Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright infringement not intended.

In News

BACKGROUND

New Exploration Licensing Policy (NELP)

|

Features of NELP · 100% Foreign Direct Investment (FDI) is allowed under NELP. · No mandatory state participation through ONGC/OIL or any carried interest of the Government. · Blocks to be awarded through open international competitive bidding. · ONGC and OIL to compete for obtaining the petroleum exploration licenses (PEL) on a competitive basis instead of the existing system of granting them PELs on nomination basis. · ONGC and OIL to get the same fiscal and contract terms as private companies. · Freedom to the contractors for marketing of crude oil and gas in the domestic market. · Royalty at the rate of 12.5% for the onland areas and 10% for offshore areas. · Royalty to be charged at half the prevailing rate for deep water areas beyond 400 m bathymetry for the first 7 years after commencement of commercial production. · Cess to be exempted for production from blocks offered under NELP. · Companies to be exempted from payments of import duty on goods imported for petroleum operations. · No signature, discovery or production bonuses. · Agreement between government and contractor is governed by a Production Sharing Contract. A Model Production Sharing Contract is created which is reviewed for every NELP round. · Contracts to be governed in accordance with applicable Indian Laws. |

Issues with NELP

|

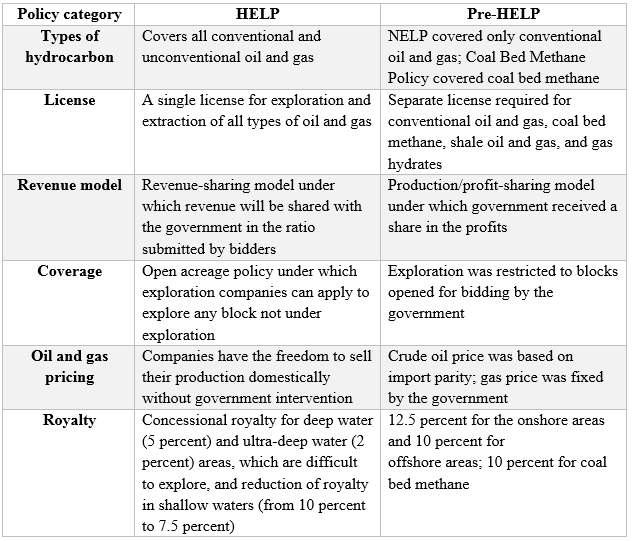

India imports 80% of its crude requirements, making the energy economy heavily dependent on foreign sources of supply. This implies, India is subjected to global price swings of crude oil. To reduce this dependency on external sources, Government launched Hydrocarbon Exploration License Policy (HELP) in 2016, in replacement of New Exploration Licensing Policy (NELP) of 1997-1998. |

Hydrocarbon Exploration and Licensing Policy (HELP)

HELP as a reform

Objectives of HELP

The major Guiding Principles behind HELP are to:

The primary objective of the HELP is ease of doing business and operational freedom to Operators, so that the existing Hydrocarbon Resources are explored more effectively, leading to a reduction in import dependence and consequently savings.

Merits of HELP

|

Open Acreage Licensing Policy-OALP · OALP is a critical part of the Hydrocarbon Exploration and Licensing Policy. · Provides uniform licences for exploration and production of all forms of hydrocarbons, enabling contractors to explore conventional as well as unconventional oil and gas resources. · Fields are offered under a revenue-sharing model and throw up marketing and pricing freedom for crude oil and natural gas produced. · Under OALP, companies are allowed to carve out areas they want to explore oil and gas in. Once an explorer selects areas after evaluating the National Data Repository (NDR) and submits the expression of Interest, it is put up for competitive bidding.

About National Data Repository: NDR is a government-sponsored E&P data bank with state-of-the-art facilities and infrastructure for preservation, upkeep and dissemination of data to enable its systematic use for future exploration and development. |

Concerns with HELP

Discovered small oil field policy

Final Thoughts

https://www.pib.gov.in/PressReleasePage.aspx?PRID=1840013

© 2024 iasgyan. All right reserved