Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Copyright infringement not intended

Picture Courtesy: en.wikipedia.org

Context: India Post Payments Bank (IPPB) announced that it has achieved a significant milestone with eight crore customers benefiting from its innovative and inclusive financial services.

Key Points from the announcement include:

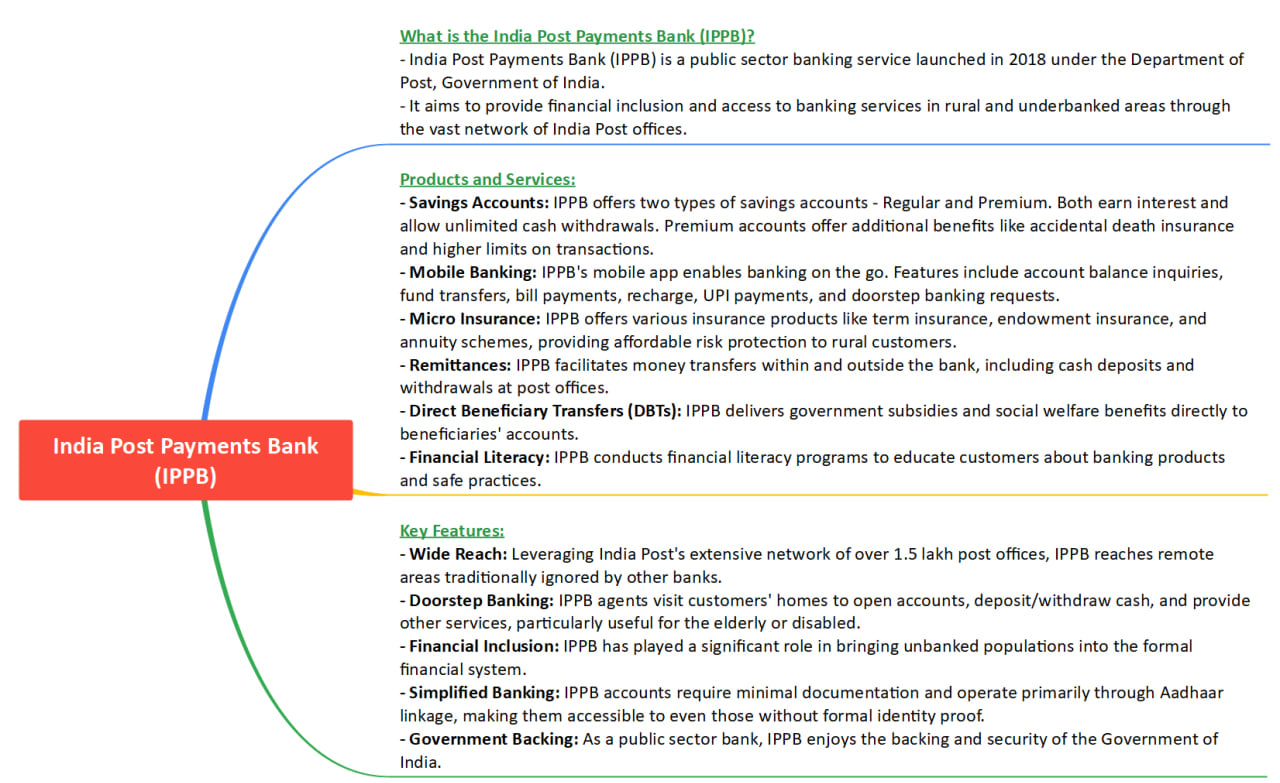

India Post Payments Bank

Key features of IPPB

Significance

|

Steps Taken to Support and Strengthen IPPB ●The government has allowed IPPB to use Aadhaar for e-KYC verification of its customers. ●The government has exempted IPPB from service tax on basic services such as account opening, cash deposit, cash withdrawal, etc. ●The government has integrated IPPB with various government portals such as UMANG, DigiLocker, Bharat Bill Pay, etc. to enable the seamless delivery of public services. ●The government has launched various initiatives such as Aarohan, Fincluvation, DakPay, etc. to enhance the capacity building, innovation and digital transformation of IPPB. |

Challenges

Way forward

Conclusion

Must Read Articles:

India Post Payments Bank: https://www.iasgyan.in/daily-current-affairs/india-post-payments-bank

|

PRACTICE QUESTION Q. How does India Post Payments Bank contribute to financial inclusion in rural areas through its services? What specific measures does it take to ensure accessibility to banking facilities in remote regions? Highlight the impact of the postal network in extending financial services to the underserved population. |

© 2024 iasgyan. All right reserved