Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Copyright infringement not intended

Picture Courtesy: www.businesstoday.in

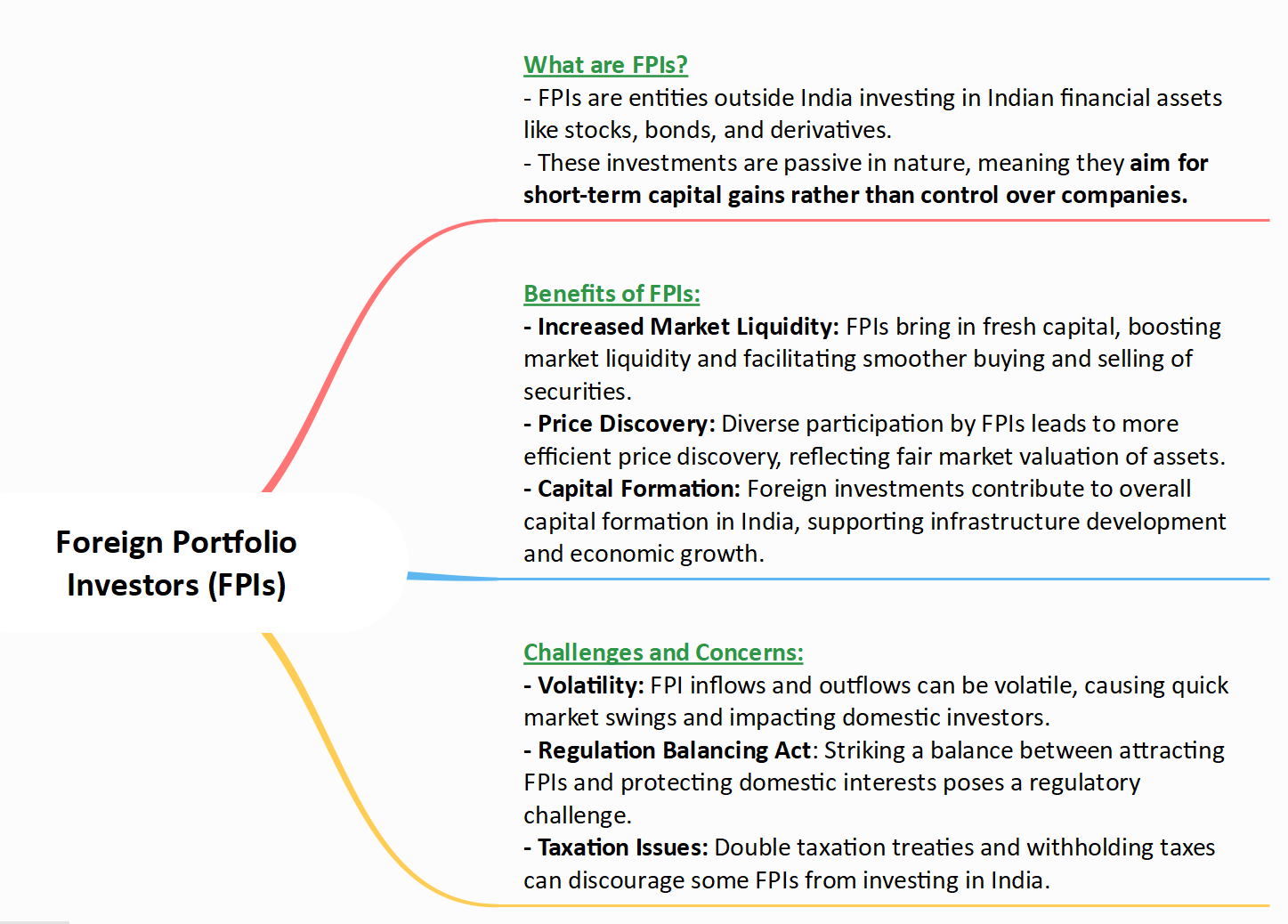

Context: The Securities and Exchange Board of India (SEBI) is implementing additional disclosure norms for Foreign Portfolio Investors (FPIs) to address concerns about possible round-tripping.

Details

Key points related to SEBI's additional disclosure norms

Concentration of Investments

Preventing Misuse of FPI Route

|

Press Note 3, issued during the COVID-19 pandemic, amended the foreign direct investment (FDI) policy to prevent opportunistic takeovers/acquisitions of stressed Indian companies at a cheaper valuation. It introduced restrictions on entities from countries sharing a land border with India and mandated government approval for changes in beneficial ownership in FDI entities in India. |

Details Required

Exempted FPIs

Potential Impact on Market

Conclusion

Must Read Articles:

|

PRACTICE QUESTION Q. How are technological advancements like blockchain or artificial intelligence impacting the landscape of foreign portfolio investment in India, and how can these technologies be leveraged to improve efficiency, transparency, and risk management in the FPI ecosystem? |

© 2024 iasgyan. All right reserved