recovery

Post-pandemic, recovery in the Indian economy has been uneven. The second wave of the COVID-19 pandemic in 2021 devastated lives and livelihoods. The economy stuttered again when a third, albeit less severe, wave saw the spread of the Omicron variant early this year.

Supply-side shortages

The return of pent-up demand in economies worldwide as the pandemic subsided. The pace of recovery caught suppliers off guard, contributing to supply-side shortages.

Russia's invasion of Ukraine

Next came Russia's invasion of Ukraine. Sunflower and wheat supplies, to name just two commodities, from these two nations were impacted, leading to a rise in global prices for these crops. As supplies in general tightened across the globe, commodity prices too rose and overall inflation accelerated. India witnessed a quickening pace in price rise. Inflation stayed above the Reserve Bank’s upper comfort level of 6% for five months running, touching 7.8% in April, before receding to a slightly less aggressive 7.04% in the subsequent month.

Uneven Industrial production

Industrial production has seen a bumpy ride without giving confidence of a full and final recovery from the pandemic. For example, the S&P Global India Manufacturing Purchasing Managers’ Index (PMI) slid to 53.9 in June — the lowest level in nine months — from 54.6 in the previous month. Experts attribute this to inflation pressures, which also dampened business confidence sentiment to a 27-month low in June, as per survey-based findings.

Consumption expenditure

Consumption expenditure too has remained weak in the subcontinent.

U.S. Federal Reserve interest rate

Add to the mix the U.S. Federal Reserve raising the benchmark interest rate starting March this year. On June 15, the Fed announced the most aggressive interest rate increase in almost 30 years, raising the benchmark borrowing rate by 0.75 percentage points in its battle against surging inflation. The key rate range had gone up from 0-0.25% in March to 0.75-1% in May.

When the differential between the interest rates in the U.S. and other markets narrow, and if such an occurrence is accompanied by the strengthening of the dollar, then the ability of investors to realise healthy returns is impacted. For returns are measured not only by the value appreciation of assets but also by exchange rate changes. If the dollar strengthens against the rupee, then an investor is able to realise fewer dollars for a given quantum of rupee assets liquidated. Further, if inflation quickens in the overseas market where the investor has placed funds in, then real returns are even further impacted.

They then tend to exit assets seen as ‘risky’ such as in emerging markets like India, Brazil or South Africa.

Depreciating rupee

The rupee has been depreciating against the dollar, which has seen a general strengthening against several other currencies. The rupee touched its record low of 79.33 against the greenback on Tuesday.

With each of these factors contributing to a decline in confidence of robust economic performance, FPIs have been exiting market investments over these past months.

Impact does an FPI sell-off have?

Conclusion

https://epaper.thehindu.com/Home/ShareArticle?OrgId=GTMA0J9KU.1&imageview=0

© 2024 iasgyan. All right reserved