Disclaimer: Copyright infringement not intended.

Context

- When the pandemic began, carmakers stopped requesting chips from suppliers due to low demand for new vehicles.

- And now, as they ramp up production to meet consumer demand, chip makers are down on supply because they have cut deals with other industries.

Chip/Integrated Circuit/Semiconductor

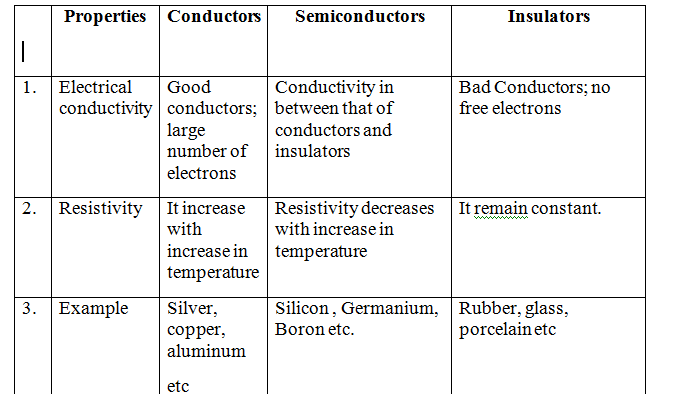

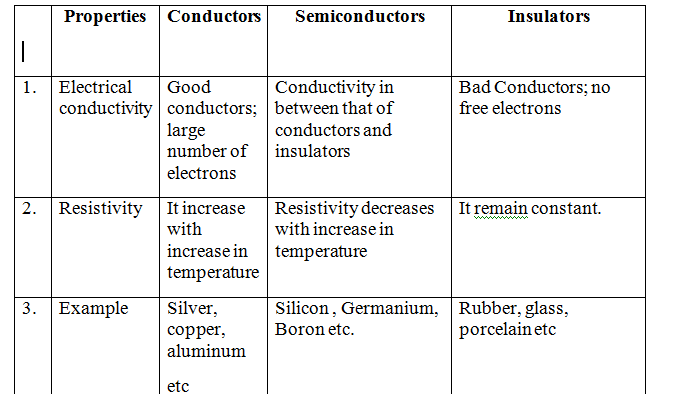

- Integrated circuits (commonly known as chips/semiconductor chips) have properties that are somewhere between conductors and insulators.

- Usually made of silicon, they are used to power a wide range of devices - cars, laptops, smartphones, household appliances and gaming consoles.

- These tiny objects perform a host of functions such as powering displays and transferring data.

- So, a supply crunch has a consequent impact on sales of cars, fridges, laptops, TVs and other electronic devices.

How difficult is it to manufacture Chips?

- Manufacturing advanced logic chips requires extraordinary precision, along with huge long-term bets in a field subject to rapid change.

- Manufacturing a chip typically takes more than three months and involves giant factories, dust-free rooms, multi-million-dollar machines, molten tin and lasers.

- Plants cost billions of dollars to build and equip, and they have to run flat-out 24/7 to recoup the investment.

- A factory also gobbles up enormous amounts of water and electricity and is vulnerable to even the tiniest disruptions, whether from dust particles or distant earthquakes.

|

Basic Requirements for Chip Facility:

· A clean environment, ie, low air particulate matter,

· abundant supply of clean, fresh water,

· uninterrupted and stable power supply,

· quick access to an international airport or seaport,

· first-world levels of road infrastructure from the said port to the fab

· close proximity to well-trained technical talent

|

Challenges faced by the semi-conductor Industry

The world's top chipmakers still can't manufacture chips fast enough to satisfy the market's insatiable appetite.

The COVID-19 crisis

- After reaching its peak in 2011, the laptop market growth slowed down with the rise of alternatives such as smartphones and tablets. Then, the pandemic hit. This shift led to a surge in demand of chips.

- The pandemic disrupted semiconductor shipments as global demand for new mobile devices, PCs, and data center upgrades surged in response to remote work, online learning, and other stay-at-home trends.

Declining memory chip prices

- Memory chip prices soared in 2017 and 2018, but declined in 2019 and 2020 amid sluggish demand from the PC and smartphone markets.

The ongoing tech war

- The tech war between the U.S. and China, which intensified under President Donald Trump and is continuing under President Joe Biden, is another pressing issue.

- The U.S. has already levied sanctions against several big Chinese companies, including SMIC and Huawei, amid national security concerns.

- Those sanctions are exacerbating the shortage of advanced chips in China.

- They're also spurring the Chinese government to aggressively invest in its domestic chipmakers to reduce its overall dependence on overseas technologies -- which could cause a messy decoupling of the U.S. and Chinese markets.

Fluctuating forecasts

- Automakers that cut back drastically early in the pandemic underestimated how quickly car sales would rebound.

- They rushed to re-up orders late in 2020, only to get turned away because chipmakers were stretched supplying computing and smartphone giants like Apple Inc.

Stockpiling

- Chinese companies began building up inventory to ensure it could survive U.S. sanctions that were set to cut it off from its primary suppliers.

Disasters

- Several recent setbacks -- including a power outage at TSMC, a production pause at Samsung, and a fire at the Japanese auto chipmaker Renesas -- all highlight the fragility of the semiconductor supply chain.

How is the Russia-Ukraine crisis protracting this shortage?

- Palladium and neon are two resources that are key to the production of semiconductor chips.

- Now that Russia supplies over 40 per cent of world’s palladium and Ukraine produces 70 per cent of neon, there can be global chip shortage to worsen if the military conflict persiss.

- During the 2014-15 Crimea invasion, neon prices went up several times over, serving an indication of the seriousness of the current crisis for the semiconductor industry.

|

NEON AND PALLADIUM

Neon gas is used in the photolithography process that is the most common method for fabricating integrated circuits. Specifically, the neon gas is used in the laser machines that carve the integrated circuits. For use of neon gas in the semiconductor industry, the gas has to reach 99.99% purity levels — which makes it a rarity. More than half of semiconductor-grade neon comes from Ukrainian companies Incas and Cryoin.

Palladium is used for multiple purposes in semiconductor and electronic manufacturing. It is used to coat electrodes that help control flow of electricity. It is also used in plating of microprocessors and printed circuit boards — which is an essential process of chip making. Russia accounts for nearly half the global supplies of palladium and the multiple trade sanctions on Moscow threaten to constrain the availability of the element.

|

Impact

Disrupted supply chain

- The semiconductor shortage severely disrupts the supply chain and constrains the production of many electronic equipment types.

- Production of laptops, tablets, smartphones and other electronic devices are impacted by the shortage of semiconductors.

Increasing Prices

- Foundries are increasing wafer prices, and in turn, chip companies are increasing device prices.

Production Disruption in automobile Sector

- Domestic and global automobile manufacturers cut output and halt production due to the semiconductor shortage.

- According to data from Society of Indian Automobile Manufacturers (SIAM), automobile wholesales in India declined 11 percent year-on-year in August 2021.

- Chip shortages are expected to wipe out $210 billion of sales for carmakers in 2022, with production of 7.7 million vehicles lost.

Challenges specific to India

Competition

- It is difficult to compete with neighbouring countries like China and Vietnam which have been favourite destinations for global chip manufacturers due to better cost-efficiency.

Massive investment

- In addition to the huge cost, running in billions of dollars, manufacturing even a single chip requires hundreds of gallons of pure water, which may also be hard to find in India in the required quantities.

Infrastructure

- There have been challenges in setting up of Semiconductor Wafer Fabrication (FAB) units in India.

- India is still not unto the par in terms of the basic infrastructure needed.

Power Supply

- An uninterrupted power supply is another major hurdle.

- The heart of the issue is that India is still not unto the par in terms of the basic infrastructure needed to pursue endeavours in the chip manufacturing space.

Price pressure

- There is also constant price pressure from other global players, particularly China which is also building a homegrown chip program for the adoption of local semiconductors in 70% of its products by 2025.

Dependency on Imports

- India imports 100% of its semiconductors.

- Around 40 percent of India’s demand is met through imports from China, despite the frequent geopolitical impasse that the two nations find themselves in.

|

Global Giants

· Taiwan holds a virtual monopoly in the global chip manufacturing industry.

· The company is responsible for over half of all semiconductor chips that are manufactured in the world, and the country as a whole is responsible for over 60 percent of global production.

· Other major centres include South Korea and the US.

|

Government efforts

Development of sustainable semiconductor and display ecosystem in the country Programme

- The comprehensive programme for the “development of sustainable semiconductor and display ecosystem in the country” is aimed at making India a global hub of electronic system design and manufacturing.

- The scheme would provide fiscal support of up to 50% of the project cost for setting up semiconductor and display fabrication units.

100% FDI in the ESDM

- In 2016, the government allows 100% FDI in the ESDM sector through an automatic route to attract investments including from Original Equipment Manufacturers (OEMs) and Integrated Device Manufacturers (IDMs).

Electronics development Fund

- The Department of Electronics and Information Technology (DeitY) has established an Electronics Development Fund (EDF) managed by Canara Bank to provide risk capital and to attract venture funds, angel funds and seed funds for incubating R&D and fostering the innovative environment in the sector.

Initiatives under Telecom and Electronic Policies

- Some of the initiatives outlined in the National Electronics policy and the National Telecom policy are in the process of implementation, such as Preferential Market Access (PMS), Electronics Manufacturing Clusters (EMC) and Modified Special Incentive Package Scheme (M-SIPS).

Scheme for Promotion of manufacturing of Electronic Components and Semiconductors (SPECS)

- Ministry of Electronics and Information Technology (MeITy) has drawn up the Scheme for Promotion of manufacturing of Electronic Components and Semiconductors (SPECS).

Production-linked incentive scheme (PLI) scheme

- Under the scheme, the Centre will offer financial support to companies that want to manufacture a range of semiconductor goods in India.

- The subsidy will bring down the production costs of companies manufacturing such goods, and thus encourage them to set up new factories and other facilities.

Global efforts

- Factories that produce wafers cost tens of billions of dollars to build, and expanding their capacity can take up to a year for testing and qualifying complex tools. In the US, the Biden administration’s $2 trillion infrastructure investment package includes $50 billion for the semiconductor industry.

- The South Korean government has announced a massive $451 billion investment to help companies boost production of semiconductors.

- Many tech companies have begun developing their own chips, a move that will not only alleviate the current supply concerns but will likely help the industry in the long-run.

- Western countries are focusing on the need to shift manufacturing within their countries and become self-reliant.

- Amid, the Russia-Ukraine Crisis, the U.S. government is looking to pass the CHIPS Act, a law that would provide semiconductor firms with $52 billion in subsidies to advance chip making in the country.

Way Ahead

- As 5G mobile networks proliferate with many people working from home, the need for more powerful, energy-efficient chips is only going to grow.

- The rise of artificial intelligence is another force pushing innovation, since AI relies on massive data processing.

- Indian semiconductor industry is set for a stable upsurge with bright prospects provided India's generic obstacles like redtape-ism, fund crunch and infrastructural deficits are adequately addressed.

- Steps needed to be taken:

- Land Acquisition by the government: acquire the land and develop a special economic zone (SEZ) which would encompass a complete semiconductor manufacturing ecosystem.

- Cover all ancillaries: The monetary benefits being extended for setting up a fab should be made available for all the ancillary units manufacturing specialty chemicals to clean room apparel.

- Focus on simple technology: The requirements are less stringent and the fabs less expensive. These companies typically operate at much lower gross margins as opposed to the large fabs and OEMs.

- With the implementation of fabrication capabilities in India, the country could achieve a degree of self-sufficiency in the sector of semiconductors.

- Building a strong semiconductor industry would put an end to the country’s reliance on imports to meet its semiconductor needs and will help in the creation of jobs.

https://epaper.thehindu.com/Home/ShareArticle?OrgId=G8I9RTDMR.1&imageview=0

1.png)