Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

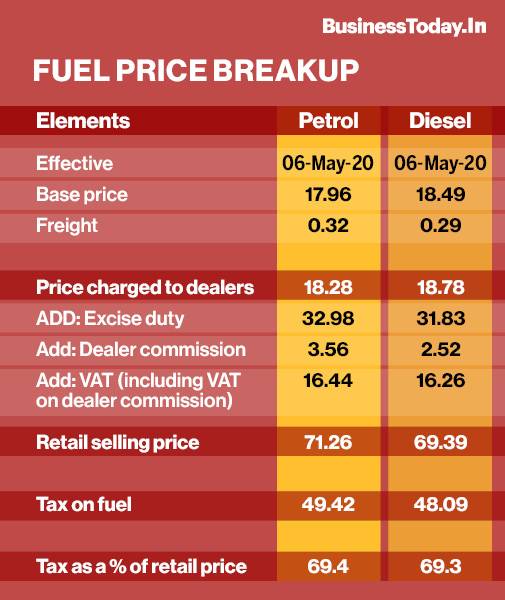

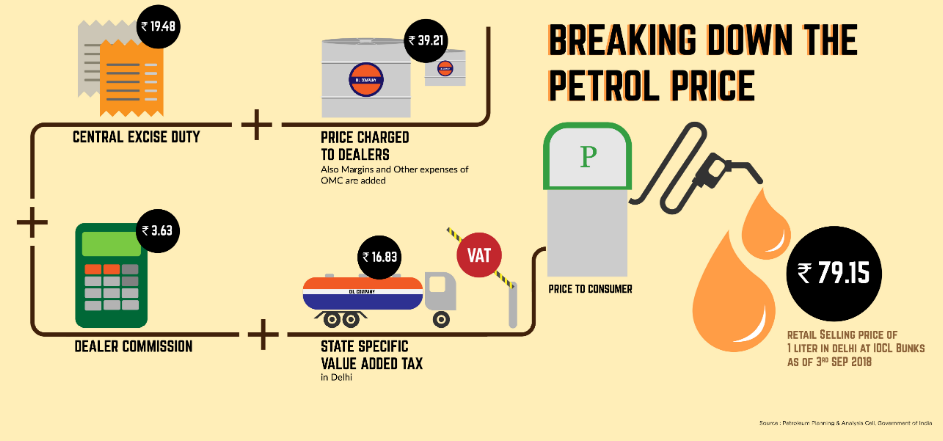

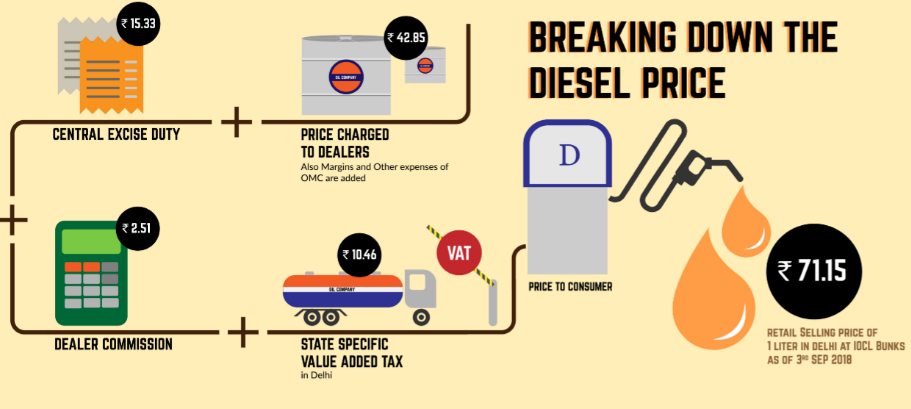

Taxes and duties on petrol and diesel

Example of Break-up of Prices

The Petrol & Diesel prices have 4 different components. Here is an explanation of these components:

Example of price break:

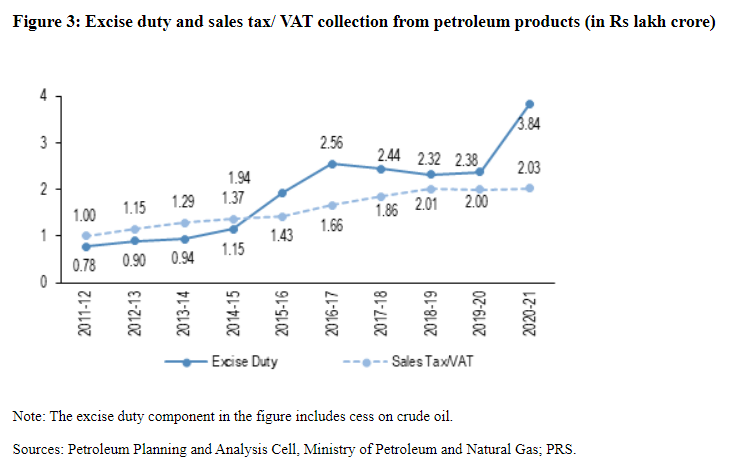

Fuel levies as revenue share

How are Fuel Prices Determined in India?

India imports 80 percent of crude oil. We process this crude oil in our domestic refineries to generate petroleum products. A large share of our petrol comes via this process. In fact, we barely import any petrol or diesel. This crude oil goes through three stages of the transaction before it comes to your automobiles in the form of petrol and diesel.

How can Government controls Prices of Fuels?

Who is the official regulator of Fuel prices in India?

How Retail Price Of Petrol & Diesel Calculated?

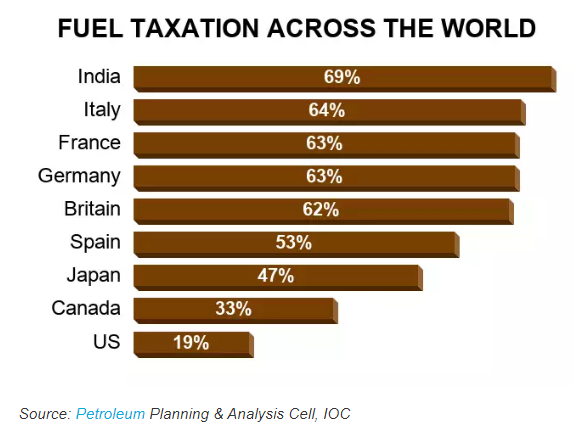

Fuel prices in India are one of the highest taxed in the world. The amount we pay for 1 Liter fuel consists of average 70% taxes.

|

Important terms related to Fuel Pricing Oil Refineries: These refineries buy or extract crude like WTI (West Texas Intermediate) Crude, Brent Crude, OPEC Basket crude, etc. and convert these crudes into petrol, diesel, Aviation turbine fuel, Biofuels, etc. Examples of such refineries are Reliance Industries, Nayara Energy, Bharat Petroleum, Indian Oil, Shell, ONGC, Saudi Aramco, etc. OMC (Oil Marketing Companies): These are the companies who market the converted crudes (petrol, diesel, etc.) to dealers and ultimately to users. Examples of such refineries are Indian Oil, Bharat Petroleum, Shell, Essar, etc. Dealers: Dealers are the People who are engaged into business of buying fuels from OMCs and distributing them to users. They are distributors of fuel. Example: Arvind Patel and Pravin Patel are distributors of cars of Maruti Suzuki Co., they are called dealers of the company and runs the business known as ‘Patel Motors’. Users: We are the users of fuel for our vehicles, also the airplane transport companies who buys the aviation turbine fuels from OMCs directly to keep their planes flying through the skies. |

https://docs.google.com/document/d/1NHmvsHzveTR-k6cH0NpBZEetw91qzdJNbNp7RJQpIWI/edit

© 2024 iasgyan. All right reserved