Copyright infringement not intended

Context: The Rajasthan Platform Based Gig Workers (Registration and Welfare) Bill, 2023, which was passed by the State Assembly on July 24, is the first legislation of its kind in India. It covers all platform-based gig workers who are residents of Rajasthan or work in the State for at least 90 days a year.

Details

- The gig economy is growing rapidly in India, especially in urban areas where online platforms connect workers with customers for various services such as food delivery, ride-hailing, home cleaning, and more. These workers, known as gig workers, often face challenges such as low and irregular income, lack of social security, and poor working conditions. To address these issues, the Rajasthan government has recently introduced a landmark bill that aims to provide registration and welfare benefits to the State's gig workers.

- The recently passed Rajasthan Platform Based Gig Workers (Registration and Welfare) Bill, 2023 outlines welfare schemes for approximately three lakh gig workers in the state.

Key features of the Bill include:

- Applicability: The Bill applies to "aggregators" (digital intermediaries connecting buyers and sellers) and "primary employers" (individuals or organizations engaging platform-based workers).

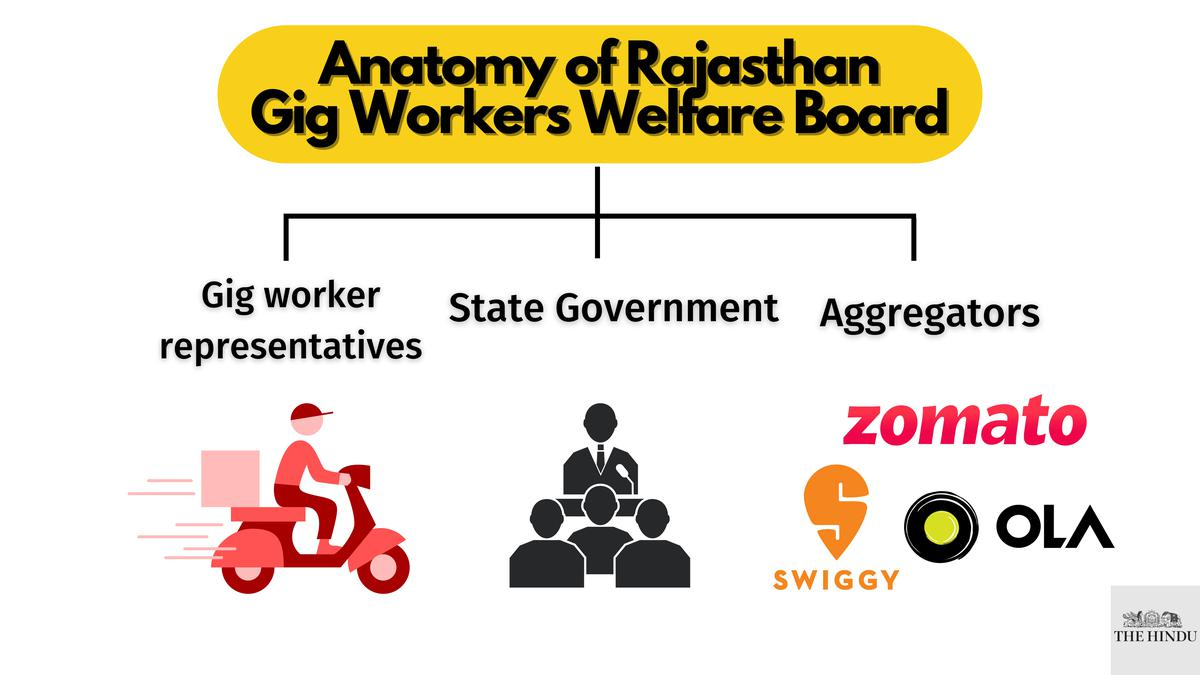

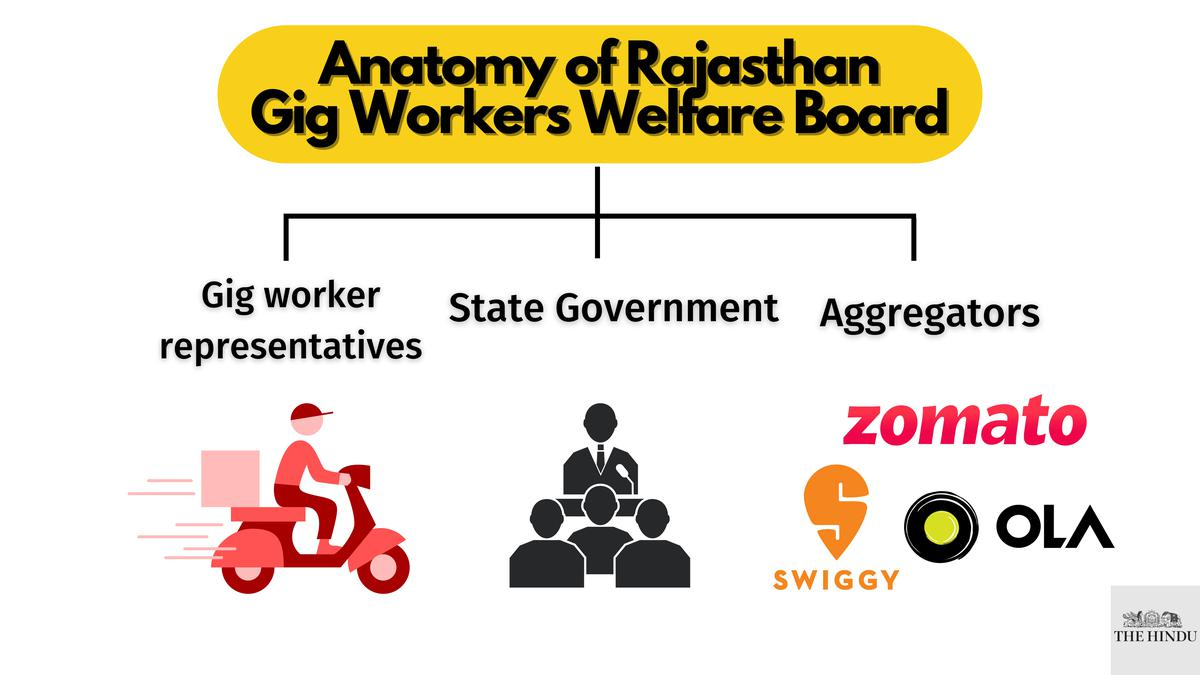

- Welfare Board: The Bill proposes a Welfare Board comprising State officials, representatives from gig workers, aggregators, and civil society.

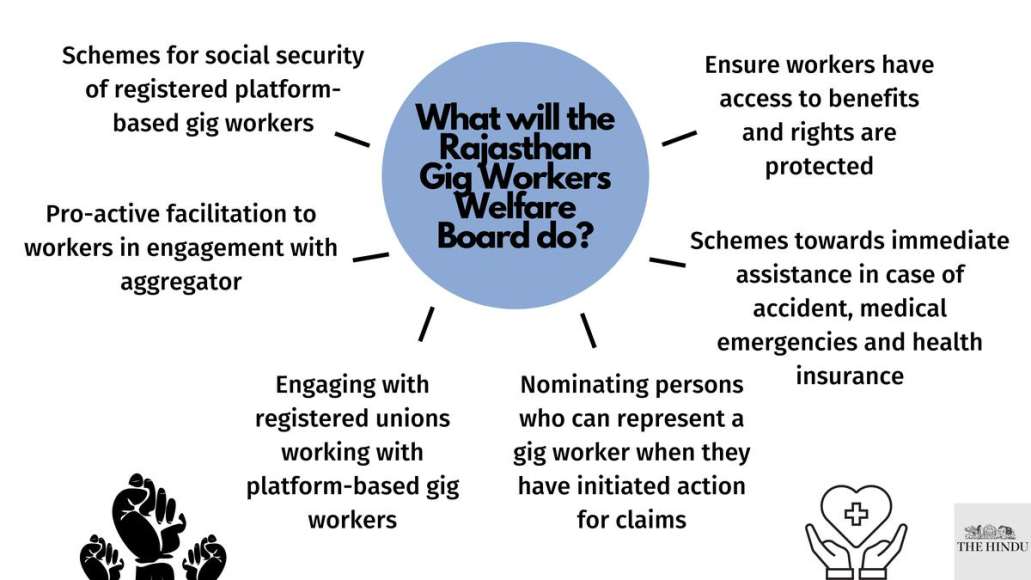

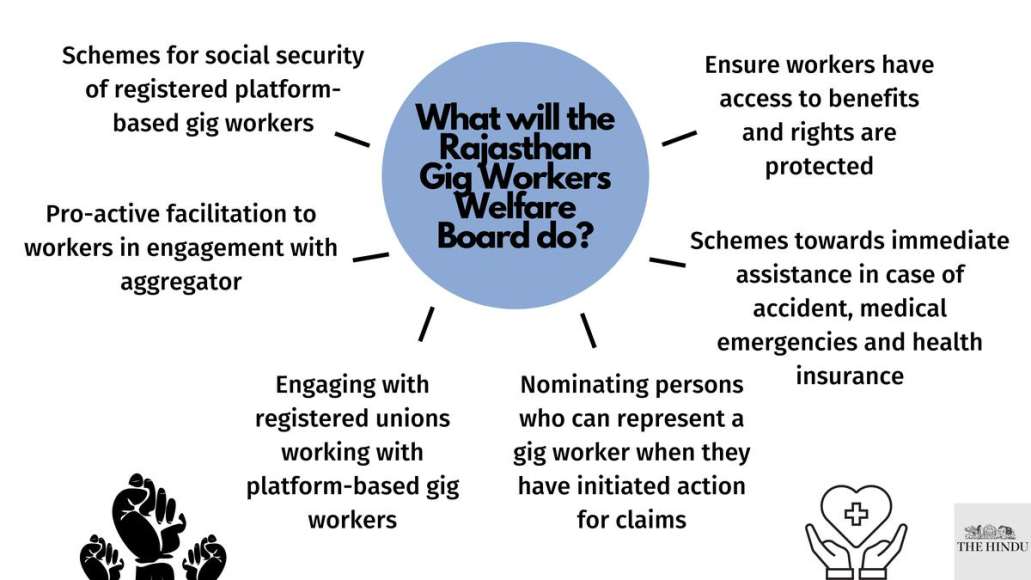

- The Board will be responsible for setting up a welfare fund, registering platform-based gig workers, aggregators, and primary employers, and ensuring social security guarantees for gig workers.

- Database and Unique ID: The Board will maintain a database of companies and workers, and each gig worker will receive a unique ID, valid indefinitely.

- Funding: The Social Security and Welfare Fund will be created with contributions from individual workers, State government aids, and a 'welfare cess' paid by aggregators. The welfare cess, not exceeding 2% nor falling short of 1% of each transaction's value, will be submitted by aggregators within the first five days of each month.

- Workers' Rights: The Bill recognizes gig workers' right to be registered with the Welfare Board upon joining an app-based platform, irrespective of the duration or number of providers they work for.

- Schemes for Social Security: The Welfare Board will formulate schemes for social security, including accidental insurance, health insurance, and other benefits related to health, accident, and education.

- Grievance Redressal: Gig workers can file grievances related to entitlements, payments, and benefits provided under the Act either physically or online through the web portal. There is also an Appellate Authority to address objections raised by employers.

- Accountability of Aggregators: Aggregators are obligated to deposit welfare cess on time, update the gig worker database, and document any variations in numbers. Failure to comply may result in fines, with increasing penalties for subsequent violations.

Although the Bill is a significant step towards addressing gig workers' welfare, some concerns have been raised by labour unions, such as vague terminologies, funding sources, enumeration of benefits, and effective redressal mechanisms. Unions recommend clearer definitions, sourcing funds solely from aggregators and the State, detailed enumeration of benefits, and a more effective grievance redressal mechanism to ensure the welfare of gig workers.

Gig workers

Meaning

- Gig workers are individuals who engage in temporary, flexible, and project-based work arrangements, often through digital platforms or apps, rather than traditional full-time employment.

- The term "gig economy" originated from the concept of musicians or artists being paid for individual performances, or "gigs." However, in recent years, the gig economy has expanded to include a wide range of industries and job categories.

Key features of gig work

Flexibility

- Gig workers have the freedom to choose when, where, and how much they work, offering them a greater work-life balance. They can adjust their work schedules according to their personal needs, preferences, and availability.

- They can work from anywhere, as long as they have access to the internet and the necessary tools or equipment. This flexibility can also help gig workers pursue multiple income streams, learn new skills, or explore new career paths.

Digital Platform Dependence

- Gig work is facilitated through digital platforms or apps, connecting workers with potential employers or clients. These platforms or apps act as intermediaries or marketplaces, matching gig workers with suitable work opportunities, and providing them with information, ratings, reviews, and payments. Some examples of these platforms or apps are Uber, Airbnb, Upwork, Fiverr, TaskRabbit, and many more.

- Gig workers rely on these platforms or apps to find and secure work, communicate with clients or employers, and manage their work activities.

Variety of Jobs

- Gig workers can access various job opportunities across different industries and sectors, catering to their diverse skills and interests. They can perform different types of tasks or services, such as driving, delivering, cleaning, writing, designing, teaching, consulting, and more.

- They can work for different clients or employers at the same time, increasing their exposure and experience. They can also choose the level of complexity and difficulty of their work assignments, depending on their qualifications and capabilities.

Independent Contractor Status

- Gig workers are often considered independent contractors, not employees, which means they are not entitled to traditional employee benefits and protections. They are responsible for their taxes, insurance, health care, retirement savings, and other expenses.

- They have less job security and stability than regular employees, as they can be terminated or replaced at any time without notice or compensation. They have less bargaining power and influence over their working conditions and terms of service

Impacts on the labour market and the overall economy

Economic Growth

- By providing businesses with a flexible and on-demand workforce, the gig economy enhances economic growth. Businesses can adjust their workforce size and composition according to their needs, resulting in cost savings and higher productivity. Additionally, gig workers can work across different sectors and projects, stimulating innovation and entrepreneurship.

Employment Opportunities

- The gig economy creates new sources of income for individuals with different skills and backgrounds. It provides an alternative to traditional employment for people who may face challenges in finding or keeping a job, such as those with low education levels or disabilities. This wider access to the labour market can lower unemployment rates and increase workforce participation.

Workforce Diversity

- The gig economy enables individuals from diverse backgrounds and demographics to join the labour market on their terms. It allows people to balance work with other aspects of their lives, such as family or education, fostering workforce diversity and inclusivity.

Changing Work Dynamics

- The gig economy challenges the conventional norms and structures of work. It has led to the expansion of remote work and the gig-on-demand model, changing the relationship between employers and workers. This change has encouraged businesses to adopt more flexible practices to attract and retain talent.

Steps taken by the Indian government

Social Security Measures

- The Indian government has introduced some social security measures for gig workers. One notable initiative is the Pradhan Mantri Shram Yogi Maan-dhan (PMSYM) scheme, which is a voluntary pension scheme for unorganized workers, including gig workers. Under this scheme, eligible workers can contribute a certain amount regularly to build a pension fund, which would provide them with a pension after attaining a certain age.

Labour Code Reforms

- In 2020, the Indian government consolidated and streamlined various labour laws into four labour codes, including the Code on Social Security. While the implementation of these codes might vary across states, they aim to provide gig workers with certain social security benefits and protections.

Digital Platforms Guidelines

- The Indian government has issued guidelines for digital platforms that employ gig workers to promote transparency, fair practices, and grievance redressal mechanisms. These guidelines are designed to protect the rights and interests of gig workers in the digital economy.

Skill Development Programs

- The government has launched various skill development and upskilling programs to enhance the employability of gig workers and equip them with relevant skills for their work. These programs aim to improve their income potential and job opportunities.

Welfare Schemes

- Some state governments in India have initiated welfare schemes and financial assistance programs specifically targeted at gig workers to support them during periods of economic hardship, such as the COVID-19 pandemic.

While these initiatives are steps in the right direction, the gig economy poses unique challenges that require ongoing efforts from the government to ensure the well-being and protection of gig workers. There is a need for continuous assessment and adaptation of policies to address the evolving needs of gig workers and promote a fair and inclusive gig economy.

Challenges

- Lack of Social Security: Gig workers often lack access to traditional employee benefits such as health insurance, retirement plans, paid leave, and unemployment benefits. This leaves them financially vulnerable during times of illness, injury, or economic downturns.

- Income Instability: Gig work can be unpredictable, resulting in irregular income streams. Gig workers may face financial uncertainty due to fluctuations in demand for their services, making it challenging to plan for the future.

- Exploitative Practices: Some digital platforms or employers may engage in exploitative practices, such as unfair wages, arbitrary account deactivations, and a lack of transparent policies. Gig workers may have limited recourse to address such issues.

- Lack of Legal Protections: Gig workers are often classified as independent contractors, not employees, leaving them without the same legal protections and rights afforded to traditional employees.

- Work-Life Imbalance: While gig work offers flexibility, it may also lead to difficulties in setting boundaries between work and personal life, resulting in work-life imbalance and potential burnout.

- Limited Skill Development: Gig workers may face barriers to skill development and upskilling opportunities, which could hinder their professional growth and earning potential.

- Access to Finance: Gig workers may face challenges in accessing financial services such as loans and credit, as they often lack a stable income and formal employment records.

Some possible ways forward

- Enhanced Social Security: Governments can explore innovative ways to provide gig workers with social security benefits and protections, such as portable schemes that allow workers to accumulate and transfer benefits across different platforms and jobs, or hybrid models that combine contributions from workers, platforms, and the state.

- Regulatory Framework: Formulating comprehensive regulatory frameworks to protect gig workers' rights and ensure fair practices by digital platforms is essential to prevent exploitation, discrimination, and abuse. Such frameworks should also clarify the legal status and classification of gig workers, as well as their entitlements and obligations.

- Skill Development and Upskilling: Investing in skill development programs to empower gig workers and improve their income-earning potential is crucial to enhance their competitiveness and employability in the dynamic labour market. Such programs should also include digital literacy and soft skills, as well as opportunities for lifelong learning and career advancement.

- Stakeholder Collaboration: Encouraging collaboration between governments, businesses, and gig worker representatives to address challenges and create a sustainable gig economy is key to fostering trust, dialogue, and cooperation. Such collaboration should also involve sharing best practices, data, and insights, as well as promoting awareness and education among gig workers and the public.

Conclusion

- The gig economy is here to stay, and it offers immense opportunities for innovation, growth, and inclusion. However, it also requires a collective effort to ensure that gig workers are not left behind or marginalized in the process. The way forward involves striking a balance between the flexibility and opportunities provided by the gig economy while ensuring fair treatment, security, and well-being of gig workers as a vital part of the modern workforce.

Must Read Articles:

Gig Economy: https://www.iasgyan.in/daily-current-affairs/gig-economy-26

|

PRACTICE QUESTION

Q. What is the significance of gig workers in the economy, and what are the main challenges they face? What measures can be taken to address these challenges and pave the way forward for a more sustainable and equitable gig economy?

|

https://www.thehindu.com/news/national/explained-rajasthans-draft-bill-for-gig-workers/article67060044.ece