Free Courses Sale ends Soon, Get It Now

Free Courses Sale ends Soon, Get It Now

Disclaimer: Copyright Infringement not intended.

Context

What Is a Sovereign Credit Rating?

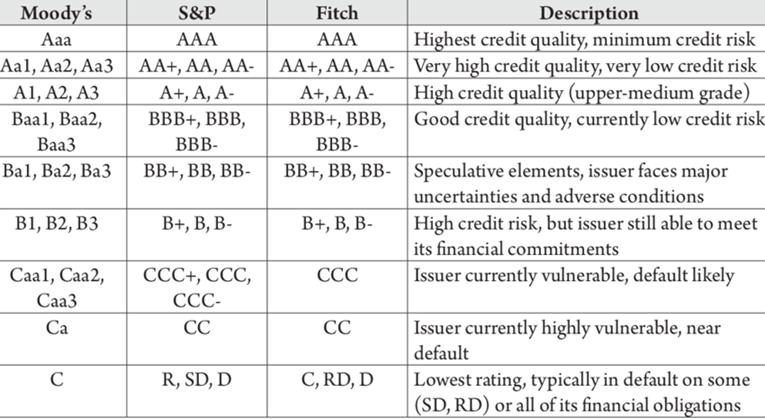

Some Credit Rating Scales

Importance of Credit Ratings

Strength of India’s sovereign rating

Criticism of Credit Rating Agencies

Registered Credit Rating Agencies in India

All the credit rating agencies in India are regulated by SEBI (Credit Rating Agencies) Regulations, 1999 of the Securities and Exchange Board of India Act, 1992

© 2024 iasgyan. All right reserved