Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

Context

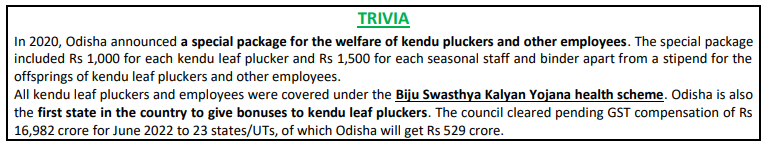

Odisha’s Demand

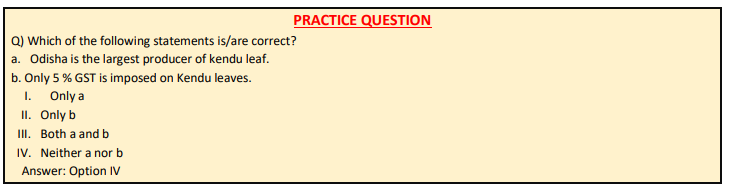

Implications of GST on Kendu Leaves according to Odisha

Stance of GST Council

Kendu Leaves

© 2024 iasgyan. All right reserved